Anchoring

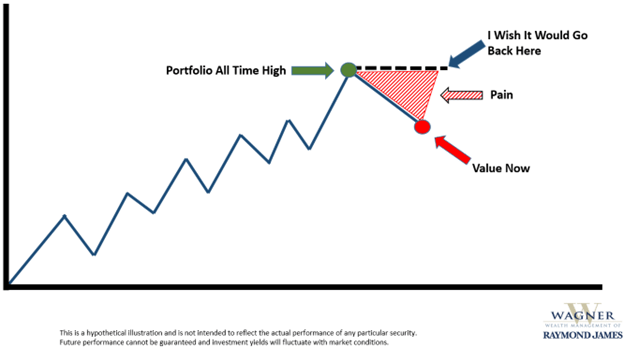

Every time the stock market declines, it feels like this…

Since 1988, the US Stock Market has traded at an all-time high on about 650 different days (source: Ben Carlson, S&P 500 Index). Sounds great, right?

However, 650 days is only about 6% of all the days since 1988.

So that means about 94% of the time, the stock market has been trading at some level lower than its all-time high.

Which means that 94% of the time we are all thinking “I really wish it would go back up to where it was”.

This is normal. Psychologists call it anchoring.

Why do stock investors elect to be tortured like this about 94% of the time?

So they can seek to retire, stay retired, fund college educations, pass wealth on to their loved ones, start businesses, protect their family, and many other worthwhile reasons. It is the price to be paid in the critically important quest to create and sustain wealth over time.

Author: Rick Wagner

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.