Coiled Spring

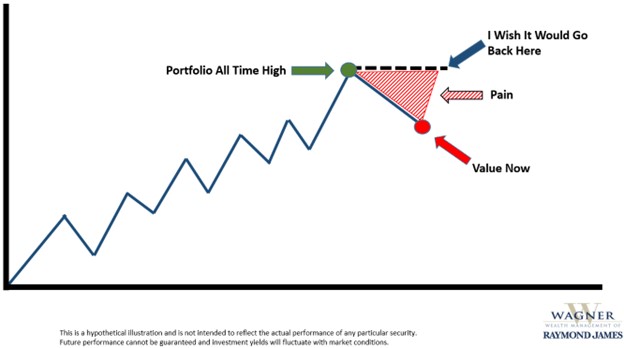

Being an investor in almost anything has been frustrating for the last 2 years. Our team’s savings is invested in the markets just like our clients’, so we get it.

The markets in general hit their recent all-time high at the end of 2021. That means most investors have been patiently waiting to get back to those levels.

So is there any good news? Certainly. This kind of multi-year period of down, up, down, up………but no real progress………usually means the markets are a coiled spring. When you coil up a spring tighter and tighter and then let go of it, that spring expands incredibly quickly.

I have been through 6 of these phases in my 30-year career, and all 6 have ended the same way. Unexpectedly. And with a sudden, powerful, sustained move higher. BOOM. Back when I was on the exchange trading floors in the 1990’s, traders started calling this phenomenon a “rip your face off rally” (I know, strange). It will be really fun when we hit that point. It’s almost certainly comin’.

What is the likely catalyst to help the coiled spring of the markets get released?

Interest rates. It’s interest rates.

- Odds are very high that interest rates start declining in 2024.

- And falling interest rates likely will be a massive tailwind for stocks, bonds, and most other major asset classes. (except for cash….savings account rates have historically fallen quickly when interest rates declined)

- Yes, the Fed has been pushing interest rates up for almost 2 years to fight inflation.

- But eventually the math always wins.

And the math shows that:

- Inflation has been falling for 14 months (mission accomplished by the Fed?)

- Economic growth is slowing, which encourages the Fed to lower interest rates to try to avoid a rough economy

- The US Debt is much more expensive to finance with interest rates up at these levels (which incentivizes the Fed to lower rates)

Author: Rick Wagner

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.