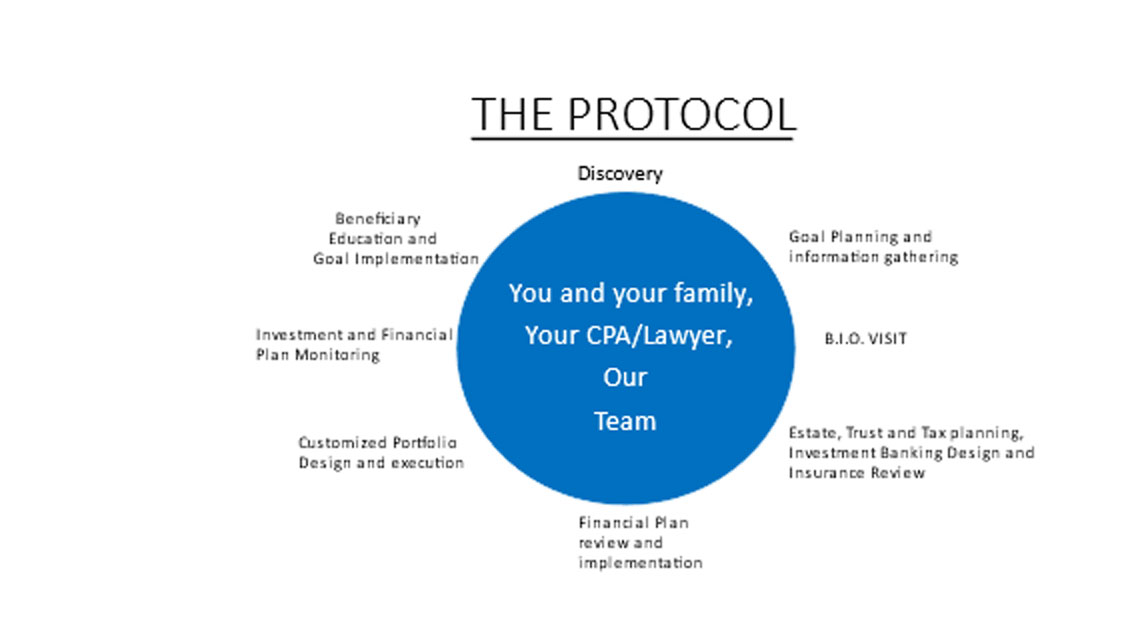

The Protocol

Our philosophy is simple – but by no means easy. First, we must understand the client and their specific goals, needs and concerns. Only then can we begin to manage the investments.

Our planning process is all about risk/return and making sure we achieve all your life’s goals without unneeded risks. We have a dedicated and proprietary process that allows us to make sure we achieve those goals with the exact level of risk needed. Unlike others, WE DO NOT CHARGE OUR CLIENTS FOR THE FINANCIAL PLAN! A doctor does not operate without a plan, nor do we invest without one.

We are dedicated to High and Ultra High Net Worth planning. Our process is thorough and all-encompassing and is something that other advisors can’t or won’t do but, we believe is the backbone to investing. The Protocol will take all your financial, personal, business and life’s goals into account, from Charitable giving down to buying that dream car, boat, or plane.

When finished, the plan will tell us the exact risk and return we need to attain to make sure we achieve all your objectives. How does it work…

-

This point over the process is the 30,000 foot view and is the beginning of the relationship. We will get to know you and you will get to know our team. To make sure we are a good fit for your needs, we will meet via phone calls and in person meetings to discuss your concerns, goals and current investment picture.

-

This is where the Journey begins! We start with a meeting where we ask the questions that will frame your wealth management strategy, examples are:

- What are your wishes and concerns?

- What is your family status?

- Do you have Business or Investment Banking needs?

- Insurance needs?

- Charitable inclinations?

- What Lending needs do you have?

- Do you have an Estate plan in place or Trust needs?

- What about your children and their education?

- Your elderly parents' needs?

- Retirement Desires (travel, income needs, cars/boats/homes?)

- What does your investment and debt picture look like?

- What does your risk profile look like? What causes you to lose sleep at night?

We will plan for the next 20,30,40,50 years of your life considering everything from car and home purchases to weddings, to the income you need to live on now and through retirement.

-

This is the single best day you can spend on your financial needs! For our HNW clients with net worth’s over 5 million dollars with more complex needs, we recommend a BIO visit to our home office in St Petersburg, FL.

The day is tailored, at your instruction, to fit your needs, concerns, and desires.

You will meet with the heads of our departments to address any estate planning, trust, tax planning, charitable desires, investment banking or lending needs. We also will bring in our HNW Private wealth consultants to review your current investment scenario along with a meeting with our investment strategists for a market overview. We have paid attorneys and CPAS on our staff to lay out any tax or trust planning needs for you to take back to your professional for drafting.

Here is an example of a BIO day…

8:00 am - 9:00 am PST Private Wealth Premier Solutions, Wealth Planning

Adam Nibert, CFP®, Vice President, Private Wealth Premier Solutions

John Hanlon, MSFS, CPWA®, ChFC®, CLU® PRIVATE WEALTH CONSULTANT9:00 am - 9:45 am PST Alternative Investments Group

Solitaire Dasher, CAIA®, Product Specialist

Cari Kearney, Regional Structured Investments Consultant10:00 am - 10:45 am PST Cash and Lending Solutions

Lauren Ahern, CPWA®, Director, Private Wealth Premier Solutions10:45 am - 11:30 am PST Raymond James Trust Company

Jamie Neilson , CFP®, CTFA, First VP, Managing Trust Officer

Bill Frazier, Trust Consultant1130-1pm Lunch with CEO/CFO or other senior RJ Executive

1:00-1:45pm Estate Planning and Private Wealth Strategy, Lawyer

Matt VanCleve, J.D., CFP®,1:45-2:15pm Investment Strategy

Anne Platt, Vice President, Investment Strategist2:15-3:00, Investment Banking

Sean Bunner, Director, Business Development, Investment Banking -

After the completion of the BIO visit or Goal Plan meetings our team will take all the information gathered and put together your financial plan. This will be a 50 plus page plan that will lay everything addressed out and give us an exact plan to use towards our investment strategy.

Using a number of sophisticated analytical tools — including The Monte Carlo Simulation, a dynamic financial forecasting method — to perform our own analysis of your investments, the plan will give us an exact risk metric for us to invest by, an annual return goal and a percentage outcome of achieving all your goals set for in the plan.

We will review the plan with you and make any changes needed before moving on to the investing stage.

-

We take a highly systematic approach to crafting your individual portfolio — never sacrificing long-term objectives for short-term fads. Balancing proven methods with innovation, we employ classic economic models while acknowledging the value of a little volatility and the importance of financial behavioral tends.

Drawing on these methods, we'll use what we've learned about you to develop personalized allocation, diversification and risk management strategies designed to direct your assets to growth and reduced volatility. We place special emphasis on ensuring that the risk taken in your portfolio matches your true risk tolerance needed to achieve your goals.

Examples of investment tools that we use are:

- Alternative Investments

- Structured Investments

- Tailored Fixed Income

- Stocks

- Mutual funds and ETFs

- Closed End Funds

- Insurance

- Private Placement Investments

- Options Strategies

Once You've approved our recommendations, we'll begin the process of putting them to work. As we implement the pieces of your plan, we'll handle all the practical affairs and paperwork and keep you updated each step of the way.

-

As the process continues, we remain committed to our protocol. We'll carefully and consistently monitor your portfolio's success, holding regular reviews and additional meetings as needed to keep you informed of the success of your plan and the factors affecting it.

As the markets move and your goals change, we'll take steps to ensure that your plan adapts to the changes.

-

Now that the plan has been implemented and the plan in place, we transition some of our focus to your other goals that may include:

- Beneficiary/Next Generation preparation and education meetings

- Charity Coordination

- Lending Needs

- Investment Banking and Business Needs

- Family Office Management

- Donor Advised funds

- Estate and Legacy Planning

- CPA and Attorney Coordination

- Long Term Care Preparation

- Credit Monitoring (in Partnership with EverSafe)

- Specialized Insurance (in Partnership with Marsh)

- Medicare Consulting (in partnership with ClearMatch)