Growth Investing or Value Investing: Which Strategy Is Better?

In the world of investing, there’s a friendly rivalry that's been the talk of the town for quite some time. Picture this: on one side, you’ve got the value investing aficionados, and on the other, the growth investing enthusiasts. It’s somewhat the financial world’s take on the age-old cats versus dogs’ debate—each camp has its devoted followers, convinced they're backing the winning team. The ongoing tussle over which investment strategy produces the best long-term returns is still very much alive, fueling spirited discussions brimming with evidence and anecdotes from both sides. It’s a bit like how cat lovers and dog admirers tirelessly tout the virtues of their furry friends while playfully poking holes in the other’s choice. So, which investment philosophy takes the gold? This piece dives deep into the heart of this rivalry, taking a closer look at both strategies to see if we can declare a victor.

Growth Investing Simplified:

On one hand, we have growth investing which targets those high-flying companies poised for faster-than-average growth in revenue, cash flow, or profits. Picture these businesses as the ambitious new guys on the block, putting every penny they earn back into the business so they can continue to fuel their growth—be it hiring a fresh batch of talent, investing in the latest equipment and technology, or acquiring smaller companies that can add value to their business model. As a result, more often than not, these companies aren’t paying dividends because they are all about reinvesting that money to climb higher and grab a bigger slice of the market pie. Here’s a little heads-up for investors eyeing those growth companies though: they’re kind of like the roller coasters of the stock market. Their share prices tend to be higher than the broader market during good markets but can swing up and down from time to time. The reason for this is that a big chunk of their value comes from how much growth people think they’ll achieve in the future, so when perception is good, their price can increase quite rapidly, but when perception is bad, the opposite can happen. So, if you’re the kind of investor that has a greater appetite for risk and doesn’t mind volatility in your portfolio, betting on these high-potential players could be right up your alley, especially if you’re in it for the long haul and can ride out those ups and downs.

Value Investing Simplified:

Value investing, on the other hand, is all about playing the stock market’s version of a treasure hunt—digging around for those hidden gems whose stock prices haven’t caught up to their actual fair market value. These investors are always on the prowl for deals, snapping up shares that seem like a steal compared to their true worth, and then patiently waiting for the rest of the market to wake up and smell the coffee. And if that happens, voilà, the stock’s price climbs, and you make money. A lot of these value companies are well-established names with long track records of success who for whatever reason have fallen out of favor with the investing public. Also, they typically are profitable companies who pay substantial dividends, making for a nice little income stream as well. Now, while these value stocks might not promise the moon and the stars in terms of growth, they’re often seen as the steadier ships in choppy waters, appealing to those who prefer a smoother ride or have a short-term time horizon.

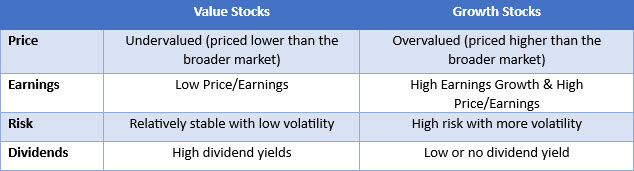

Growth vs. Value Stocks - A Technical Summary:

Historical Performance

Contrary to expectations, value investing has surprisingly been the dark horse that’s quietly led the race over the majority of the history of the stock market. And the key to its success, dividends, which have largely made up for the more modest stock price appreciation. But all that has changed in recent decades. Growth investing has been giving value investing a run for its money which can, for the most part, be attributed to historically low interest rates. With the extremely low interest rates we’ve been in over the last decade or so, money has been easy and cheap to come by, acting like rocket fuel for those high-flying growth companies. This easy access to cheap cash allows them to pump money into their operation and continue to invest in their growth, all without breaking the bank. Now, as the tide has shifted, and interest rates have increased, we might just see value investing make a comeback and reclaim its throne in the future. But as with all things in the market, only time can tell whether that’s true or not.

Which is Better?

Deciding between growth and value investing boils down to personal preference, how much risk you’re willing to stomach, your investment goal, and how long you plan to stay in the game. Market cycles are key players too, with value stocks often shining in bear markets and rough economic patches (relatively speaking) and growth stocks often soaring in bull markets and times of economic boom (relatively speaking). These market ebbs and flows should be top of mind when you’re planning your investment strategy. In addition, investors may also want to consider incorporating both philosophies into their portfolio, ensuring to allocate them in the best vehicles given their features.

If you are still struggling with what philosophy to incorporate or what specifically to invest in, please reach out to me directly and we can discuss your situation in more detail. Thank you for reading. I hope you found this article useful!

Any opinions are those of Yapheth Norris and not necessarily those of Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Russell 1000 Value Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and lower forecasted