Stunning Savings in a Year of COVID

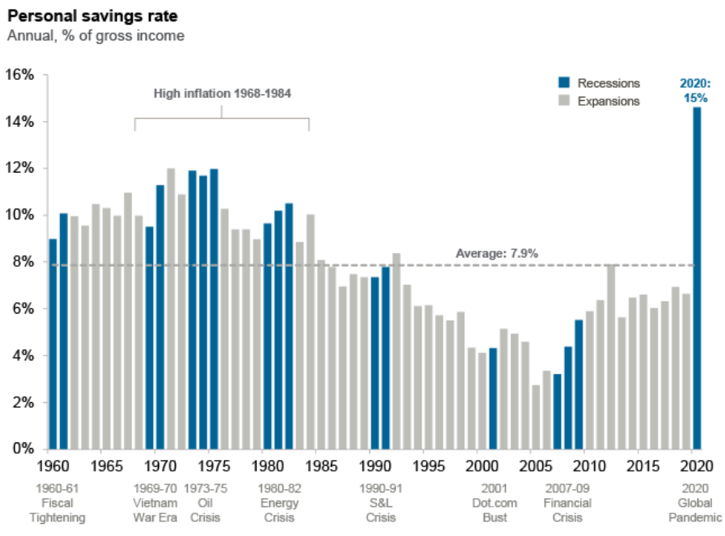

We just experienced the only recession where the personal savings rate hit a 50-year high. That is a stunning result during a global pandemic. American’s saved $1.8 trillion more than they would have had we not experienced a pandemic. That is an unbelievable backdrop for an economy that is reopening, and consumers ready to unleash pent up enthusiasm to travel and reconnect with experiences. We believe experiences are coming back, and investors are well served to own companies and sectors that benefit from this tailwind.

As we move beyond 2020, and the market volatility we endured, let us never forget the “fact of the year” related to markets. Missing the 5 best days last year would have resulted in a return of -21% compared to +18% for the S&P 500 Index.* Let that sink in.

Until next time…

Bryan

Chart Source: JP Morgan Guide to Retirement, Q1 2021

*Source: CNBC.com

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of [INSERT NAME] and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Past performance does not guarantee future results. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.