Managing Significant Wealth Events

Sophisticated capabilities and elevated support to help you meet the unique demands of significant wealth.

Those who experience a significant wealth event can expect its privileges are matched by its challenges, its conveniences by its complexities.

Finding the right professionals – the right partners – is essential to rising to the unique demands of wealth, especially when that wealth arrives suddenly.

A significant wealth event refers to a meaningful increase in the liquid assets under your direct control. This can be the result of a planned milestone, such as the sale of a business, or an unexpected development, like an inheritance or a lottery win. Whatever the catalyst, this type of event is often followed by an array of changes. Friends, colleagues and even family members may start seeing you differently. You may see yourself differently, too.

That’s when you need a firm that knows that how much you have will never be as important as who you are. A firm that makes your well-being its highest priority. And that’s precisely what you’ll find at Raymond James. As your advisor, we’ll work with you to help ensure our firm’s far-reaching capabilities and time-tested strength can meet your every need. Together, we’ll provide you with pragmatic, personalized guidance designed to address every matter money touches, helping you establish a reliable foundation for today, tomorrow and years to come.

A refined approach to wealth management

In good times or bad, a significant wealth event usually requires careful management to help you preserve that wealth, provide income for your lifestyle and build your legacy. That’s why utilizing Raymond James’s wealth planning expertise can help develop a holistic plan for the wealth you received through:

- Sale of real estate or other family asset

- Capital markets transaction (e.g., IPO)

- Substantial inheritance

- Lump-sum retirement payout

- Divorce

- Legal settlement

- Exercise of stock options

- Unexpected financial windfall

- Success as an athlete or entertainer

No matter how wealth is created, it brings with it an assortment of fresh challenges and exciting opportunities. And as with any substantial amount of money, it should be carefully managed and preserved to help make it last as long as you need it to.

To make the most of your money today while preparing for what’s ahead, it’s essential to seek expert, impartial advice. Working with wealth specialists at Raymond James allows me to develop and implement a wealth strategy tailored to your unique needs. You can count on us to craft a strategic plan for the financial, legal and tax implications of your new wealth while also working to address its more emotional aspects.

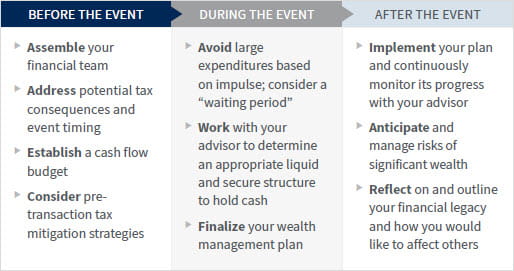

THE PHASES OF A SIGNIFICANT WEALTH EVENT

The timeline below illustrates the value of professional guidance throughout a significant wealth event by touching on general strategies that can be applied during each phase of the event.

THE IMPORTANCE OF PLANNING AHEAD

Planning ahead is an important part of any financial plan, and while you can’t predict all wealth-creation events, putting a plan in place is essential whether you anticipate that event or not. A holistic financial plan helps ensure that all facets of your new wealth – from your investment portfolio to your estate and tax plan – work in unison to help meet your needs and advance your objectives.

Additionally, while you can’t predict all wealth-creation events, there are some you may be able to anticipate, such as receiving an inheritance or retiring with significant corporate benefits. In these situations, it’s essential to recognize the importance of planning ahead.

Depending on how you receive your wealth, there will be key tax and estate planning implications to consider. For instance, if you own a family business or sizable real estate asset and wish to transfer wealth to family members or charities over time, we can determine the most tax-efficient strategies for doing so. In many situations, gifting partial ownership of the asset through trusts or a family limited partnership can provide greater tax benefits if it is done prior to the sale of the asset. This type of planning must occur well in advance, as some tax and estate benefits may be lost after the transaction is initiated.

Once we determine your unique objectives, we’ll strategize with wealth specialists before implementing a step-by-step process designed to help you ask and answer key questions, a process developed and refined over more than 50 years of helping uniquely successful individuals and their families.

A PLAN THAT ADDRESSES YOUR NEWFOUND NEEDS

In order to build and preserve newfound wealth, there are important steps to take ahead of the wealth-creation event. First, we’ll assemble a team of trusted professionals. You should also make sure to inform your accountant, lawyer and other advisors on your impending significant wealth event. Moving forward, you’ll want to:

EVALUATE YOUR LIFESTYLE

- Keep in mind that wealth will not only affect your life, but also the lives of those around you.

- There are important topics you’ll want to discuss with your loved ones, including early retirement, charitable giving goals and college funds for children or grandchildren.

ESTABLISH A FINANCIAL PLAN

- Working with your team of knowledgeable professionals, you should determine your short- and long-term goals, and focus on developing a documented plan and investment strategy to help you achieve them.

ANALYZE CURRENT INVESTMENTS

- A significant wealth event can cause your financial goals to change drastically, with capital preservation and income generation often taking precedence over future growth.• It is essential we discuss any of your new objectives and parameters.

If your wealth event will come from the sale of a business, our team can serve as your liaison to Raymond James Global Equity & Investment Banking, leveraging their deep expertise and sophisticated strategies for your benefit.

NAVIGATING A SIGNIFICANT WEALTH EVENT

It’s no secret that a significant wealth event brings with it financial and emotional changes. When you first receive your wealth, your primary objective may be to put it into secure, liquid investments with competitive yields, which you can then use to make other, longer-term investments. But there may be other options worth considering. Together, we can explore a variety of investment strategies and select a wealth management approach fit for your needs.

There are other important steps you can take to help ensure the success of your wealth management strategy. For instance, you should consider:

AVOIDING IMPULSIVE FINANCIAL DECISIONS

- New wealth can encourage you to make large purchases, give overly generous gifts and make rash investments. It’s important to protect yourself from making these costly mistakes.• Be prudent with borrowing, and consult me if you are considering taking out a loan or a line of credit.

ESTABLISHING A “WAITING PERIOD”

- A “waiting period” during which you will make no large outlays can help protect you from ill-considered spending. This will help ensure you take the time to thoughtfully consider how you wish to use your wealth.

FINALIZING YOUR FINANCIAL PLAN

- If your wealth-creation event was anticipated, you may already have a plan in place to help you reach your financial objectives.• If the event was unexpected, we can work together to assemble a team of professionals to establish your plan.

MONITORING YOUR TAX STRATEGIES

- A qualified tax professional can provide you with guidance on tax planning strategies catered to your individual situation.

PRIORITIZING YOUR PRIVACY

- Since money often attracts attention, you’ll want to guard your privacy and remain discreet about your newfound wealth.

LIFE AFTER A SIGNIFICANT WEALTH EVENT

Most wealth-creation events are inevitably followed by a period of adjustment. As your dedicated partner, we will be there to guide you through each step, from selecting investments to creating a diversified portfolio. Together, we can work to:

- Implement the various components of your financial plan, from estate and tax planning to investment and risk management.

- Monitor your cash flow and spending, carefully planning to help ensure your money lasts as long as you need it to.

- Manage risk, especially from financial fraud and frivolous lawsuits, and establish asset protection strategies.

- Create a lasting legacy and work to fulfill your philanthropic aspirations.

THE EMOTIONAL IMPACT OF WEALTH CREATION

Like any significant life event, sudden wealth brings with it an abundance of complex emotions. Psychologists have even coined a term for it: sudden wealth syndrome. This condition can manifest itself in a variety of ways, from reckless spending to withdrawing from family and friends. You can more easily address the emotional challenges of sudden wealth by relying on impartial, knowledgeable guidance from your wealth specialists. Working together, we can help you address these considerations, such as:

- Planning and preserving your estate

- Exploring the services available through our affiliate Raymond James Trust

- Giving to your favorite charities

- Funding a child’s or grandchild’s future

- Transferring wealth to the next generation

Emotional dynamics reinforce the need to assemble an experienced team of trusted financial professionals. Sharing your biggest concerns will allow us to create tailored strategies designed to address your unique circumstances.

A SEAMLESS, COORDINATED APPROACH TO WEALTH

Since 1962, Raymond James has been helping individuals like you rise to the demands of significant wealth. And as a Raymond James advisor, I’m equally committed to establishing long-term relationships based on personalized service and a thoughtful, deliberate approach to planning. In short, when we work together, your financial well-being will be at the forefront of everything we do – exactly as it should be. Our wealth services are supported by teams of professionals who leverage our firm’s national strength on a personal basis, giving you access to the full spectrum of our sophisticated, expansive services at Raymond James. Together, we can help determine how you can build, use and preserve your wealth through our menu of robust offerings:

- Investment management

- Estate and charitable planning

- Business succession planning

- Cash management and lending

- Risk management

Starting the conversation

To help inform our conversation regarding your significant wealth event, we’ve provided a short list of questions for you to consider. Please review them and discuss the appropriate points with your family so we can continue building your plan.

- Will this event and resulting wealth change my lifestyle or objectives significantly?

- How can I estimate my future living expenses and income needs?

- Can this wealth be my primary source of income going forward?

- Are there specific family members with whom I want to share my new wealth? If so, how will I accomplish this?

- What are my biggest concerns regarding the wealth event?

- Will I continue to work with my existing attorney and/or tax professional?

- What other relationships with financial professionals do I have or should I consider?

- Have I planned purchases or investments with the assets from this event?

- Have I and my existing professionals estimated the tax impact of the event?

- Are there specific charities I would like to support?

- Has my estate plan been updated to reflect my new financial situation?

When you’re ready, we will help you address these and other questions you may have. And as always, we look forward to providing you with the high level of personal service and professional attention you deserve. Today, tomorrow and for many years to come.