Economic Concept: The Money Supply

There is an economic law known as “supply and demand.” Put simply, if many people want something and there isn’t enough of it for everyone, it becomes more valuable. Why? Because those who TRULY want it, will pay more to get it—weeding out those who can’t afford it. However, if there is MORE supply (say iPads) than there are people who want it, then it becomes less valuable. The price will drop until enough people want to buy the extra supply (at some point everyone likes a bargain).

The same applies to money. Remember, money is a resource that is traded, purchased (paying interest to borrow money through a loan) and sold (through savings accounts in exchange for the interest the banks are willing to pay to use your money). Monetary Policy is the management of the money supply, to encourage economic growth (and employment), while keeping inflation in check.

Expansion of the money supply (in other words, either releasing more dollars into the economy, or printing more money) is good when it stimulates the economy and employment; because your prospects for income increase. However, not all expansion is good. Expansion of the money supply is bad when it creates inflation, because the purchasing power of your income (and the money you have saved) goes down when prices of goods and services go up. How does this happen? When you expand too much. Remember, supply and demand. Too much supply lowers value.

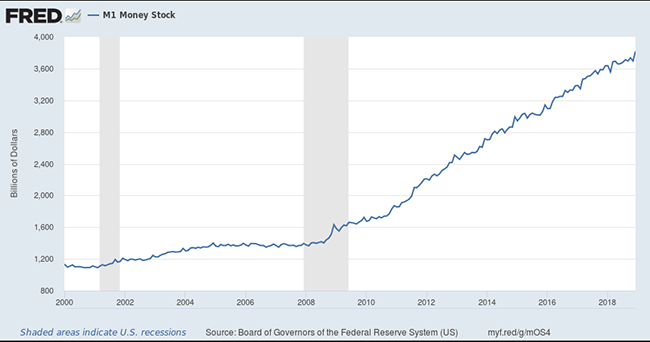

Since the Global Financial Crisis, our monetary authorities have embarked on massive stimulus, by lowering interest rates to almost zero and by creating huge amounts of base money. A measurement of this base money is called M1. Here is a chart that shows how much money has been created recently:

Many people have expressed great concern about this. You may have seen in the media things like: “…the explosion in the supply of money will create hyperinflation, like it did in Germany in the 1930s and places like Zimbabwe recently…” or “…get out of US dollars, because the value is going to collapse!” While it is a good thing to question and analyze how this may impact the economy and your wealth, there is more to the story than this.

The effective money supply is the amount of money created by the Federal Reserve, plus the amount of additional money that is created through lending and borrowing. If you earn $1000, you spend some of it (which then becomes income for someone else), and you may save some of it. Let’s say you save $100. Your bank account goes up by $100. The bank can then lend out up to $90 of that to someone else (a person or a business). That person will probably do the same thing—spend the $90 or deposit some of it in their bank. And then the cycle repeats.

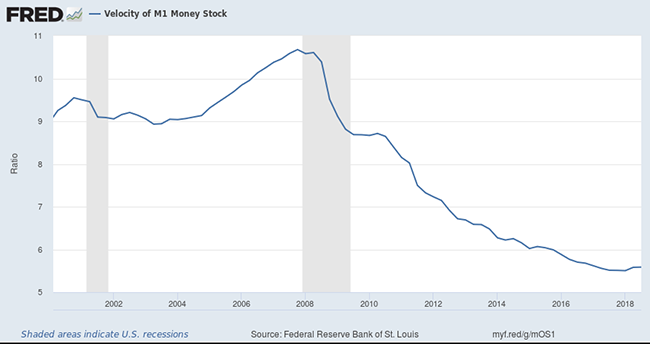

When the monetary authorities create new dollars, they knew money may recirculate fast or it may lay dormant (if deposits are not lent and borrowed). The speed at which dollars circulate into the economy is referred to as “The Velocity of Money,” or how fast is money entering the economy.

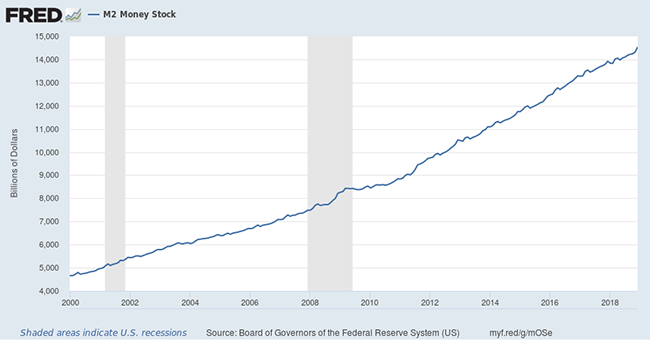

When you take into account not just the newly created money, but also how fast it circulates in the economy, you get the effective amount of money that exists. A measurement of this “effective” money supply is called M2. Here is a chart of how fast the effective amount of money has been growing:

As you can see, the amount of the “effective” money supply had been growing at about the same rate as it was growing before the global financial crisis and the massive amounts of monetary policy stimulus. The next charts shows why the effective money supply has not exploded the way the base money supply has:

This chart shows the speed at which money circulates (velocity) has fallen precipitously. I estimate that the substantial increase in the creating of base money (M1) has simply offset the dramatic decrease in money circulations. Sort of like if your heart rate slowed dramatically—you may need an I.V. of plasma to keep you from passing out.

This drop in velocity is likely the result of people and businesses trying to reduce their debt since the financial crisis began. The demand for lending and borrowing dropped as a result of this; so base money is not being recycled as quickly through the banking system. When you understand that the banking system is like the veins that bring life-sustaining oxygen and blood flow to the entire body (the economy), if there’s clogging somewhere (money not moving), it can lead to disaster.

Given this, I believe that for now, the fears of inflation are overblown. Until the money starts entering circulation faster, the monetary authorities would have to “print” a lot more money before the “effective” amount of money supply would be inflationary. Need some evidence: the U.S. dollar has been strong, energy prices are falling, gold prices are falling, and commodity prices are falling. Where are prices rising? They’re rising in the cost of education and healthcare, because of government controls and intervenes; but that is a story for another day, so don’t get me started.