Recession?

A recession is defined by Oxford Languages as “a fall in Gross Domestic Product (GDP) for six straight months”. So to be able to say “hey, we are (or were) in a recession!” you have to look backwards at least 6 months in time. Knowing this, would any of us be shocked if in the next 6 months or so we see headlines which read “the US is officially in a recession”? I wouldn’t be surprised.

The next natural leap is to assume “well, if we know the odds are high of a recession being official in the next ≈ 6 months…….can’t we just assume that will make stocks go down? So wouldn’t selling stocks and trying to time the market make sense?”

History says “not so fast”.

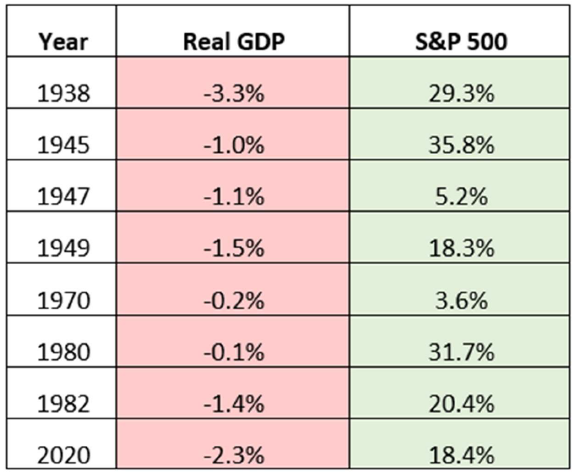

Why? Because we have seen many recessionary years, with negative GDP, where stocks have gone UP during that same year. For example:

This makes no sense, right? How could the economy be receding, but stocks move higher?

One of the biggest reasons is stocks are often a leading indicator. Frequently stocks will move based on the next 6 – 12 months, and not the last 6-12 months.

This is what makes investing so challenging for the inexperienced. Assuming “I can just watch the news and get a feel for how things are in the economy, and then use that information to buy or sell stocks” often leads to disaster.

Sources: US Bureau of Labor Statistics and FactSet.

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.