Does Recession = Sell?

The media is cranking up the “a recession is coming!” headlines again. Great clickbait. Here are some recent ones…

So should this prompt you to take some kind of drastic large-scale action with your portfolio? No.

The US has experienced 11 recessions in the last 75 years. So on average 1 recession about every 7 years. Using history as a guide, we should expect about 4 unpredictable recessions over the next 30 years.

Recessions are part of the normal inhale/exhale cycles in the economy. If you have a financial plan, it is essential that plan expects recessions to come and go forever.

Just 3 years ago in 2022, we saw LOTS of similar headlines…..

….but it never happened.

And if you read those headlines in 2022 and panic sold your stocks, you missed the 2 very strong stock return years of 2023 (S&P 500 +26%) and 2024 (S&P 500 +25%).

Yes, eventually we will have another recession. And one after that. But predicting recessions is ridiculously difficult. Even if you pull a rabbit out of your hat and nail a recession prediction perfectly, in the past we have seen stocks actually go up during some recessions. Why? Because often stock prices lead the economy by around 6 – 12 months. More on this here: Recessions & The Markets.

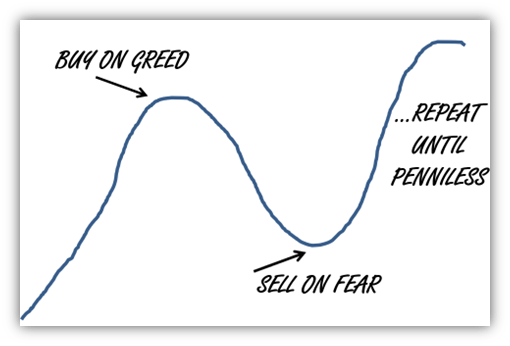

Trying to use news to drive massive portfolio shifts tends to lead to this destructive phenomenon…

The better choice is to avoid the noise, and instead use an asset allocation which combines stocks with other assets which are not stocks (i.e. bonds, cash, etc.). An allocation which you can live with through up and down cycles as you work to build and preserve wealth over your lifetime.

Authors: Keith Wagner & Connor Wagner

Source: FactSet

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.