History doesn't repeat itself, but man always does

“History doesn’t repeat itself, but man always does.”i - Voltaire

September 6, 2024

In numerous letters, I have shared the following - Changes in things like GDP and corporate sales are much less volatile than changes in corporate profits let alone stock prices. In bull phases, stocks have a tendency to rise considerably more than underlying fundamentals (e.g., corporate sales and earnings). In bear market environments, the opposite is true. When sales contract modestly, earnings tend to go down more, and stock prices decline even more - sometimes alarmingly so. Intellectually, most investors know the benefit of buying low and selling high. However, this is not what many investors do. Rather, they extrapolate and imagine the old rules don’t apply (or at least not anytime soon). They see, bona fide winners and say, ‘I need to own that great company.’ Because you simply cannot capture the returns that accrue before you own a security, investors who buy in late, often miss out on the lion’s share of the gains. Conversely, during periods of uncertainty, prices can decline at an alarming rate. The news about both the economy and markets is often very disconcerting. That causes many investors to sell and seek a ‘safe haven’ to ride out the storm. Our innate nature causes most of us to override our rational thinking such that we tend to buy high and sell low. Emotions trump reason and contribute to poor timing and results.

While we don’t know what lies ahead with any specificity, we mentally prepare for a wide range of outcomes. We acknowledge that current leading segments may well continue their winning ways and vice versa. To help ensure we engage our logical side and decrease our emotional side, we assess valuations and expectations along the way. We also actively seek out investment opportunities in things that tend to behave differently along the way. We challenge ourselves to envision what could cause beleaguered market segments to perform better in the next 3, 5, 10 or more years. Conversely, we also try to discern what might cause the most popular/best performing segments to provide disappointing results in the years ahead. Does this approach work perfectly? Of course not. We often have less ownership of segments that continue to perform exceedingly well and too much of segments that continue to perform poorly. That is the price of diversification. However, as I have also shared, long-term success is not so much a function of maximizing results in the best of times but enduring through the lean periods with emotions intact and capital invested in accord with our long-term needs and objectives. As the saying goes, ‘if investing was easy, we would all be rich.’ However, many investors simply don’t achieve favorable outcomes. Success requires persistence, a willingness to save for the future and a resolve to stay the course with a sensible plan.

We all recognize that surprises – favorable and otherwise happen. However, it seems clear that near what prove to be the end of a protracted bull or bear market phase, we collectively expect more of the same. In the absence of concerns, let alone setbacks, valuation metrics like the PE (price-to-earnings ratio) expand. ‘Risky investments’ like stocks are rewarding and investors take note. Favorable returns foster a belief that we are in a new era of predictable (and certainly desirable) growth. Optimism is the prevailing sentiment and naysayers are viewed as clearly wrong. Then, out of nowhere, something unwelcome happens and once again elevated expectations and valuations contract further than many investors deem possible. That’s why we tend to see larger, longer and more destructive declines in stock prices than the decline in the overall economy or corporate sales and earnings. Then these much lower valuations pave the way for longer and stronger recoveries when many investors least expect them. It has happened throughout history.

“Having, and sticking to, a true long-term perspective is the closest you can come to possessing an investing superpower.” - Cliff Asnessii

We simply cannot know before the fact, how long and how high a favorable cycle will last or when and at what level a downtrend will end. Nevertheless, history does serve up powerful, timeless lessons. For instance, when you own securities (market segments, asset classes, etc.) that perform differently from each other, you can smooth out the volatility of investment values over time. Of course there is a trade-off. When you own diversified assets, you forego the opportunity to have all your assets in the best segments in favor of reducing market fluctuation along the way. That’s important because investors are prone to the tug and pull of fear and greed along the way. The hidden benefits to diversification are powerful. Because over multi-year and decade periods, securities can go up more than down (e.g. increase 5-fold but only lose 100%), winners tend to have greater impact than those that disappoint over the long-term. In sum, diversification is prudent, helps foster favorable long-term outcomes and is often referred to as the closet thing to a free lunch when it comes to investing.

“Those who cannot remember the past are condemned to repeat it.” - George Santayana

Each era is different. Sometimes, new industries emerge and companies within them generate well-above average growth in sales, earnings and cashflow. This in turn fosters investment flows that pave the way for extremely pleasing investment gains. Ingenuity and capital combine forces and power gains in the economy and improve the lives of people, nations, etc. Our aggregate standing of living has increased significantly over time. There is so much to like about the inventiveness of people and societies over time. However, history is replete with myriad of examples of individual companies, industries and sectors that lead returns in one period that fail to maintain their prowess and dominance in others. Capitalism is dynamic and so are markets.

We don’t know when or what will cause the next significant decline in the markets. There is never a proclamation beforehand that we can ‘take to the bank.’ That said, declines are part and parcel of markets, and they often occur unexpectedly. Sheldon Stone – a founding Principal of Oaktree Capital observed that “The air goes out of the balloon much faster than it went in.” That being the case, we think it’s necessary to expect the unexpected and actively ask what could upset the apple cart when things are going swimmingly. Conversely, history shows that markets turn up meaningfully well ahead of the official ‘all-clear’ signal.iii

Because markets travel farther up and down a great deal more than the economy or a given market segment’s sales and earnings, we actively monitor valuation metrics (e.g., things like the PE or price to sales, book value or cash flow metrics). Are we looking for clairvoyance? Not at all. The good news is market segments including those that make up the U.S. stock market do not move in lockstep. That’s why we are committed to maintaining diversification in order to help safeguard against the risk of being concentrated in the wrong segments at the wrong times. That’s why ownership of ‘ziggers and zaggers’ (securities that perform differently over time) is essential to our process. Our consideration of valuation metrics aids our ability and willingness to avoid excessive ownership of very popular securities to own securities that have a recent, often-multi-year record of yielding disappointing results.

As always, we welcome your questions and views.

W. Richard Jones, CFA

Partner, Harmony Wealth Partners

i “We have Met the Enemy and He is Us.”

The quote above is from a U.S. Navy commander to General William Henry Harrison during the War of 1812. When you think about it, we humans are to blame for the tendency for markets getting out-of-kilter on the high and low side. Near epic tops memories of pain and loss have receded substantially. Also, we are most influenced by the events we actually experience. Reading about economic and market history simply pales in comparison to what we experience directly. For relatively new investors, markets have been rewarding and incidences of pain have been relatively fleeting. By comparison, international markets have generally been disappointing investments. The prevailing sentiment of many investors seems to be – ‘We're number 1. We never lose, it's just a question about how much higher we will go and how soon we will get there.’ Then, after periods of sustained losses and continued bleak news in the economy, it is simply hard to envision better days lie ahead - at least not anytime soon. We do our utmost to help avoid the common mistakes that many investors including professionals make when they become excessively emboldened to take risk or hide out in the comfort of cash.

ii Cliff Asness is the co-founder of AQR Capital Management (a quantitative hedge fund).

iii

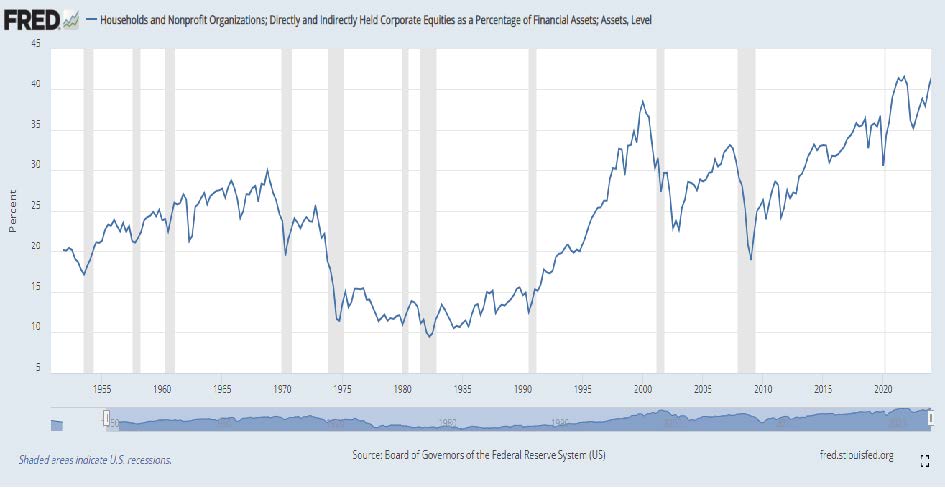

I found this chart interesting. Notice that in bear market environments, stocks tend to account for a relatively low percentage of most peoples’ financial assets. Today they are higher than ever including the 2000 market top and much higher than the 2009 bear market low. Of course, this ratio could still go higher. That said, it can be helpful to place current conditions in the context of history and ask how might the trend change?

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of W. Richard Jones and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.