Earnings season off to a strong start

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The S&P 500’s 4Q24 earnings season has been scoring touchdowns

- The tech sector got blitzed by competition from China AI

- Despite weakness, mega-cap tech earnings are not offsides

Ready for the Big Game? This weekend will mark one of the most-watched television events of the year, with upward of 200 million people tuning in to see if Kansas City can make history with an unprecedented three-peat! With excitement building, the National Retail Federation expects Americans to spend a record $18.6 billion—a 7.5% increase from last year. Another area seeing a big surge is the cost of commercials, which have set a new record at up to $8 million for just a 30-second spot. This year, AI-themed ads are expected to be all the buzz. Speaking of AI, the Tech sector has been in the spotlight recently, with concerns about new entrants raising questions about the outlook for this highly-valued sector and sending some jitters through the market. Below, we provide an update on the 4Q24 earnings season and explain why our positive outlook on tech- related companies remains unchanged:

- 4Q24 Earnings Season Has Been Scoring ‘Touchdowns’ | The 4Q24 earnings season is off to a strong start. So far, over 75% of the S&P 500’s market cap has reported, with earnings on track to rise 14% year-over-year. This marks the sixth consecutive quarter of positive EPS growth and the best quarter of growth in three years. To date, 78% of companies are beating estimates, which is above the 5-year average, and in aggregate, they have exceeded estimates by ~7%. One of the most notable stories this earnings season is the broadening of earnings beyond mega-cap tech. In fact, S&P 500 earnings excluding mega-cap tech are up 10% year-over-year—the best pace of growth since 1Q22.

- Tech Sector Got ‘Blitzed’ By China AI | Broadening earnings have boosted market performance, with 10 out of 11 sectors delivering positive returns year-to-date. However, the Tech sector has lagged and is currently the only sector in negative territory. In fact, mega-cap tech (or MAGMAN, which includes MSFT, AAPL, GOOGL, META, AMZN, and NVDA*) has had its worst start to a year relative to the S&P 500 since 2013, trailing the S&P 500 by ~4%. While the overall market has managed to climb despite the weakness in mega-cap tech, it's crucial to have a perspective on where these companies are heading, as they collectively make up about 30% of the S&P 500. Despite recent market jitters, we remain optimistic about mega-cap tech for the following reasons:

- Mega-Cap Tech Earnings Are Not ‘Offsides’— While earnings have broadened beyond mega-cap tech, this does not mean that tech fundamentals have deteriorated. Although some mega-cap tech names traded lower after reporting their results, it's important to note that each company has beaten bottom-line estimates. In fact, MAGMAN is on pace to grow its earnings by approximately 27% year-over- year in 4Q24—well above the S&P 500’s 14% pace. With AI investment remaining a key focus for businesses (evidenced by a record number of AI mentions on earnings calls over the last three months across all 11 sectors) and consumers (AI search interest is near a record high), mega-cap tech earnings growth should outpace the broader market each quarter this year. Additionally, margins for mega- cap tech are expected to be nearly double that of the S&P 500 (25% vs. 13%), and MAGMAN’s dividend growth is on track to outpace the broader index. This leaves mega-cap tech on favorable fundamental footing.

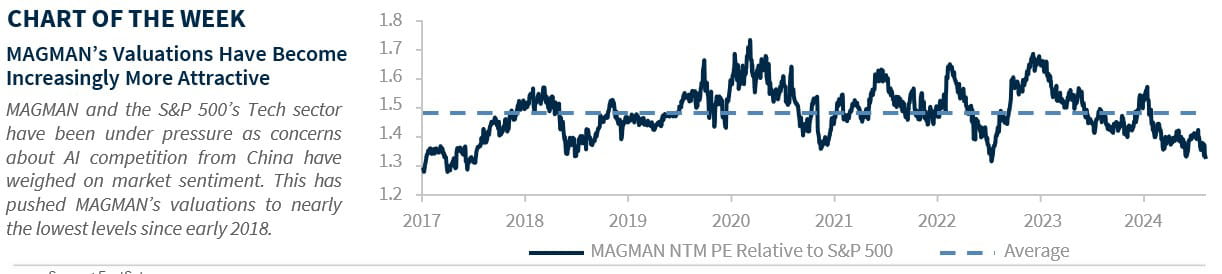

- Tech’s Recent ‘Fumble’ Has Made Valuations More Attractive—While mega-cap tech has outperformed the S&P 500 by ~100% since the start of 2023 (~157% vs ~58%), it has ironically become more undervalued relative to the S&P 500 over time. Why? Because its earnings have consistently outpaced the broader index. Currently, MAGMAN is trading at about a 30% premium to the S&P 500 on a next twelve months price-to-earnings (NTM PE) basis, which is well below the previous five-year average of ~50% and nearly the lowest level since 2018. With mega-cap tech consistently beating its quarterly earnings estimates by a larger margin compared to the broader market (10- year average ~9% vs. 6%), its recent underperformance has pushed valuations to attractive levels relative to the S&P 500.

- Mega-Cap Tech ‘Zone’ Is Bigger Than Just Tech—The Info Tech sector alone has the highest weighting in the S&P 500, exceeding 30%. However, mega-cap tech is much broader, encompassing companies in other S&P 500 sectors like Communication Services (e.g., Google and Meta) and Consumer Discretionary (e.g., Amazon). Including these other mega-cap names, the ‘tech-related’ weight climbs to ~45%. To put this into perspective, MAGMAN has a combined market cap of over $16 trillion—that's nearly five times the Russell 2000’s total market cap and roughly equal to the MSCI EAFE Index and close to the combined GDP of Germany, Japan, France, the UK, and Canada. This is why it's crucial to pay attention to these tech-related behemoth companies, as they dominate the performance of the S&P 500.

- Concerns About DeepSeek ‘Competition’ Overblown—Despite headwinds to the mega-cap tech space from the release of cheaper Chinese AI models and potential negative impacts on US AI investment, the 4Q24 earnings season has quelled those concerns. The four mega-cap tech names that have reported so far (MSFT, GOOG, META and AMZN) are unfazed by China’s AI and have reported that they expect to grow capex by ~49% Y/Y in 2025. This supports our view that AI infrastructure investments will remain strong through 2025 as these companies increase their capacity to meet demand, which should support the prospects of these companies.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.