When Should I Start My Social Security?

You need to earn 40 credits to be eligible for Social Security benefits (need at least 40 quarters of $1,510 of earnings or more). Most workers cover that requirement by working for 10 years. Social Security retirement benefits are calculated based on the average of your top 35 years of earnings. If you have less than 35 years of earnings (for example, you were laid off or caring for family members and out of work for three years during your working years), you may want to work enough additional years so you have a full 35 years of earnings. Otherwise, the Social Security Administration will average in zeros for any years less than 35.

Your benefits can begin as early as age 62, but you get a reduced amount (-25% or more) compared to waiting. As you wait, your benefit goes up a little bit every month until full retirement age. And it really jumps a lot for every month you wait between full retirement age and age 70. Consider the following when making your Social Security election decisions:

There are 4 key factors:

- If you need the income to balance your personal budget.

- When you plan to stop earning income (i.e. from working).

- Your feelings on how long you might live.

- Your spouse, and their potential to receive benefits.

If you need the income to balance your personal budget

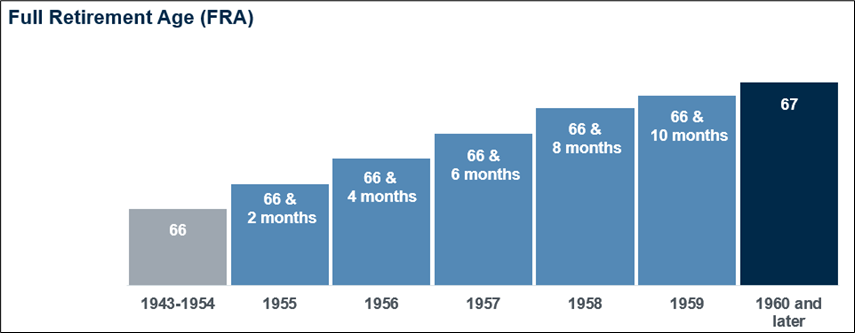

For our average WWM client, if they are 62 years+, they need the income that Social Security would provide to finance their life, and they no longer have earned income (typically from working), they are wise to consider applying for Social Security. After all, the crucial factor here is they need the income, plain and simple. The reduction for taking it early is 0.525% from the full retirement amount for each month they start receiving benefits early. For example, if you turn 62 in 2024 you would reach full retirement at age 67. Receiving benefits at age 62 instead of at age 67 would result in a benefit reduction of about 30%. But if you need the income to pay the bills, you flat out need the income.

When you plan to stop earning income (i.e. from working)

But…if you will have earned income to declare (i.e. from a business or working), whether or not you should start your Social Security payments will depend on your age, and on the amount you are likely to earn. If you are below full retirement age, you can earn up to $22,320 in 2024 before your Social Security benefits are reduced by $1 for every $2 earned over that level. In a year the worker hits full retirement age, the test is more generous — the worker forfeits $1 in benefits for every $3 in 2024 earnings above $59,520. Once you have reached your full retirement age, you can have unlimited earned income and still collect your full Social Security benefits. How is “income” defined? The SSA only counts the wages you make from your job or your net profit if you're self-employed. They also include bonuses, commissions, and vacation pay. Also, they only count your own one-person income, even if you file your taxes married-filing-jointly. Note: If you work while claiming early benefits, call the SSA with your estimated earnings so you don't get more benefits than you’re due. Eventually, earnings are posted to your record and they'll see they overpaid you. The SSA will want the money back — and will withhold benefit checks until the overpayment is cleared.

Your feelings on how long you might live

This is where longevity comes in. And it's not easy because nobody really knows how long they will live. Given a 9 to 10 year breakeven period, if you are eligible for benefits at age 62 (i.e. you no longer have earned income over $22,320 in 2024), but you decide to wait until age 67, you need to expect to live to about age 77 to make up for the five years (age 62 to 67) that you received no Social Security. Once you are over age 77, having waited to full retirement age will begin to benefit you. However, if you pass away prior to age 77, you likely would have been better off taking the smaller amount at age 62. Just know that the closer you are to your full retirement age (often about age 67) when you start getting social security benefits, the lower the number of years you'll need to breakeven.

Your spouse, and their potential to receive benefits

Also remember that your decision can affect your spouse. For example, Mary can file for her spousal benefits (typically half of her spouse Jake’s actual benefit) if she is at least 62, and Jake has reached full retirement age & filed for his own benefit. But remember: Mary’s benefit of 50% of Jake’s benefit stops growing when Mary reaches her Full Retirement Age. So Mary should never wait to apply for her benefits after her FRA, or she will be throwing money away. What if Jake dies before Mary? Mary is most likely eligible for a survivor benefit based on Jake’s work record, particularly if Jake had earned more than Mary over Mary’s lifetime. But, if Jake begins receiving Social Security benefits early and then he dies, Social Security cannot pay Mary a full benefit from Jake’s record ---- instead Mary will likely get the reduced benefit that Jake was receiving. However, if Jake waits until after his full retirement age of 67 to get benefits, and then he dies, Mary—if Mary is at least full retirement age (often age 67)—generally will receive the same full (not reduced) benefit amount that Jake would have received.

Don't forget Medicare at age 65

If you plan to delay receiving Social Security benefits until after age 65, you should sign up for Medicare three months before reaching age 65, regardless of when you reach full retirement age. Otherwise, your Medicare medical insurance, as well as prescription drug coverage, could be delayed, and you could be charged higher premiums and/or penalties.

What’s the Max?

The maximum possible benefit, for a worker retiring at Full Retirement Age, is $3,822/month in 2024. That equates to $45,864/year.

Your best resource for specific Social Security data is www.ssa.gov

Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Rick Wagner & Wagner Wealth Management of Raymond James, and not necessarily those of Raymond James.