What's Behind the Curtain? A Look Beyond the S&P 500's Top Ten

“Pay no attention to what’s behind the curtain” -- The Wizard of Oz. Once exposed, the Great & Powerful Oz wasn’t at all what Dorothy expected. Neither are the current S&P returns.

We’re pulling back the curtain to reveal the handful of stocks driving YTD returns in the S&P 500 index. The top 10 performers have contributed heavily to the index return while the other 490 stocks have detracted from it.

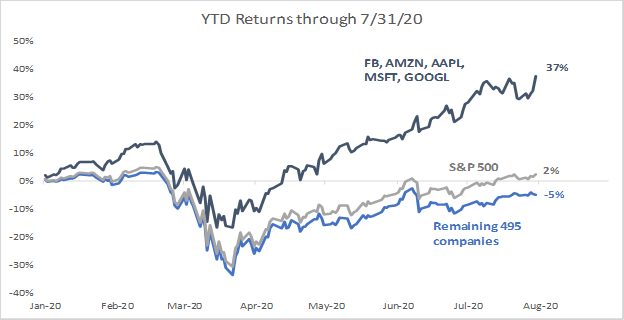

Using common broad market indexes (ie. S&P 500 Index) as a gauge of overall market performance is becoming increasingly misleading. As of 7/31/2020, the S&P 500 had a year to date return of + 2.38%. What is more interesting, detailed in the chart below, is the return variance in the 5 largest stocks (Facebook, Amazon, Apple, Google, Microsoft). Those stocks have a YTD return of +37% and the remaining 495 companies YTD return is -5%.

|

|

|

S&P 500 Weight (%) |

YTD return |

Cont to SP500 return |

|

Ticker |

Company |

bps |

||

|

AMZN |

AMAZON COM INC |

4 |

71 |

229 |

|

AAPL |

APPLE INC |

5 |

45 |

213 |

|

MSFT |

MICROSOFT CORP |

5 |

31 |

155 |

|

FB |

FACEBOOK INC |

2 |

24 |

49 |

|

NVDA |

NVIDIA CORPORATION |

1 |

81 |

48 |

|

PYPL |

PAYPAL HLDGS INC |

1 |

81 |

42 |

|

GOOGL |

ALPHABET INC |

3 |

11 |

35 |

|

NFLX |

NETFLIX INC |

1 |

51 |

31 |

|

ADBE |

ADOBE INC |

1 |

35 |

22 |

|

HD |

HOME DEPOT INC |

1 |

23 |

21 |

|

S&P 500 |

|

100% |

2% |

238 |

|

Top 10 contributors |

23 |

41 |

846 |

|

|

S&P 500 ex-top 10 |

77 |

-4 |

-608 |

|

Source: Putnam Investments Quantitative Equity Group

Source: Putnam Investments Quantitative Equity Group

Easily misunderstood index calculation methodology is responsible for the current situation. The S&P 500 Index is a market capitalization weighted index. You might think that the 500 stocks in the S&P 500 index that each stock would account for .20% of the overall total. Not so. Actually, the 10 largest stocks now make up 23% of the index weight and those 10 stocks are up 41% YTD. Bigger companies have a bigger weighting in the index. As a comparison, the S&P 500 Equal Weight Index has a YTD -6.45%.

Assessing and managing risk is more challenging than ever. If you invest in the stock market, it is important to take a close look behind the curtain and understand how risks are changing and in some cases compounding as a handful of stocks are doing the heavy lifting for S&P 500 returns.

If any of this has you asking questions or needing clarification, connect with us. Our deep bench of thought leaders and resources are here to help.

The S&P 500 is unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. This material is for informational purposes only. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.