Bitcoin Makes A Run, 2024

Bitcoin is in the news again as it moves higher, up 165% over the last year to a current value of about $43,400 per bitcoin.

Over the last 10 years, the average annual gain in bitcoin’s price has been a whopping 152%/year.

(Source: FactSet, Inc.)

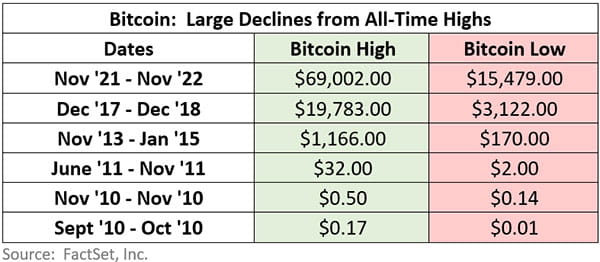

Owning bitcoin is no place for the timid, as its price has historically had some incredibly wild swings…

Bitcoin is the original cryptocurrency. The Bitcoin White Paper was published in late 2008, when the World was dealing with the Great Financial Crisis.

A time when the creator(s) of Bitcoin felt the banks had too much power over individuals, and the government seemed intent on printing an unlimited amount of new dollars (which waters down the value of existing dollars, often leads to inflation, etc.).

The Bitcoin Network was created because those people asked “How do we take some of the power back? Is there a way we can transfer value to each other without a bank, 24 hours/day, and without all the friction of the traditional banking system?”

And the Bitcoin Network was their answer.

People who operate on the Bitcoin Network are called miners. They process the transactions as they happen back and forth.

The founder(s) had to create an incentive for the miners to operate on the Bitcoin Network. And that incentive is bitcoin itself, the currency. Miners earn a bitcoin reward when they process transactions on the network.

One of the most remarkable things about the Bitcoin Network is that it is everywhere and nowhere, all at once. Sort of like the internet. It is made up of millions of computers which operate around the globe (the miners), using a transparent, democratic, incentive-based process for processing transactions. There is no centralized hub, no “Bitcoin Headquarters”, no CEO of Bitcoin, and no board of directors or group of humans which control the Bitcoin Network.

A few possible use-cases for bitcoin:

- A store of value. Some people believe that gold is a useful store of value. Buy some gold bars, store ‘em away. Carry them with you when you move. Bitcoin enthusiasts would ask “do you know how heavy a bar of gold is? And how sure are you that you can protect your gold from being stolen? And even if you can carry & protect your gold, do you realize that the price of gold has barely kept up with inflation over the last 4 decades?” (source: Jeremy Siegel)

- A method of payment. Right now, it is difficult to envision buying a cup of coffee or a television with bitcoin. The price soars and dives faster than the Blue Angels. But bitcoin advocates suggest that if (when?) the price becomes more stable, bitcoin may offer an almost frictionless low-cost method for making transactions, even across international borders.

- Cross-border asset movement. Imagine you are a successful person who lives in a country where a coup has been staged. A violent overthrow of the government. And the new government leaders have taken over the corporations and banks, and are trying to lock down the citizens. If your money is in a traditional bank inside that country, it’s probably not your money any longer (it’s the government’s $). If it’s in gold, you must haul all that heavy gold around with you as you make your escape. And the entire time you have a giant target on your back (“Hey! There goes that person with the big bag of gold!”). But bitcoin enthusiasts would say that if your money is in bitcoin, it cannot be confiscated. And it is not difficult to protect. And once you get to a new country, you can control all of your assets with a simple cell phone.

Similar to any new frontier asset, you can find a huge range of strong opinions on the future of bitcoin. But one thing is for certain, it is hard to ignore.

Would you like to learn more about bitcoin & cryptocurrency? Our WWM team is hosting a 30 minute webinar on this topic on May 16th. You can register HERE.

As always, we are here to help you if you have questions.

Authors: Keith Wagner, Connor Wagner, & Rick Wagner