Tarrifs

With President Trump announcing various potential tariffs on some of our trading partners, we thought it might be helpful to provide a little perspective on their potential effect on our economy and markets.

Tariffs are controversial with a lot of articulate, persuasive arguments both for and against. But most of history does not look kindly on the overall impact of tariffs.

Simply put, tariffs are taxes enacted on certain items that we import, and the cost of those items will generally go up for consumers. Does that cause overall inflation? No, but it increases the cost of those goods that were hit with tariffs.

However, it means that companies that manufacture products we use every day may have to now use more expensive components and recreate new supply chains that have provided the most cost-efficient manner of producing these goods. Foods, especially fresh fruits and vegetables could also become more expensive at the grocery store. And this means that we consumers will have somewhat less money to spend on other goods and services.

While tariffs may benefit certain protected industries in the U.S., which are easily seen and promoted by politicians- what is the real cost to the rest of us?

If the steel industry, as an example, can continue to sell steel at prices which are higher than would be paid if it were imported, then it may mean that more steel workers will be employed had tariffs not been implemented. But it also means that every steel item we purchase is going to cost all of us more.

So each consumer who pays a nickel more for a steel can of beans or $2,000 more for a new car has less money to spend on other items. But these issues are relatively invisible compared to the well represented and protected industries that are highlighted by the media, lobbyists and politicians.

We are all made aware of the “seen benefits” of certain policies, but what isn’t seen or doesn’t happen because of these policies goes unmentioned. The increased cost of steel may help the steel industry, but that means that since we pay more for steel products, we have less funds to buy a suit we might have purchased from our neighbor’s clothing store or a couple of dinners out at a local restaurant.

It is important to remember that the actions that never happened due to a policy don’t receive any attention. The new suit that was not purchased or the vacation that never happened don’t get any headlines. It is always the beneficiaries of certain policies that get the political and media attention.

While tariffs may cause a one-time increase in the cost of certain imported items, they do not cause ongoing inflation. It just means that we will have less to spend on other items. So for those other items to be purchased, their cost will have to come down to clear the market and keep inventories from building.

Inflation can only happen if the supply of money in our economy grows faster than our output of goods and services.

As Milton Friedman said, “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money that in output.”

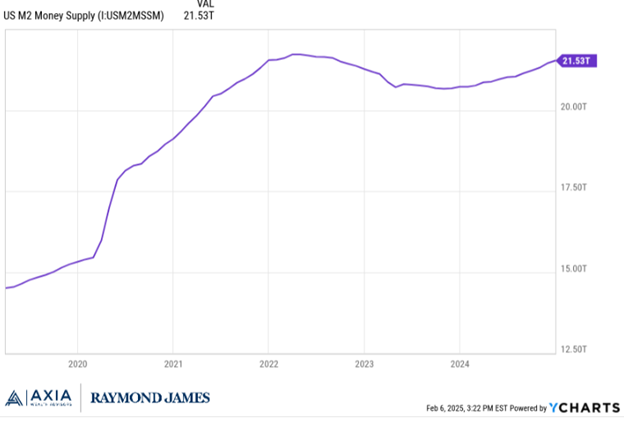

In other words, only Washington can create inflation by increasing the supply of money faster than the economy is growing. We saw that in vivid colors during the pandemic when inflation grew to 9%. The chart below shows the growth of the money supply and is why inflation took off during covid.

Also remember that tariffs can go both ways. Other countries that feel hurt by our tariffs on their goods, they can do the same to us. Which can then hurt domestic industries that export some of their goods.

Hopefully our new administration will consider all the consequences as they determine the trade policy for the U.S.

Regardless, the stock and bond markets are currently taking this in stride as they try to determine what is really going to happen.

As always, we are here to answer any questions or thoughts you may have and we will be in touch.

Thank you again for your trust and confidence in us.

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of John Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.