Comprehensive guidance to support your needs

An exit plan strategy for selling your business

Like most business owners, you may have a large portion of your net worth tied to the value of your business, but you probably don’t know exactly how much your business is worth or how you can actually exit from it in a sensible and tax-efficient manner.

Do you want a family member or key personnel to take it over? Or do you see yourself selling to an outside company? And if so, how do you go about doing so?

A sobering statistic is that only 30% to 40% of family-owned businesses endure through the second generation, and only about 13% are passed down successfully to a third generation, according to businessweek.com. Poor succession planning and unprepared next-generation leaders are among the reasons why.

If you don’t have qualified family members or business partners to succeed you, you may want to consider selling your business to your employees via an employee stock ownership plan (ESOP). It offers the flexibility to customize the sale of your business to fit your objectives and needs. We can help you determine if an ESOP sale is a feasible alternative for you.

The key, of course, is having a well-developed exit plan in place years before you actually leave the business. Without a plan, you run the risk of undervaluing or overvaluing your company, being unable to control the exit, paying too much in taxes, regretting selling (or not selling) your business, and failing to achieve your personal goals. There’s a lot at stake, which is why it’s wise to have a trusted guide like Encore Wealth Management of Raymond James.

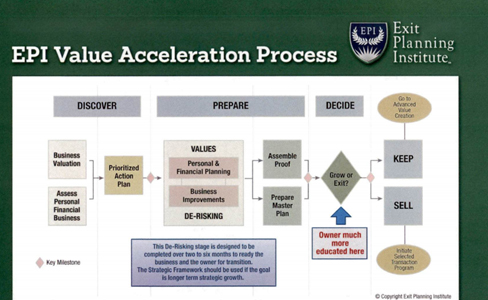

As a Certified Exit Planning Advisor, Charles Fischer is well-versed in effectively addressing the many personal, business and financial issues involved in growing and selling a business. The objective of the business exit plan he will develop for you is threefold: attempt to maximize transferable business value, ensure that you are financially prepared for the sale, and ensure there is a plan in place for “what’s next.” Our objective is to help you successfully transition from your business and prudently transfer your business assets to personal wealth.

Our services include:

- Business growth strategies

- Business action planning

- Cash management

- De-risking strategies

- Business valuation

- Benchmarking

- Exit option analysis and implementation

- Personal financial planning

- Personal wealth management

- Estate planning

- Charitable giving strategies