Midterm Years

We are in a midterm election year, and the stock and bond markets have been doing their best to shake out the weak hands. The US stock market peaked on January 3rd, and has declined -14% since. (S&P 500 index, source: Factset)

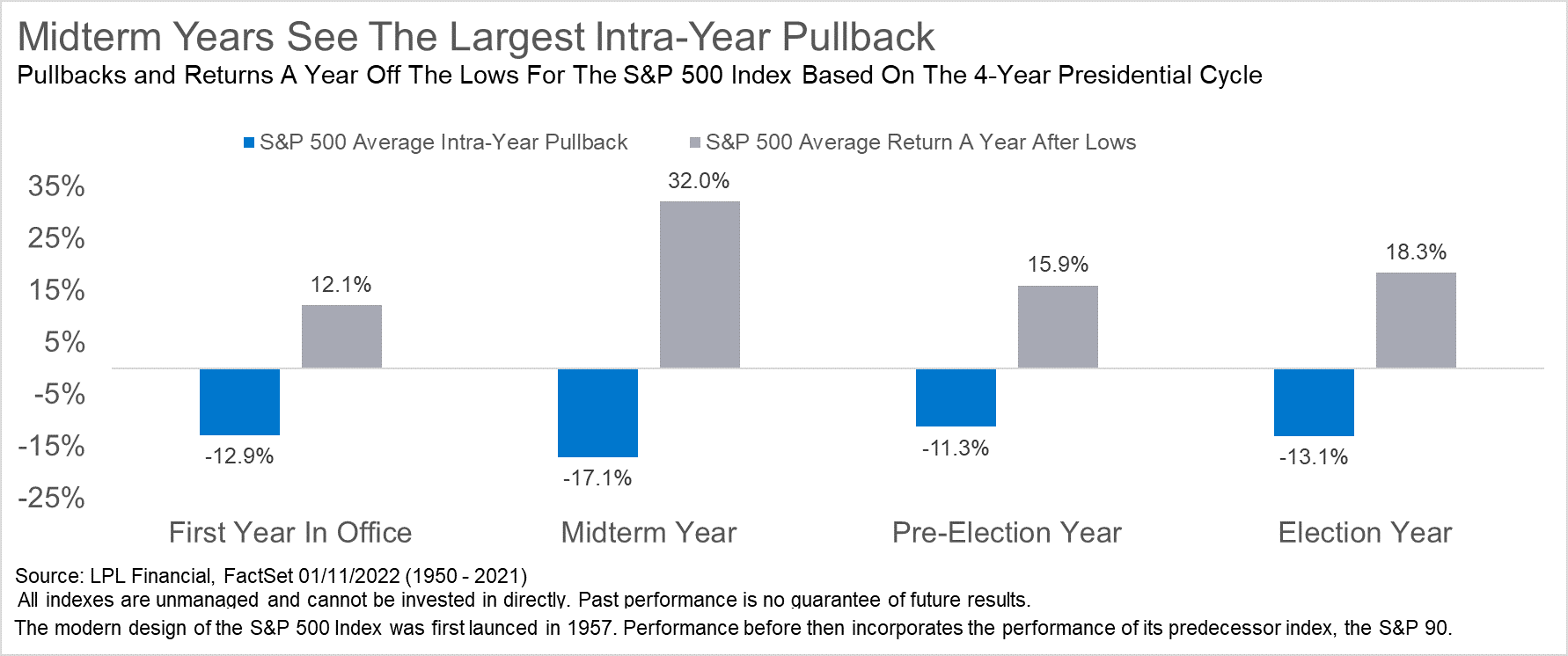

Many investors forget that double-digit declines in stocks during a year are actually normal. After only one -5% pullback all of last year, the markets are reminding us of that truth in 2022. Since 1980, the average correction in any year is -14%.

And historically midterm years have been especially rough, down more than -17% on average peak-to-trough. The good news is that historically, a year later, stocks have gained more than +32% on average. Great illustration of this from LPL Financial below.

Source: LPL Financial

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.