11 Days

It is natural as investors and humans to wrestle with this kind of decision:

“Should I sell the portion of my portfolio that is in stocks, and move that $ to cash, because of”….

- The election

- The Middle East

- The US Dollar

- The deficit

- The market is “up too much” or “too high”

- The news

- The economy

- Interest rates

- Whatever the media is telling me is “bad” right now

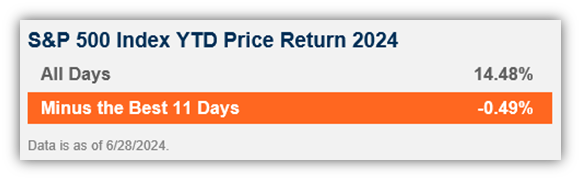

The stock market has gained +14.48% this year. 124 trading days in:

- 69 have been up days

- 55 were down days

But if you emotionally went to cash, and missed JUST THE ELEVEN BEST DAYS this year, your stock market return would be -0.49%.

(source: First Trust)

Trying to time the market is a great way to stack the odds of success against yourself. Being an investor is hard enough….avoid making it even more challenging by thinking you can zip from cash to stocks and back.

Authors: Keith Wagner & Connor Wagner

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.