Where Are Home Prices Going?

Since 1891, the value of the average home in the United States has grown at a rate of about +3.1%/year (source: Case-Shiller & The Bureau of Labor Statistics).

- That’s a little less than bonds (+5.1%/year)

- And noticeably less than large cap stocks (+10.2%/year)

(source: Ibbotson)

Some years have been boom years in home prices:

1894 +17%

1946 +24%

2021 +19%

And some years have been busts in home prices:

1896 -13%

1901 -16%

1932 -10%

2007 -5%

2008 -12%

2009 -4%

2010 -4%

2011 -4%

Where does our team think home prices go from here? Well, housing prices have declined about -1.7% over the last 12 months (source: Case-Shiller). But they likely have further to fall. The odds of a crash in housing prices are tiny. It is more likely we see modest price declines over the next few years.

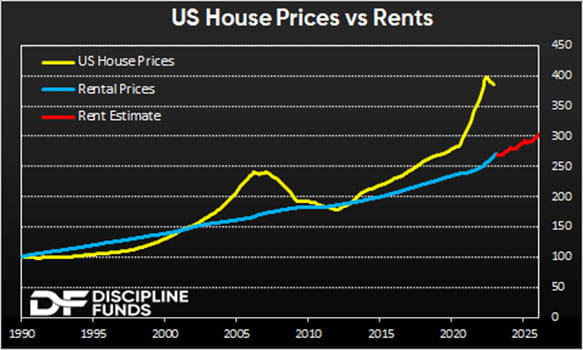

Why? Because historically, US house prices and rents have tended to correlate closely. But over the last few years, house prices and rents have decoupled bigtime…

Something has to give. Either:

- House prices need to go down

- Rents need to go up

- Or a combination of the two

The spread between the two is almost certainly not going to be closed solely by rents going up, because rents would have to go up A LOT (which would bleed through to inflation, and then cause interest rates to go up even more, which would eventually crush home prices). The gap between home prices and rents will eventually close, and it will almost certainly close by home prices coming down.

Authors: Keith Wagner & Rick Wagner

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.