Retirement & The Markets

“My retirement date is nearing, but the markets have not been comfortable lately. Does this present a problem for me?”

This is a question our team fields a few times every single year. It’s why back in early 2021 we published this Marketmail: What if you Retire Right Before a Bear Market?

Imagine having committed to the effort of the construction of a comprehensive financial plan, with the primary goal of that plan being retirement. The BIG day arrives: you meet with your financial planner for the reveal, and you are elated to see that the results project you to be on-track. All set, able to retire when you hoped, and almost certainly live the retired life you dreamed about. RELIEF.

But then, as you are flipping through the pages of your plan, the financial planner tells you this: “Your plan is on-track, but only if the markets do not go through any down cycles before or during your 25+ year retirement.” What? How could a real financial plan only budget for up markets, for decades? You know intuitively this plan you are looking at is a complete joke.

If you have an actual comprehensive financial plan in place, it will include these 2 essential items:

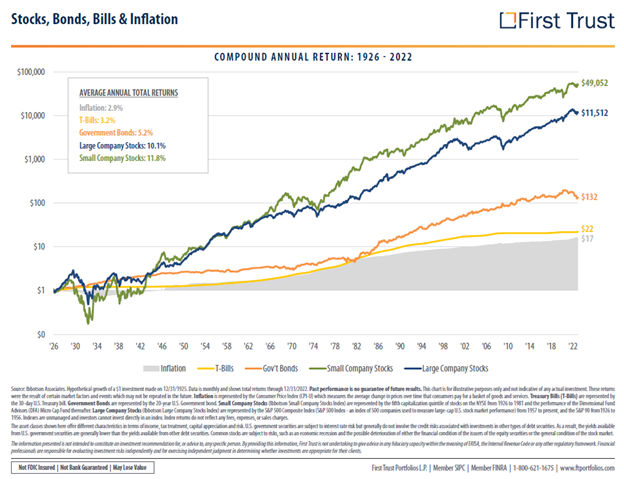

- An underlying assumption that before and throughout your retirement the capital markets will do what they have always done. Cycle down and up, and down and up…..the natural process which over time has enabled so many to achieve their dreams.

- A stress-test which asks this question: “If you retire, and then experience 2 down years in the markets at the beginning of retirement, is your financial plan likely to still stay on-track?” This test is important because it seeks to protect you from something called sequence-of-returns risk.

All of our clients’ financial plans include these 2 essential items.

Our team would love to be able to enable every single client to retire with all their money stashed in nice quiet cash. Unfortunately, the vast majority of retirees will quickly run out of money using this strategy due to the erosive power of inflation. Day by day, they will outspend their savings. These tend to be the retirees who wake up one day in their late 70’s, and with extreme regret realize they have to go back to work just to survive.

Incorporating a diversified portfolio is critically important for almost all retirees, and it requires an expectation that the portfolio value will naturally cycle down and up with the markets. Both before and during retirement.

Authors: Keith Wagner, Rick Wagner

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.