Rate are higher - now what?

Monthly Update – October 2023

Written By: Greg Reabold – Financial Advisor | Raymond James

Why should you care – the opportunity to grow your wealth

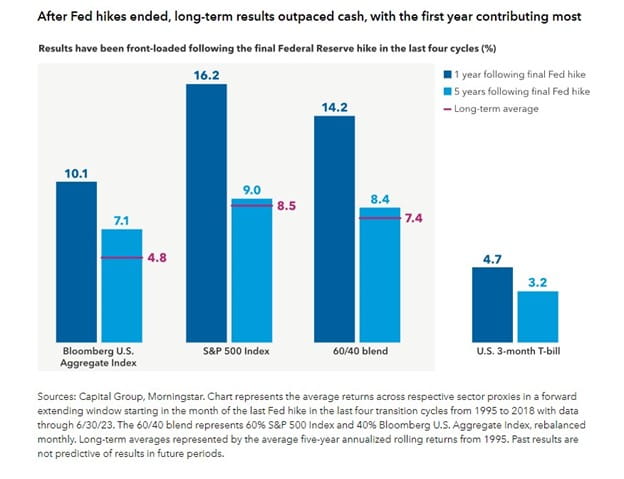

Yes, rates are higher. Yes, inflation is stickier than what the “experts” predicted. Yes, rates may stay higher for longer than anticipated. But, eventually, rates will plateau and likely decline – although, I don’t think we will return to the ultra-low rate environment we have seen in the last several years. When the Fed stops raising rates, I believe there will be opportunities to grow your wealth. The below picture outlines the performance of bonds, stocks (S&P 500), a mix of both stocks and bonds, and the US 3-month T-bill (cash) after the Fed stops raising rates. This data is based on the last four transition cycles we have had in the economy from 1995 – 2018. You can see that the risk assets – stocks and bonds – have historically provided better returns for investors. In particular, bonds have provided significantly above average returns for investors after the Fed hikes end.

Challenging Market – Where we came from

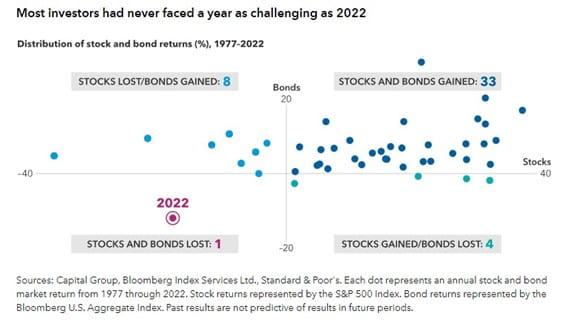

2022 was a challenging year. As I have shared in previous communications, it was a tough year not because of the volatility we saw in equity markets, but because of 1) The volatility we saw in the Fixed Income Market and 2) The fact that both stocks and bonds had a negative return for the year. As you can see from the below picture, 2022 was quite an outlier!

Cash Rush

In response to the inflation of recent years, the Fed has raised interest rates, which is what caused the volatility in Bond prices last year. This raise in interest rates has had a positive impact: increasing the return on cash alternatives such as money market funds and CD’s to north of 5%. The combination of the volatility and the increased rates on cash returns has led to many investors fleeing to cash alternatives – and it’s hard to blame them!

What Comes Next

Prediction is difficult – particularly when it involves the future. – Mark Twain

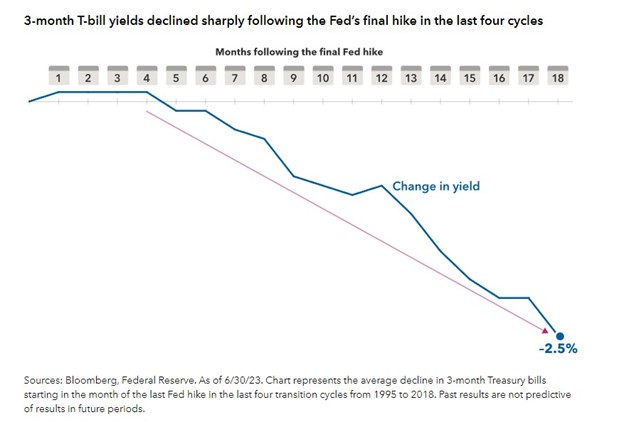

Trying to predict the future is a silly endeavor. Eventually, the Federal Reserve will pause their raising of interest rates. Whether that occurs in 2023, 2024 or 2025 is anyone’s guess. If you want to humor the “experts” by giving credance to their forecasts, many of them are predicting we could start to see them decline in 2024/2025. There is an old market adage that says: rates take the stairs up and the elevator down. This is generally because the Fed is slow to raise rates, but when they do raise rates it often slows economic growth. Sometimes this can lead to a recession. When economic growth stalls out, it is typical to see rates then get cut to try and stimulate economic growth. This is the normal ebb and flow of the economic cycle. When rates finally plateau, it is likely that you will see the interest rate you can earn on cash alternatives such as CD’s and Money Markets drop swiftly. The below picture outlines the significant declines in yields on the 3-month T-bill over the next 18 months after the Fed’s final hike going back to 1995.

Conclusion – if investing were easy, we would all be wealthier

Sitting in CD’s/Money Markets and earning 5% is a nice feeling – particularly after the last 10 years or so of low rates. Investing in risk assets such as stocks and bonds was never intended to be a smooth ride. There are times where your account values will decrease. This opportunity for your money to decrease is what creates the opportunity for your money to increase. History shows that as the Fed stops their rate hikes, those who are willing to provide their money with the opportunity to decrease are often rewarded with above average increases. Could this time be different? Sure. Should everyone rush into risk assets? No. What should you do? Have a tailored plan that provides you with the ideal return profile you need on your investments. If you need or want the types of returns that risk assets historically provide, you should be optimistic about the future.

Disclosures

Any opinions are those of Gregory Reabold and not necessarily those of RJFS or Raymond James. The information contained does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

CDs are insured by the FDIC and offer a fixed rate of return, whereas the return and principal value of investment securities fluctuate with changes in market conditions.