Are Big Greedy Companies Really Buying All The Homes?

It seems like every month there is another mainstream media article telling us that the reason people can’t buy a home is because corporate America is buying all the homes. But are those headlines actually supported by the truth, and by data?

For example, the Tampa Bay Times published just such an article titled “How corporate investors are taking over Tampa Bay’s neighborhoods”.

The tone of this article is basically “you can’t buy a house because of big companies”. Our WWM team would find this article useful…..IF the data proved that to be true. We have no interest in defending any big company randomly. But the data proves the opposite point. Which leads us to wonder where the journalistic integrity has gone in this country.

The 2 writers of this article say “Large companies have amassed around 27,000 homes across three counties.” In the fine print at the bottom, the Tampa Bay Times specifically cites pulling data from 3 counties: Hillsborough, Pasco, and Pinellas.

There are 634,000 homes in Hillsborough County, 280,000 in Pasco County, and 520,000 in Pinellas County. (sources: each county’s website)

That’s about 1,434,000 homes in those 3 counties. Which means “large companies have amassed 1.8% of all the homes in those 3 counties.” Come on………a measly 1.8% of all the homes. Nowhere near enough to move the needle on home prices.

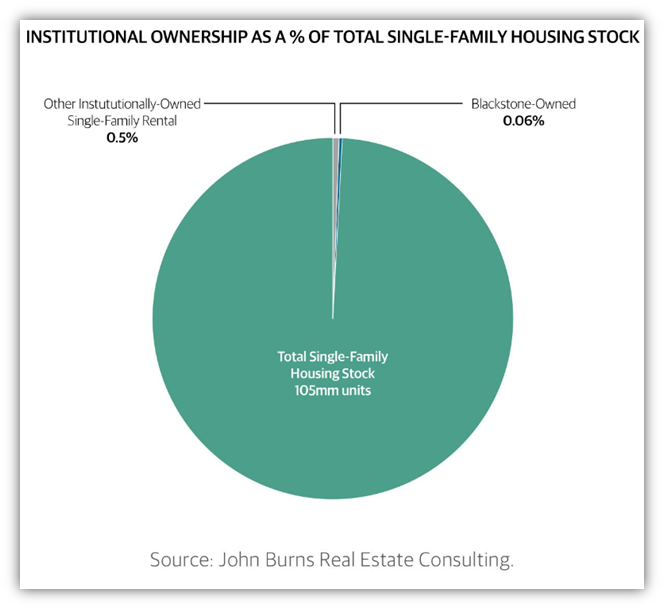

John Burns has some good data on institutional ownership and buying patterns.

Institutions own less than 1% of the more than 100+ million single-family homes in the United States:

It feels like the mainstream news media in the US was irretrievable corrupted upon the advent of the internet, in a chase for clicks and advertising revenue.

The reason homes are so expensive is mostly because the federal government continues to binge spend drunkenly as it has done for at least 25 years.

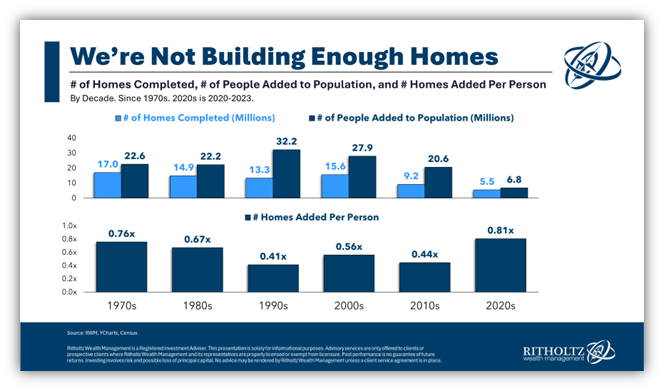

And the secondary reason is that home builders were disincentivized to build new homes after the 2008 great financial crisis, so there is a large supply shortage. Ben Carlson offered an excellent snapshot of this issue…

“Hitchen's Razor” states what can be asserted without evidence can be dismissed without evidence. The burden of proof is on the one making the claim. Hitchen's Razor cuts down unfounded arguments and superstition. Demand data, not inflammatory media rhetoric.

Authors: Connor Wagner & Rick Wagner

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.