History

Raymond James Financial: Company History

In 1962, Bob James set out to build a different kind of financial services firm.

In the years since, that firm has grown to become a leader in its industry, dedicated to and driven by a focus on independence, integrity, conservative risk management and always putting clients first.

In the years to come, we’ll work to carry our success – and Bob’s legacy – to new heights.

Bob and Tom James, 1980

1960s

“We are in a people business, inside as well as out.”

– Bob James, Founder and CEO, 1962 to 1970

During its critical formative years, Raymond James expanded its service offerings, its workforce – even its workspace.

Tom James, the son of co-founder Bob James, joined the firm fresh out of Harvard Business School. Within a few short years, Raymond James had moved its client-first practice into an 8,000-square foot office.

1962

Our firm takes its first steps, incorporating as Robert A. James Investments.

1964

Edward Raymond sells Raymond and Associates to Bob James, with the agreement that Bob will name the new firm Raymond James & Associates. Soon after, Ed suffers a near-fatal car accident and never joins the firm. Bob, however, insists on keeping Ed’s name on the door, ahead of his own.

1965

Bob brings his brother Roy James on board to establish the firm’s Marketing department.

1966

The Dow Jones Industrial Average closes at 838.92, and Raymond James reports revenue of $3.3 million.

1966

Bob James’ son Tom joins the firm full time.

1967

We expand our capabilities with the formation of the firm’s Investment Banking division.

1968

From humble beginnings in an apartment building on 3rd Avenue N., we graduate to an 8,000-square-foot space on downtown St. Petersburg’s Central Avenue.

1968

We continue expanding our offerings with the establishment of a general insurance agency, known today as Raymond James Insurance Group.

1968

Investment Management & Research, Inc. (IM&R), later part of Raymond James Financial Services, is formed to engage in investment banking activities and reaches the $1 million revenue mark.

1968

The firm opens specialist operations on the Philadelphia Stock Exchange to support institutional clients.

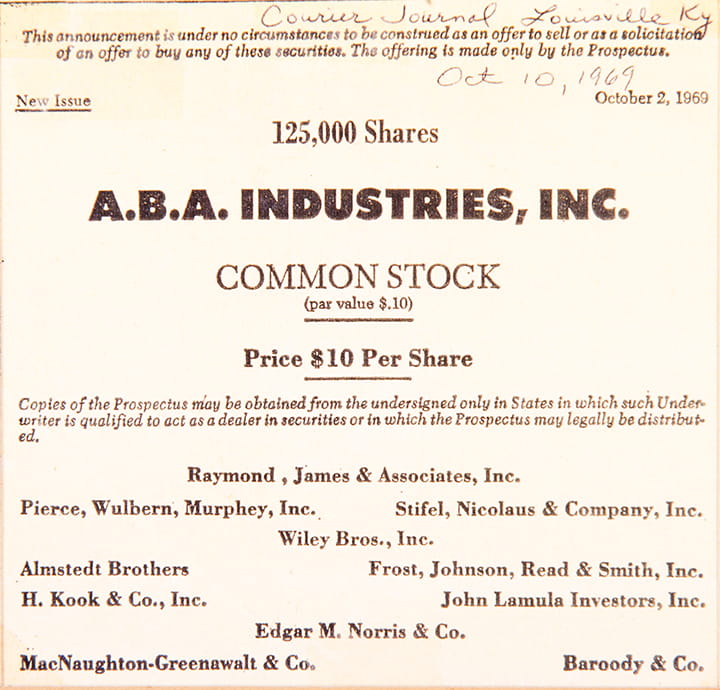

1969

Our first successful stock underwriting, for ABA Industries, is complete.

1969

Raymond James Financial officially incorporates as a holding company.

1969

The firm files for an initial public offering with the SEC, but market conditions put the move on hold.

1969

Raymond James begins recruiting from top business schools to support ambitious growth objectives.

1970s

“As my father always said, ‘It’s all about the people.’ If you don’t have the best people, if you don’t constantly refresh your universe of people by bringing in new talent and motivating those already here, then you can’t be successful in the long run.”

– Tom James, Chairman and CEO, 1970 to 2010

Eager to build on a promising start, Raymond James moved confidently into its second decade.

Tom James, the son of founder Bob James, was named CEO at the start of the decade, and in 1973 Raymond James gained a seat on the New York Stock Exchange, helping to ensure the best execution for clients.

1970

After deciding to devote his time to serving individual clients and training financial advisors, Bob James names his son Tom CEO.

1971

The firm’s first computers are introduced to improve the efficiency of day-to-day operations.

1971

The Dow Jones Industrial Average closes at 858.71, and Raymond James reports revenue of $6.2 million.

1972

We again expand our offerings as the Equity Research department begins operations.

1973

To help ensure the best execution for clients and to reflect the firm’s growth, Raymond James & Associates gains a seat on the New York Stock Exchange.

1973

The firm begins offering formal classroom training to associates, leading to the formation of Raymond James University.

1973

During the economic downturn of 1973 and 1974, with the survival of the firm in the balance and capital reserves dwindling, Tom James sells off portions of his prized rare coin collection to help keep our doors open.

1974

Investment Management & Research (IM&R) reactivates as an independent contractor broker/dealer.

1975

Raymond James acquires Financial Service Corporation (FSC) and folds it into IM&R, forming the first large-scale network of independent financial advisors.

1976

The firm begins offering correspondent clearing services to independent broker/dealers.

1976

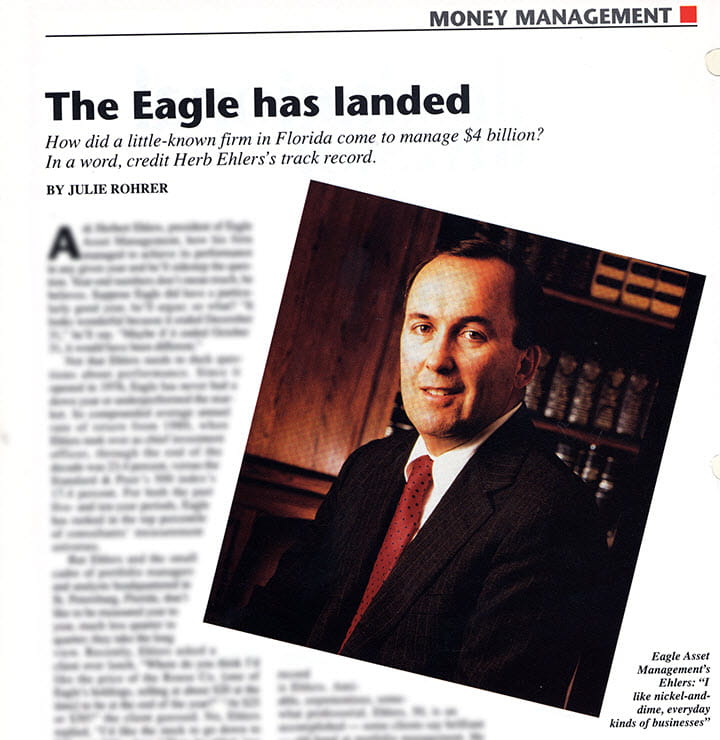

Raymond James Asset Management, later Eagle Asset Management and today one of the firms that make up Carillon Tower Advisers, is formed.

1979

Financial Planner magazine names Bob James the most prolific leader of financial planning seminars in history.

1980s

“It all begins with listening to people and accurately assessing their true financial needs.”

- Bob James

The decade dawned as Raymond James posted its first year with net income of more than $1 million.

But bigger events were in store. In 1983, Raymond James celebrated a day many years in the making as the company went public with a $14-million initial public offering. While that celebration was both delayed and dampened by the untimely death of the firm’s founder Bob James in May of the same year, the firm’s employees were heartened by the strong future built on the father of financial planning’s legacy.

1980

Raymond James surpasses $1 million in net income for the first time.

1980

Robert Thomas Securities is formed as an independent contractor broker/dealer.

1981

Herb Ehlers takes the reins at Raymond James Asset Management, which in 1984 he renames Eagle Asset Management.

1981

The Dow Jones Industrial Average closes at 1546.67, and Raymond James reports revenue of $81.2 million.

1983

Raymond James founder Robert A. “Bob” James dies. His legacy was not only a firm focused on financial planning, but a people-centered approach to business that inspired those who knew him.

1983

After a 14-year delay, Raymond James goes public with a $14-million initial public offering.

1983

The firm’s stock is listed on the NASDAQ.

1984

The firm spends Presidents Day weekend moving into new headquarters on 66th Street in St. Petersburg.

1984

Our offices on 66th Street in St. Petersburg.

1985

Raymond James pays its first dividend.

1986

The New York Stock Exchange approves Raymond James stock for listing under ticker symbol RJF.

1986

With this certificate, our NYSE stock listing is official.

1987

We complete construction of Tower 1 of the Raymond James Financial Center, located in the Carillon office park on 15 acres of former swampland.

1987

A bird’s-eye view of our Carillon campus.

1987

On October 19, 1987, known as “Black Monday,” the stock markets experience a dramatic plunge that prompts many firms to shut down their trading desks and turn off their phones to minimize losses. Raymond James refuses to do the same. Our desks stay open to help meet clients’ needs, resulting in our first and only unprofitable quarter since the firm went public in 1983.

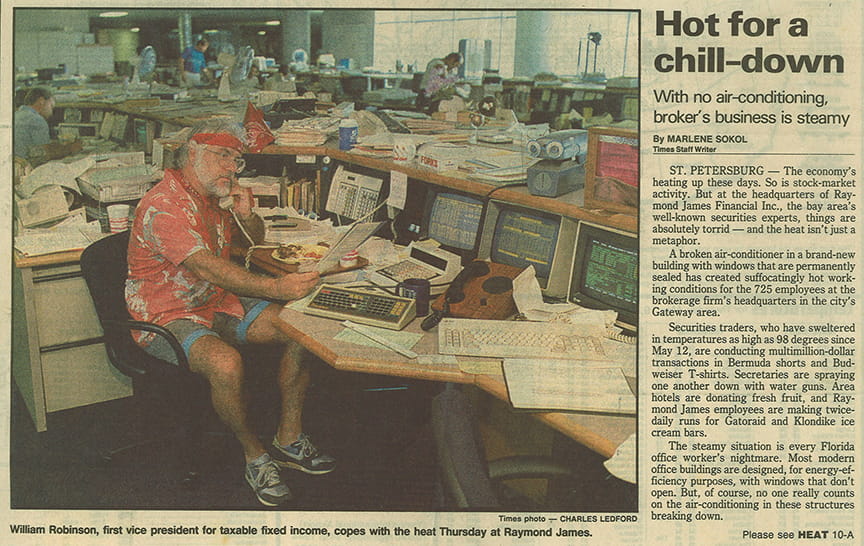

1988

Raymond James associates prove they’re made of sturdy stuff, and garner international notice, when they endure an eight-day air conditioning outage – and 90◦+ temperatures – with panache.

1988

Our air conditioning outage makes headlines.

1989

Our research and asset allocation results make their national debut in *The Wall Street Journal*.

1990s

“The fact is that commitment to clients and commitment to financial advisors is sacrosanct.”

– Tom James

During a decade of prosperity, Raymond James reached several milestones.

In 1994, Raymond James Bank was founded as a savings and loan association, enhancing the firm’s offerings to include the benefits of a national charter for advisors and client.

1990

Our corporate culture and long-held commitment to client service is codified and given a name: Service 1stSM.

1991

The Dow Jones Industrial Average closes at 5172.12, and Raymond James reports revenue of $554.1 million.

1992

Our newest subsidiary, Raymond James Trust Company, forms.

1994

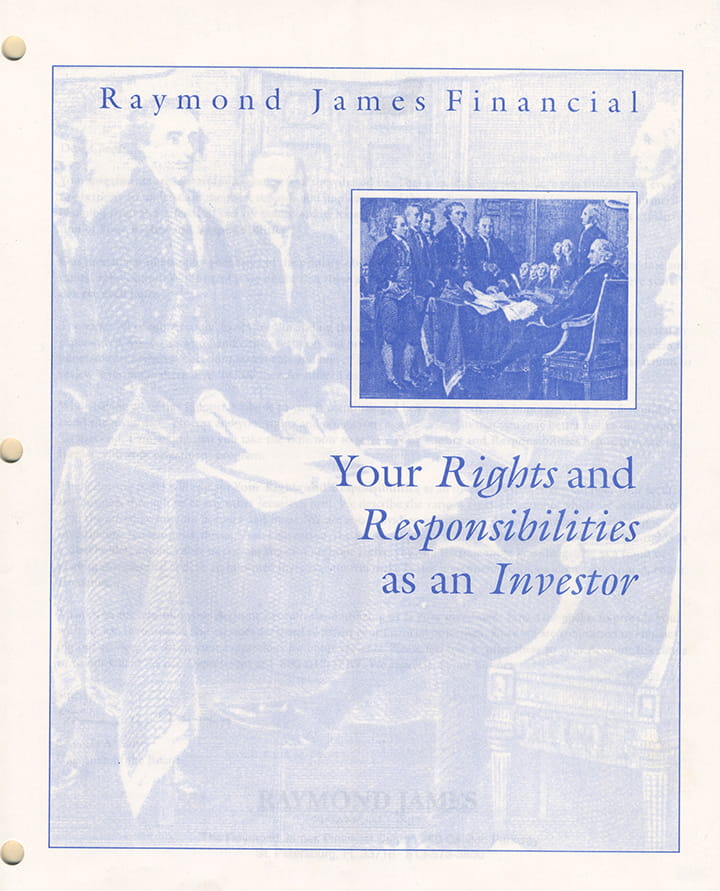

The firm publishes the Client Bill of Rights, penned by CEO Tom James, which sets the standard for our industry.

1994

The Raymond James Client Bill of Rights.

1994

Raymond James Bank is founded as a savings and loan association (S&L) to offer the benefits of a national charter and to provide even more resources to advisors and their clients.

1995

The Dow Jones Industrial Average hits 5,000 for the first time.

1996

The firm takes another step into the digital age, offering clients access to their account information on raymondjames.com.

1997

Raymond James International Holdings, Inc. is established, expanding international operations and bolstering the firm’s presence in cities like Paris and Geneva, Switzerland (offices established in 1987 and 1988, respectively).

1998

Raymond James Bank completes nationwide introduction of residential lending products.

1998

Raymond James becomes the title sponsor of the Gasparilla Festival of the Arts, which has been held in Tampa since 1970.

1998

The firm purchases the naming rights to Tampa’s new stadium, and the Bucs help christen Raymond James Stadium® with a win over the Chicago Bears.

1998

Raymond James Stadium’s opening day, September 20, 1998.

1999

Our independent contractor subsidiaries IM&R and Robert Thomas Securities merge to form Raymond James Financial Services.

1999

We begin offering online trading to clients through their financial advisors.

1999

We make our most significant acquisition to date with the addition of Detroit-based regional broker/dealer Roney & Co.

1999

The Dow Jones Industrial Average hits 10,000 for the first time.

2000s

“The best way to ensure the firm’s long-term success is to focus primarily on our clients’ needs.”

– Bob James

From the beginning, Raymond James put clients first because it was the right thing to do.

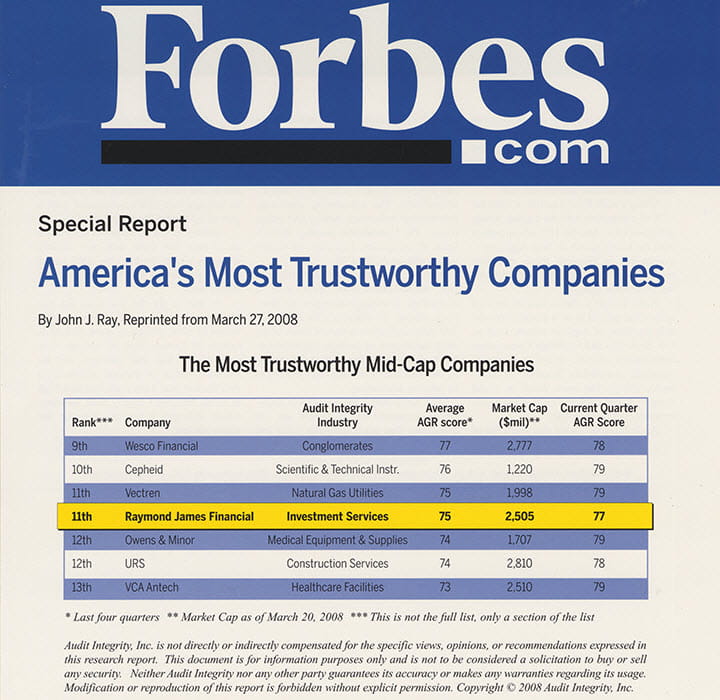

That commitment was honored in 2008, when Forbes.com recognized the firm as one of America’s Most Trustworthy Companies and one of America’s Best Big Companies.*

*The Forbes rankings for “America’s Most Trustworthy Companies,” are compiled by financial analytics company Audit Integrity after it assesses companies for the integrity of their operations. The Forbes rankings for the “400 Best Big Companies in America” are based on stringent criteria including accounting and governance ratings, revenue, positive equity, long-term earnings growth and debt-to-capital ratios.

2001

Raymond James acquires Canadian firm Goepel McDermid to form Raymond James Ltd.

2001

Raymond James Stadium plays host to Super Bowl XXXV and the Baltimore Ravens’ defeat of the New York Giants.

2001

As a result of its growth, the firm is named among the Fortune 1000 for the first time.

2002

Raymond James makes its debut on Fortune’s Most Admired Companies list.* *Fortune ranking based on an average score of nine key attributes of reputation: innovation, people management, use of corporate assets, social responsibility, quality of management, financial soundness, long-term investment, quality of products/services, and global competitiveness.

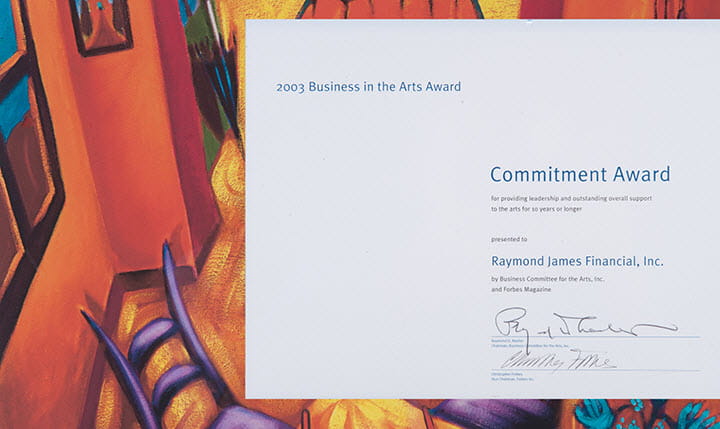

2003

Raymond James is honored with the national Business in the Arts award.

2004

Construction is completed on the fourth tower of the Raymond James Financial campus.

2004

Governor Jeb Bush and the Florida Cabinet recognize Tom James as the 2004 Florida Free Enterpriser of the Year.

2005

The firm purchases a 38,000-square-foot space in Southfield, Michigan, to serve as an operations center and business continuity hub.

2008

Raymond James is ranked highest in both investor satisfaction and employee advisor satisfaction by J.D. Power and Associates.*

*Raymond James received the highest numerical score among full service brokerage firms in the proprietary J.D. Power and Associates 2008 Full Service Investor Satisfaction StudySM. Study based on responses from 4,528 investors measuring 19 investment firms and measures opinions of investors who used full-service investment institutions. Proprietary study results are based on experiences and perceptions of consumers surveyed in April-May 2008. Your experiences may vary. Visit jdpower.com.

2008

Forbes.com names the firm one of America’s Most Trustworthy Companies and One of America’s Best Big Companies.*

*The Forbes rankings for “America’s Most Trustworthy Companies,” are compiled by financial analytics company Audit Integrity after it assesses companies for the integrity of their operations. The Forbes rankings for the “400 Best Big Companies in America” are based on stringent criteria including accounting and governance ratings, revenue, positive equity, long-term earnings growth and debt-to-capital ratios.

2008

Tom James is named Ernst & Young’s National Entrepreneur of the Year in the financial services category.

2009

Raymond James Stadium hosts its second Super Bowl – Super Bowl XLIII, where the Pittsburgh Steelers triumph over the Arizona Cardinals.

2009

We bolster our mergers and acquisitions business with the acquisition of Lane Berry & Co., a middle market investment banking and advisory firm.

2010s

“This really is a client-first, long-term-focused organization. It’s something that’s been woven into our core values from the beginning and something we take great pride in.”

– Paul Reilly, CEO, 2010 to present

In 2012, Raymond James celebrated 50 years of taking a personal approach to long-term financial planning.

The same year, the firm positioned itself for the future, joining forces with Morgan Keegan to become one of the nation’s largest wealth management and investment banking firms not located on Wall Street.

2010

After 40 years as CEO, Tom James is succeeded by Paul Reilly. Tom remains Chairman of the Board.

2010

Financial Planning pays tribute to Tom, his ongoing work and his lasting legacy.

2010

The firm launches a new national branding campaign in print, broadcast and online, anchored by a tagline that gets to the heart of what we do: Life Well Planned.

2011

We are named the best of the best in SmartMoney’s annual America’s Best and Worst broker survey.*

*Raymond James ranked No. 1 in SmartMoney’s annual ranking of full-service brokerage firms based on feedback from industry analysts, data on the performance of stock recommendations, customer satisfaction studies and intangibles such as use-friendliness of account statements and websites.

2012

Raymond James celebrates 50 years of caring for people and their financial well-being.

2012

Raymond James and Morgan Keegan unite to become one of the largest wealth management and investment banking firms in the country not headquartered on Wall Street.

2012

In an effort to expand our banking efforts north of the border, the firm moves to acquire the Canadian assets of Allied Irish Banks.

2013

Raymond James achieves its 100th consecutive quarter – and 25th year – of profitability.

Past performance is not indicative of future results. The information provided is for informational purposes only and is not a solicitation to buy or sell Raymond James Financial stock.

2013

Executive Chairman Tom James is named one of five recipients of the annual Harvard Business School Alumni Achievement Award, the school’s highest honor.

2013

Our former Global Private Client Group CEO Chet Helck marks the end of his tenure as chairman of the Securities Industry Financial Markets Association (SIFMA), where, among many accomplishments, he played an instrumental role in creating the “Helping Americans Succeed, Helping Main Street Prosper” campaign.

2013

M&A Advisor names Raymond James “Investing Banking Firm of the Year.”*

*The M&A Advisor awards recognize excellence in deal making, restructuring and financing and celebrate the contributions and achievements of leading firms and professionals.

2013

Raymond James is the 10th leading municipal bonds underwriter in the nation, according to Thomson Reuters, continuing more than a decade of top-10 performance.

2013

The Bloomberg Riskless Return Ranking shows that Raymond James produced the best risk-adjusted return of nine U.S. brokerages, banks and advisory firms since 2009.

2014

In February, Raymond James is again named among Fortune magazine’s most admired securities companies in the world.*

*Fortune ranking based on an average score of nine key attributes of reputation: innovation, people management, use of corporate assets, social responsibility, quality of management, financial soundness, long-term investment, quality of products/services, and global competitiveness.

2014

Global Private Client Group CEO Chet Helck retires and per the firm’s management succession plans, Scott Curtis and Tash Elwyn join the firm’s Executive Committee.

2014

Raymond James Bank marks its 20th anniversary with assets exceeding $12 billion.

2014

Raymond James is honored with the Golden Hammer Award and named “Habitat Partner of the Year” by Habitat for Humanity of Pinellas County.

2014

To strengthen our business continuity and digital security efforts, the firm constructs a state-of-the-art facility and relocates our data center to Denver.

2015

Raymond James completes the acquisition of The Producers Choice, LLC, a private insurance and annuity marketing company, and its 60 associates become part of Raymond James Insurance Group.

2015

The Dow Jones Industrial Average closes at 17168.61, and Raymond James reports record annual revenue of $5.2 billion and record net income of $502.1 million.

2016

The Tampa Bay Buccaneers will continue to call Raymond James Stadium home as the firm signs a new agreement to extend its naming rights through the 2027 season.

2016

Raymond James expands its investment banking capabilities in Europe with the purchase of Munich-based M&A advisory Mummert & Company Corporate Finance GmbH.

2016

MacDougall, MacDougall & MacTier Inc. (3Macs), which was founded in 1849 before Canada’s Confederation and remains one of the country’s leading independent investment firms, is acquired by our Canadian subsidiary, Raymond James Ltd.

2016

The firm completes the acquisition of the U.S. private client unit of Deutsche Asset and Wealth Management and revives the storied Alex. Brown brand.

- 114 W. 10th Street, Suite A Anniston, AL 36201

- T: 256.831.6311

- D: 256.403.6214

- TF: 866.315.6565

Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact our office for information and availability.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

© 2025 Raymond James & Associates, Inc., member New York Stock Exchange / SIPC | Legal Disclosures | Privacy, Security & Account Protection | Terms of Use