December Surprise

As 2024 comes to a close, it doesn’t mean that the markets have gone into hibernation yet.

On Wednesday Dec. 18, the Federal Reserve (Fed) met and announced another “rate cut” of ¼ of of a point, or 25 basis points in the Fed Funds rate. This is the rate that banks lend to each other overnight and is also what drives money market funds (MMF) rates. This is the shortest of interest rates and along with the discount rate, the only rate that the Fed can control.

This announcement brings the total “rate cut” from the Fed to 1% since their meeting in September when they announced a ½ point (50 basis points) cut in the Fed Funds rate.

The stock market usually likes rate cuts, as it forces MMF rates down and thus making cash a less attractive place to invest. The theory being as cash gets less attractive, more money will flow into stocks and other longer investments with higher expected returns.

But the Fed also announced Wednesday that the rate of inflation has not come down as much as they had expected in their September meeting. And consequently, they feel that fewer rate cuts are coming in 2025 than they had implied in their September meeting.

So on Wednesday after their announcements, both stock and bond markets had a day of indigestion with the stock market dropping about 3% and the ten year Treasury bond yield increasing about .10%.

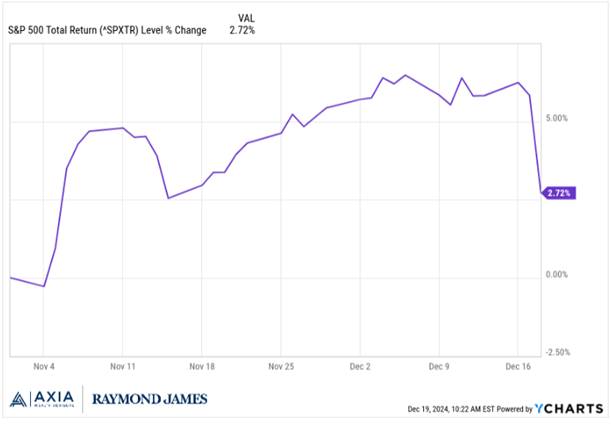

What happened? Well first the stock market had seen a big jump since the election, up almost 6% in the two months since the election. As the chart below shows, the SP 500 was up 6% after the election until Wednesday’s drop and is still up 2.7% since the election.

Also, longer term rates which are more concerned about the rate of inflation, has seen their yield increase significantly since the first “rate cut” in September.

These higher bond yields offer more competition for dollars as their returns get higher and thus more attractive to investors. So some money that may have gone into the stock market may now be more inclined to put a portion of that cash into bonds at these higher bond yields.

We use the ten year Treasury as an example because it is the most influential rate on mortgage rates, car loans, and many other rates that consumers and businesses pay. Below is a chart showing the increase in that ten-year yield since the “rate cut” announced in the Fed’s September meeting.

As you can see, the combination of interest “rate cuts” has actually increased rates in the bond, mortgage markets etc. by about 75 basis points.

Before the Fed’s announcement Wednesday, many stock market and bond market investors had been anticipating 4 more rate cuts in 2025. But they were now hearing from the Fed Chairman that the Fed is more inclined to be reluctant about future rate cuts due to the stickiness of the inflation data.

Hopefully this explains the more than 1,000 point drop in the Dow Jones Industrial Average on Wednesday, which was around a 3% drop. The chart below shows how frequent various levels of drops have been.

You can see that big ugly days are not infrequent, but they sure get our attention. Unfortunately, days like that are what we have to accept if we want to get the higher returns that the stock market has generated over the last almost 100 years as the chart shows.

Hopefully this helps you understand what happened and to understand that it is not unusual for us to have these “fun days” from time to time.

And Merry Christmas and Happy Holidays and Happy New Year to you and your family.

We are very grateful for your trust in us and we hope you enjoy your friends and family during this special period. And please do not hesitate to call with any thoughts, concerns or questions you may have.

Thanks,

Beach

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of John Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.