The Best Offense is a Good Defense

You’ve heard the term in sports, but it applies to your investments too. The best offense is a good defense. After years of market volatility, it’s a good time to reflect on your risk management strategy and your portfolio. For some, it is easy to generate returns in a bull market. Yet, bear markets expose investors without a defined investment strategy. This leads to magnified losses and emotional stress. Understanding investment risk and how to play defense with your money is crucial to preserving and growing your investments.

Minimizing losses preserves your investment capital, allowing you to maintain a larger pool of assets to generate future returns. When you suffer significant losses, a substantial portion of your initial investment is eroded, reducing your ability to participate in market upswings and potentially slowing down the recovery process. By minimizing losses, you retain a higher capital base, which can expedite the recovery of your investment value.

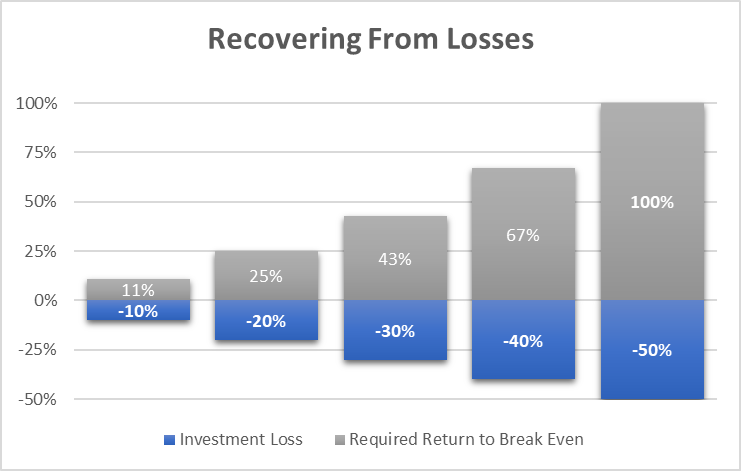

When you experience significant losses, the rate of return required to reach your original investment value becomes disproportionately higher. For example, a 50% loss necessitates a subsequent 100% gain just to break even. Whereas a 10% loss only requires an 11.11% return to break even. High return requirements increase the investment risk and extend the recovery period. Minimizing losses reduces the return needed to recover your money, making it more achievable and reducing the overall risk involved.

Lastly, and most importantly, reducing investment losses helps maintain your confidence and emotional well-being during the recovery process. Suffering significant losses can lead to fear, panic, and a loss of trust in your investment decisions. Emotionally charged investment decisions may result in impulsive actions or a reluctance to stay invested. By minimizing losses, you are more likely to maintain a rational and disciplined approach to investing, enabling you to stay the course and make informed decisions based on a long-term wealth building strategy.

Our advice - have a plan in place. Understand the risk exposures in your portfolio and how you plan to address them when market conditions change. And if this seems like too much of a task, work with a trusted advisor who specializes in risk and portfolio management. They provide experience and the technical know-how to give you peace of mind in any market environment.

- Brett Miller, CFA, CFP®

Financial Advisor, Glacier Advisors of Raymond James

Any opinions are those of Brett Miller and not necessarily those of Raymond James. This information is intended to be educational and is not tailored to the investment needs of any specific investor. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance is not indicative of future results.