Recessions & The Markets

The media isn’t very willing to broadcast this, but here are the historical facts about recessions and the markets:

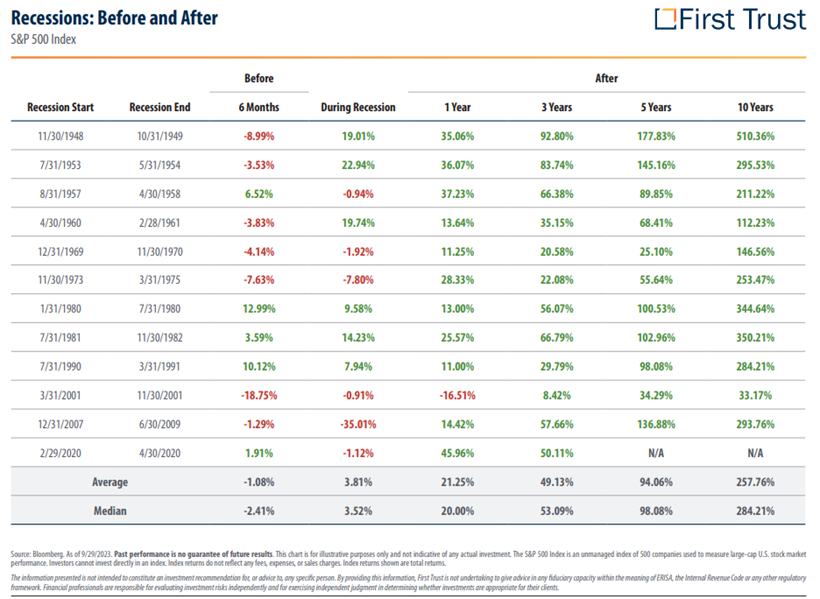

The average gain for the S&P 500 index during a recession is about +3.5%. Yes, gain.

Of course, every single recession period is different. Some down, some up. The image below will give you details.

However, historically the average 10-year return after a recession has been +257%. Wow.

The simple version is this: bad cycles lead to great cycles. But only those with discipline and patience reap the rewards.

Authors: Keith Wagner and Connor Wagner

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.