What you need to know: Tax Loss Harvesting

What you need to know: Tax Loss Harvesting

Many high-income professionals may receive incentives outside of salary or bonuses, like restricted stock units (RSUs), employee stock purchase plans (ESPPs) or Stock Options, but these plans don’t always come with directions on how to handle them.

Leveraging these incentives without careful tax planning and optimization strategies, may see your returns evaporate with taxes or leave you stuck with most of your portfolio locked in company stock.

Let me offer you a strategy that has the capability to help make a difference in your financial planning: Tax Loss Harvesting.

In this post, we'll explore:

- what tax loss harvesting is,

- who it's right for,

- the risks and limitations to keep in mind,

- and how to implement it effectively.

So, if you're a software engineer, or other high-income professional looking to optimize your financial plan, read on to discover how tax loss harvesting can help you achieve your goals.

What is Tax Loss Harvesting?

Tax loss harvesting is a strategy that takes advantage of the inherent volatility in the markets to help you keep more of your investment earnings. It works by selling investments at a loss and using those losses to offset some, or possibly all, of the capital gains (investments that you sold at a profit).

By selling securities that have declined in value from their purchase price, you can realize a tax loss that can help offset gains from other investments, or even your ordinary income, reducing your overall tax liability.

You might be saying – why in the world would I want to intentionally LOSE money on my investments?

- Imagine you are playing a game of tag with friends. You have a "safe zone" that you can run to where no one can tag you. But, there is one problem - you have to give up one of your stickers to use the safe zone.

- If you're in a tight spot and need to use the safe zone to avoid getting tagged, you might decide it's worth giving up one of your stickers. It's a trade-off - you lose one sticker, but you also avoid getting tagged.

- Tax loss harvesting works in a similar way. When you sell an investment at a loss, you're essentially giving up a little bit of your money (like giving up a sticker) in order to help reduce your tax liability (like avoiding getting tagged). By realizing the loss, you can help offset any gains you may have made from other investments, reducing the amount of taxes you owe.

- It's important to note that just like with the game of tag, you don't want to give up your stickers (or sell your investments at a loss) unless you really need to.

How it Works:

Tax loss harvesting works by leveraging naturally occurring volatility in the marketplace.

Let's say you invested $10,000 in a tech stock that has since dropped to $8,000. By selling that stock below the purchase price (cost basis), you would have a $2,000 loss.

That sounds nuts, until...

You also had a healthcare stock that performed incredibly well and saw the investment go from 10,000 when you purchased it to 18,000. You don’t want to have too much of this since you think it already made its run up, so you want to sell.

Those realized losses are then used to offset capital gains incurred by the sale of the healthcare investment. So instead of being taxed on a gain of $8,000 in that year, you instead pay taxes on $6,000. Or you re-invest those gains into something similar[1] to the tech stock you initially sold.

If your capital losses exceed your capital gains, you can even use up to $3,000 of those losses to offset ordinary income, such as your salary or wages.

Why does this work?

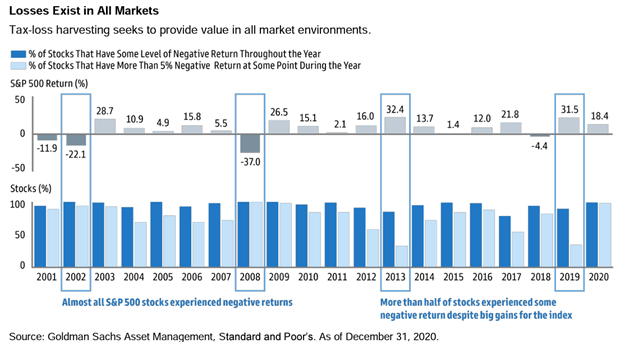

During a given year, even when an index such as the S&P 500 delivers a positive return, not every stock has a positive return throughout the year. Some stocks experience losses throughout the year, and may even end the year in the red.

When is Tax Loss Harvesting Right for You?

Diversifying out of concentrated stock positions

You have a lot of one investment, but you want to have exposure to more investments.

Many employees of publicly traded companies receive restricted stock grants as part of their compensation package, which can lead to a concentrated position in a single stock. Tax loss harvesting can be used to sell some of the shares at a loss, which can help to reduce the risk associated with a concentrated position while also offsetting any capital gains.

Rebalancing your portfolio

You win some, you lose some. Over time, your investment portfolio may become unbalanced as certain investments perform better than others. Tax loss harvesting can be used to sell investments that have lost value and offset any capital gains you may have realized, while also allowing you to rebalance your portfolio by reinvesting the proceeds from the sale into other investments that better align with your long-term goals.

Mitigating the impact of taxes on retirement savings

Nearing Retirement? For individuals who have invested heavily in tax-deferred accounts like 401(k)s or traditional IRAs, tax loss harvesting can be an effective way to help mitigate the impact of taxes on their retirement savings. By realizing losses in taxable accounts, individuals can help offset any capital gains they may have realized in tax-deferred accounts, reducing their overall tax liability and helping to ensure their retirement savings last longer.

| More Effective | Less Effective | |

|---|---|---|

| Tax Bracket | High Tax Bracket If you're in a high tax bracket, tax loss harvesting can be especially beneficial. This is because the tax savings can be more significant when you're paying a higher rate of taxes. |

Tax Bracket <24% Conversely, if you're in a lower tax bracket, tax loss harvesting may not be as effective. |

| Time Horrizon (How long until you need the money?) |

Long Term Strategy If you're planning to hold onto your investments for many years, tax loss harvesting can help you minimize your tax liability over time. |

Short-Term Strategy However, if you're a short-term investor who frequently buys and sells investments, tax loss harvesting may not be as useful. |

| Portfolio Makeup (How diversified is your portfolio?) |

Diversified Tax loss harvesting is most effective when you have a diversified portfolio with multiple investments that have gained and lost value. |

Few Investments If you only have a few investments, or if all your investments have appreciated in value, tax loss harvesting may not be as effective. |

But before you dive in, there's a handful of things you should know...

Risks and Limitations of Tax Loss Harvesting

- Understand the wash sale rule– The IRS wash sale rule is in place to discourage transactions made purely for tax purposes. A wash sale occurs when you sell or trade stock or securities at a loss and buy “substantially identical” stock or securities within 30 days before or after the sale (the “61-day window”). If you have a wash sale, the capital loss is not deductible that year.

- Beware Trading fees: Depending on your investment platform, tax loss harvesting can incur trading fees and other transaction costs that can eat into your returns.

- Portfolio disruption: Tax loss harvesting involves selling securities that have lost value and replacing them with similar, but not identical, securities. This can result in changes to your investments that may not align with your investment strategy. Additionally, if you sell a security that has declined in value and it subsequently recovers, you may miss out on potential gains.

- Select an appropriate cost basis – Understanding the implications of different cost basis methods on your client’s tax strategy is important. For tax loss harvesting on securities you may have purchased at different prices, select a method that allows you to sell holdings at a loss.

- Tax rate changes: Tax rates are subject to change, and what is beneficial now may not be in the future. While tax loss harvesting may be a good strategy for minimizing your tax liability today, it's important to keep in mind that tax laws can change over time.

- Net investment income tax: If you have significant net investment income, you may be subject to an additional 3.8% tax on that income, regardless of your tax bracket. This tax can impact the potential benefits of tax loss harvesting, so it's important to work with a financial advisor who can help you evaluate the impact of this tax on your investment strategy.

How to Implement Tax Loss Harvesting

Once you have determined that tax loss harvesting fits into your plan, here are steps to begin:

- Identify opportunities where the current stock price falls below the purchase price (AKA the investment’s “cost basis”).

- Sell stocks identified for harvesting (Make sure to confirm you are not within the wash sale window).

- Replace those stocks with securities that have similar risk and return characteristics.

- For example, you may decide to sell the stock of a large semiconductor that is trading at a loss and replace it with another stock or set of stocks—perhaps those issued by other large tech companies.

- Finally, keep an eye on your investments throughout the year to identify additional opportunities for tax loss harvesting.

DIY vs. professional management

There are two main approaches to implementing tax loss harvesting: you can either do it yourself or work with a professional financial advisor.

If you have the time, expertise, and desire to manage your own investments, DIY may be a good option. If you choose to implement tax loss harvesting yourself, you'll need to select the right software or platform to execute your strategy. Look for a platform that offers tax loss harvesting as a feature and has a track record of success.

However, if you're not confident in your ability to execute tax loss harvesting strategies effectively or don't have the time to monitor your investments closely, professional management may be a better choice.

Overall, tax loss harvesting can be an effective way to minimize your tax liability and optimize your investment returns. Whether you choose to do it yourself or work with a professional, it's important to understand the steps involved and carefully monitor your investments to maximize its effectiveness.

It's also worth noting that tax loss harvesting is just one of several tax optimization strategies available to high earning individuals. Depending on your individual tax situation, other strategies like contributing to tax-advantaged retirement accounts or making charitable donations may be more effective. It's important to work with a financial advisor who can help you evaluate your options and make informed decisions.

[1] beware wash-sale rules – you may not buy a similar security within 31 days of loss.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions expressed are those of Charlotte Galamb and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected. Past performance does not guarantee future results. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.