Resources

Economic Monitor – Weekly Commentary

by Eugenio Alemán

Remember when (almost) everyone was saying that U.S. businesses were hoarding workers?

August 23, 2024

As a businessman and ex-business owner, the idea of firms ‘hoarding’ workers never made sense. As an economist, the idea of firms hoarding workers never made sense either. And since I am a business economist, the idea of firms hoarding workers is ludicrous. So why was it that so many pundits, economists, analysts, and everybody else looking at employment data during 2022 and 2023 argued that the reason for employment to be so strong during those years was because firms were hoarding workers?

Some argued that workers were so scarce that firms were reluctant to get rid of workers. Not only firms were not willing to get rid of workers, but the argument was that they wanted to continue to hire at very high rates because they didn’t know if they were going to be able to hire workers in the future.

We started writing about this issue back in October of 2022 when everybody was talking about firms ‘hoarding workers’ (See our Weekly Economics Thoughts of the Week for October 14, 2022, titled ‘Businesses Hoarding Workers? Say What?’). At that time, we argued that what firms were doing was just trying to go back to pre-pandemic levels of employment and that they were struggling to find workers, not hoarding workers. And because they were struggling to get workers, wages and salaries were going up.

But even after firms were able to catch up to pre-pandemic levels of employment in early 2023 and employment growth continued to remain strong, we argued that we needed to see an important slowdown in employment growth during the second half of 2023 because growth in employment was outpacing growth in economic activity. In our ‘Weekly Economics Thoughts of the Week’ for June 9, June 30, and July 07, 2023, we beat the drum that employment growth numbers were making no sense.

However, almost everybody else was trying to adjust their narratives to the numbers being reported rather than analyzing what was happening in the economy and concluding that job numbers coming out from the establishment survey were too good to be true. Of course, we never joined the bandwagon of conspiracy theories regarding the reason why we believed the numbers were wrong. The reason is because we have previous experience with the damage severe crises have on statistical calculations and we knew that nobody was trying to use these numbers for political purposes.

On Wednesday of this week, the Bureau of Labor Statistics (BLS) provided a preliminary estimate of the establishment benchmark revision, which indicated, preliminarily, that from April 2022 until March of 2023, the number of jobs created in the U.S. economy was revised down from an original

2.9 million to 2.1 million. That is, the BLS indicated that their preliminary revision was lower by 818 thousand than originally estimated, or about 68 thousand less per month during those 12 months.

Again, we want to put an emphasis on the preliminary nature of this number because this is not going to be the last number. The final numbers will be released when the January 2025 establishment numbers are reported, which is going to be on February 6, 2025.

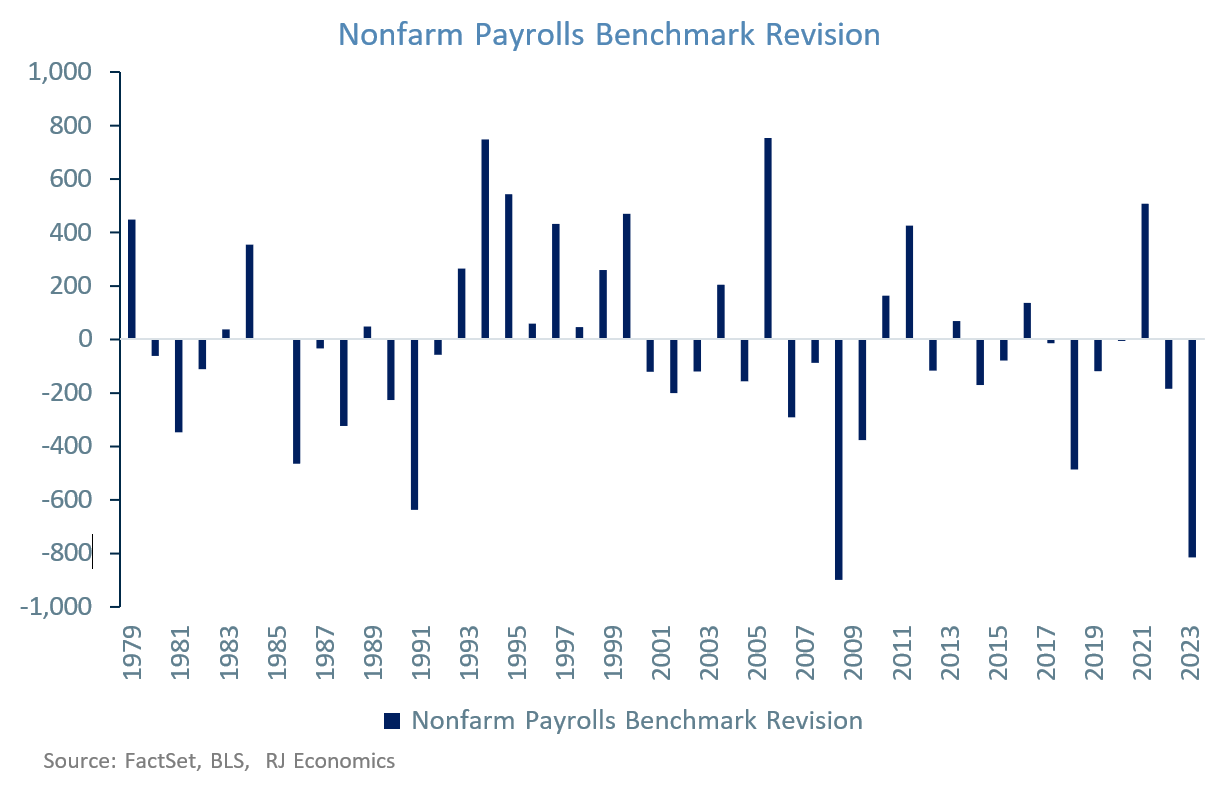

If we take a look at the chart below, we see that Wednesday’s revision was second in absolute numbers to 2009’s revision, which was -902 thousand. Thus, it is clear that after a severe recession, which was the case for the Great Recession as well as the pandemic recession, these estimates tend to produce very large negative errors in nonfarm payrolls estimates.

Again, this number may come down or move higher once we get the final numbers in February of 2025, but there is nothing mysterious or nebulous about it. It is just the nature of the beast. And as our RJ CIO Larry Adam argued during the Summer Development Conference in Orlando in July of this year, this is the reason why we use a combination of sources and our experience analyzing the economy to guide our research and our view on the economy and the markets. And that is why we wrote so many reports over the last two years providing our interpretation of what was happening to the U.S. labor market.

Having said this, the large revision by the BLS still puts U.S. employment growing at a strong clip during those 12 months, with growth in nonfarm payrolls ‘slowing down’ to an average of 173 thousand from an original pace of 242 thousand, which is still extremely strong compared to a historical average of 124 thousand per month before April of 2023 and going back to 1939. Therefore, the labor market remains in good condition despite recent increases in the unemployment rate as well as our belief that it has continued to weaken. Being that ‘to maintain full employment’ is one of the Fed’s two mandates, the slowdown in employment growth is an additional reason to support our view that the Fed will ease rates starting in September.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the U.S. Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

The National Federation of Independent Business (NFIB) Small Business Optimism Index is a composite of ten seasonally adjusted components. It provides a indication of the health of small businesses in the U.S., which account of roughly 50% of the nation's private workforce.

The producer price index is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.