Reinvestment risk

- 07.22.24

- Markets & Investing

- Commentary

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

There are many advantages and risks associated with any investment. Whether you are buying a stock, a house, a business, or a bond, each investment has unique characteristics that allow an investor to gain from particular investment features with varying risks. Typically the greater the benefit, the greater the risk and conversely, the less the risk, the less the benefit.

Investors often misconstrue a bond with a short maturity as being conservative. The reality is that staying short is neither conservative nor aggressive but rather strategic positioning on future interest rates, just the same as going long in maturity is. If we absolutely “know” that interest rates are going to be lower in 2 years (which we don’t), the riskiest maturity to purchase would be 2 years. We do not want to have to reinvest maturing money at the precise time we know rates will be lower. You could say in this instance that staying short is rather aggressive since the strategy does not align with a known event.

Most consumers understand a similar concept in the housing market. Secondary housing is in a shortage not because people don’t want to move but because they know if they sell, they will lose the very low mortgage interest rate held on their current house and risk having to secure a new loan for a new house at a much higher interest rate. A 30-year $500k mortgage loan at 2.5% is $1,975/month compared to $3,326/month at 7%.

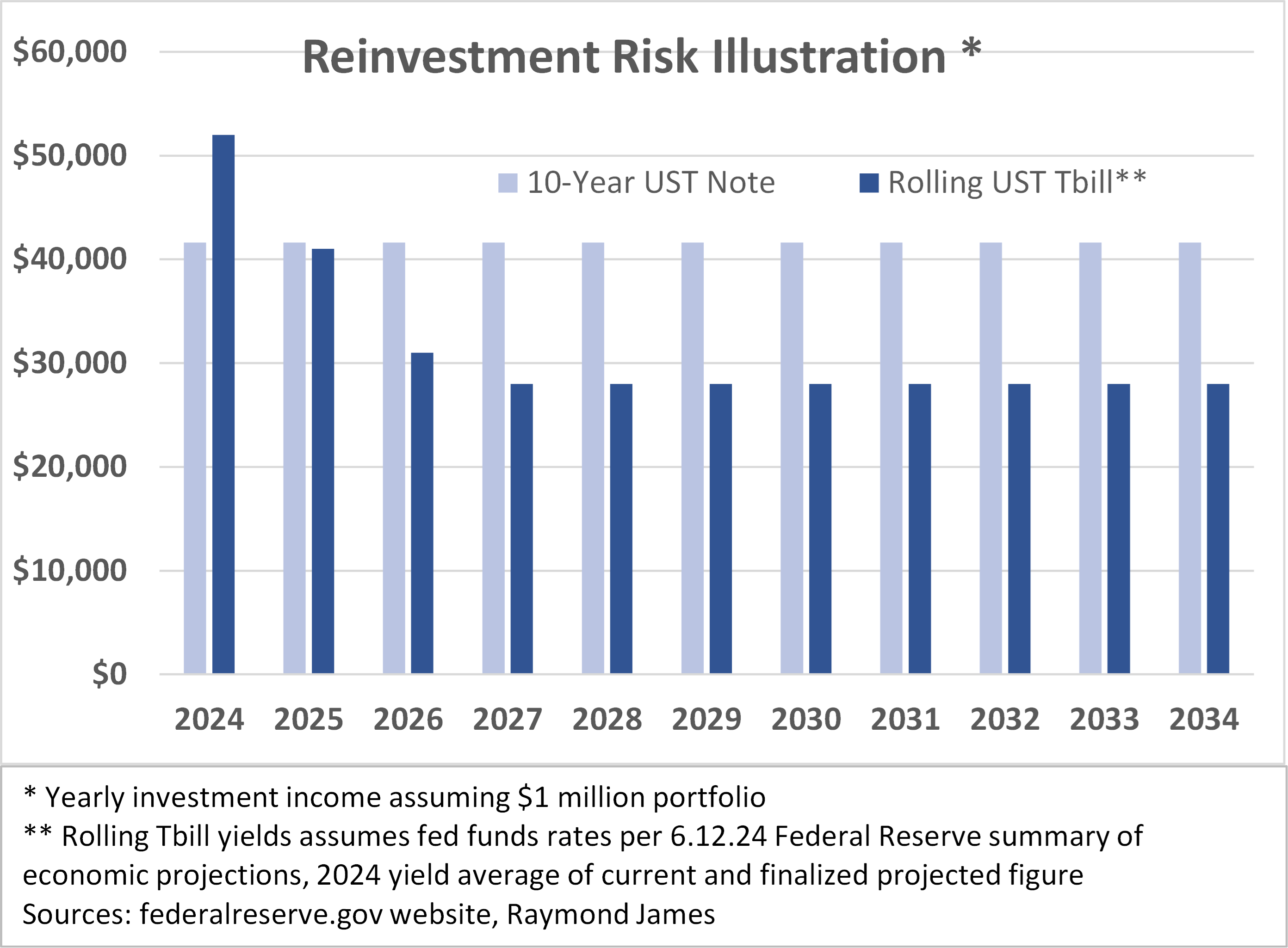

In the same way, you don’t want your monthly mortgage to increase by 68%, you do not want to see your income (investment interest earned) to significantly decrease. The illustration depicts the dilemma investors face today. It appears beneficial to receive 5.2% in a very short T-Bill – more advantageous than investing in a 10-year Treasury note at 4.16%. However, based on the Federal Reserve’s projections for future T-Bill rates, an investor would be better served locking into the 10-year Treasury. If rates were to play out as projected, the T-Bill investment would produce $348,000 versus the 10-year Treasury’s $457,600. The Treasury curve is not likely to remain inverted in perpetuity. Once the curve goes back to a normal slope, the short T-Bill or money market fund yield advantage vanishes and so might the opportunity to lock in longer at preferential higher rates.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.