The Pursuit of Income, in a Low Rate World

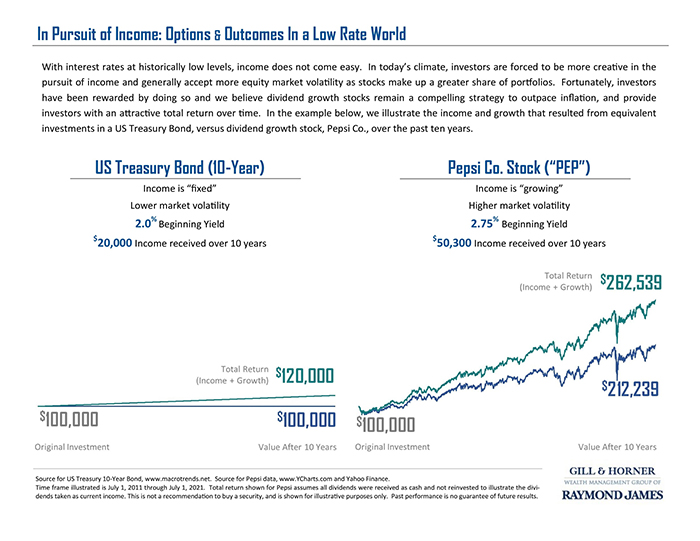

With interest rates at historically low levels, income does not come easy. In today’s climate, investors are forced to be more creative in the pursuit of income and generally accept more equity market volatility as stocks make up a greater share of portfolios. Fortunately, investors have been rewarded by doing so and we believe dividend growth stocks remain a compelling strategy to outpace inflation, and provide investors with an attractive total return over time. In the example below, we illustrate the income and growth that resulted from equivalent investments in a US Treasury Bond, versus dividend growth stock, Pepsi Co., over the past ten years.

Source for US Treasury 10-Year Bond, www.macrotrends.net. Source for Pepsi data, www.YCharts.com and Yahoo Finance.

Time frame illustrated is July 1, 2011 through July 1, 2021. Total return shown for Pepsi assumes all dividends were received as cash and not reinvested to illustrate the dividends taken as current income. This is not a recommendation to buy a security, and is shown for illustrative purposes only. Past performance is no guarantee of future results.