Investing, a Life Skill: #4, Embrace Uncertainty

“Doing well with money has a little to do with how smart you are and a lot to do with how you behave.” – Morgan Housel, “The Psychology of Money”

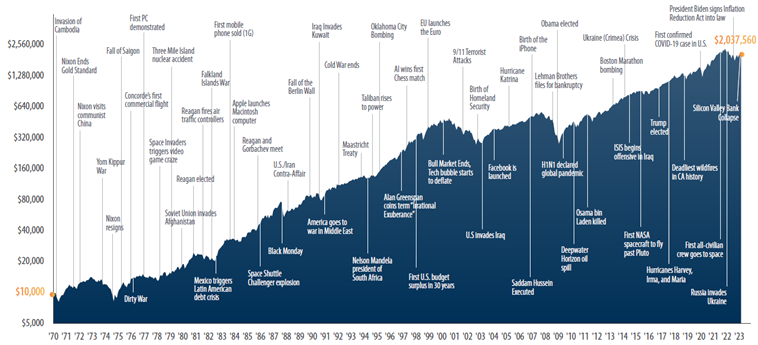

13% is the average annual return of the S&P 500 Index since 1980. As you see below this did not occur in a straight line, which is what we refer to as price of admission. The average market decline during each calendar year was -13%, reflected below through dips, corrections and bear markets. We invest through these periods, and believe investors who embrace this natural order of markets as the price of admission dramatically improve their odds of success.

This is not a recommendation to buy a security, and is shown for illustrative purposes only. Past performance is no guarantee of future results. Source: Calamos Investments and JP Morgan Guide to the Markets. Period shown represents the S&P 500 Index from January 1980 through December 31, 2022. Investors cannot invest directly in an index.

Viewed another way...markets nearly always face a “wall of worry,” each of which presents unique concerns and rationale not to invest. History has demonstrated that markets are resilient, and despite challenges (great and small) investors are rewarded by holding on and continuing to invest through these events. Accepting adversity, and investing in strategies which you have conviction in, will help during difficult times.

This is not a recommendation to buy a security and is shown for illustrative purposes only. Past performance is no guarantee of future results. Source: First Trust.