The Week in Review 11/06/2023

“Success is no accident. It is hard work, perseverance, learning, studying, sacrifice and most of all, love of what you are doing or learning to do.” - Pele

We just enjoyed the best week of 2023, in the midst of earnings, and a plethora of negativity and pessimism.

Not to mention some huge geopolitical issues among other things… the most significant, investors seem to have become convinced the Fed is done raising rates.This makes sense with the Holiday Season almost upon us and an election year as well.

The stock market registered sizable gains on the heaviest week of earnings reporting for this Q3 season. The calendar featured results from Apple, which didn't live up to the market's high expectations and languished following its report. Earnings news was generally met with a positive reaction, helped in large part by the significant drop in market rates.

The 10-yr note yield declined 31 basis points this week to 4.51% and the 2-yr note yield fell 17 basis points this week to 4.86%. Those moves were partially a reaction to the following factors:

- The Bank of Japan's tweak to its yield curve control policy was not as hawkish as feared, tempering concerns about the possibility of a destabilizing unwinding of carry trades.

- The Treasury reduced its Q4 borrowing estimate by $76 billion to $776 billion.

- The Treasury said its Q4 refunding would involve larger issuance and auction sizes for 2-, 3-, 5-, and 7-yr maturities than 10-, 20-, and 30-yr maturities.

- Short sellers covered their positions.

Another important factor driving activity in the Treasury market was the FOMC meeting. The committee voted unanimously to leave the target range for the fed funds rate unchanged at 5.25-5.50% and Fed Chair Powell's press conference was deemed less hawkish than feared. Mr. Powell noted that the Fed has come very far with its rate-hike cycle and that policy decisions have gotten more two-sided.

The Bank of England also left its key rate unchanged, although the vote was 6-3 with three voters favoring a 25 basis points rate hike.

Some of the key economic releases this week all worked in favor of the market's thinking that the Fed could be done raising rates. The ISM Manufacturing Index contracted at a faster pace in October (actual 46.7%; expected 49.0%; prior 49.0%), Q3 unit labor costs declined 0.8% on the back of the strongest productivity increase (4.7%) since the third quarter of 2020, and the October jobs report showed slower payroll growth, rising unemployment, and slower wage growth.

The fed funds futures market isn't pricing in any more rate hikes over the next 12-month horizon; in fact, it is pricing in at least two rate cuts over the next 12 months, according to the CME FedWatch Tool.That is good news indeed!

The sharp drop in rates acted as a springboard for stocks, aided by short-covering activity and a fear of missing out on further gains in a seasonally strong period for the market. Last week brought the S&P 500 into technical correction territory, but this week's rally brought the S&P 500 back above both its 200-day and 50-day moving averages.

This is significant…

The rate-sensitive real estate sector was the best performer, up 8.6%, followed by the financial (+7.4%), consumer discretionary (+7.2%), and information technology (+6.8%) sectors. The "worst" performing sector was energy, which still climbed 2.3% this week. Just about everything participated in the rally. The US dollar was weaker this week due to the thinking that the Fed might be done raising rates. The US Dollar Index fell 1.4% to 105.04.

Market Snapshot…

- Oil Prices – Oil prices dipped 2% lower on supply concerns related to Middle East tensions. West Texas Intermediate crude futures (WTI) fell $1.95, or 2.4% to close at $80.51 a barrel. Brent crude futures were down $1.92, or 2.3%, to close at $84.89 a barrel.

- Gold– Gold prices gained ground last week. Spot Gold was up 0.4% at $1,994.28 per ounce, while U.S. gold futures added 0.3% to $1,999.20. Silver finished the week at $22.025.

- S. Dollar– The dollar index fell to a six-week low due to the jobs report. The index dropped 1.1% to 105.03. Euro/US$ exchange rate Is now 1.076.

- S. Treasury Rates– Treasury yields slipped on key economic data about employment. The yield on the 10-year Treasury note was down 9 basis points at 4.577%.

- Asian shares were higher in overnight trading.

- European markets are trading mixed.

- Domestic markets are again trading higher this morning.

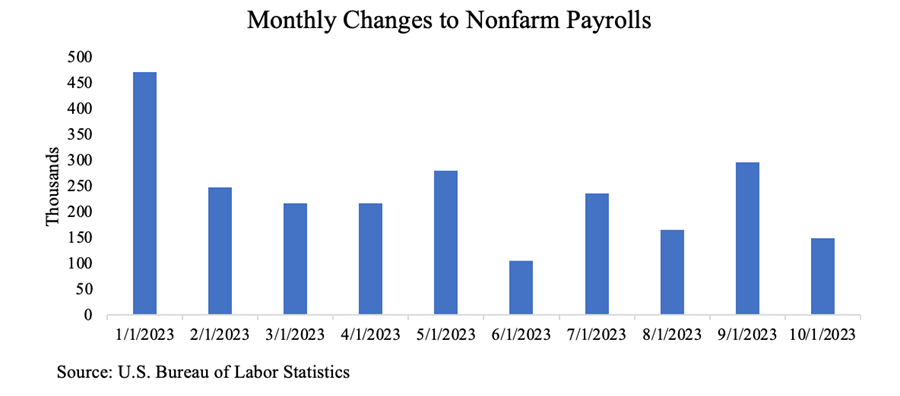

Jobs have been the “sticky wicket” in the inflation battle…

It looks like that may be easing… Nonfarm payrolls came in light for the month of October, up 150K vs. the estimated 180K and roughly half of September’s gain. Additionally, August and September reports were revised downward by a combined 101K.

This week will be relatively light on the economic front. We will hear from several FOMC members, receive the University of Michigan Consumer Sentiment for November, and have a look at the U.S. Treasury budget.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.