Putting the recent volatility into perspective

- 03.14.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Growth scare more likely a soft patch than a recession

- The recent market decline has washed out the over-exuberance

- Volatility is the price you pay to be in the market – stay the course

Keep calm and carry on. Recent weeks have seen financial markets rattled by swirling news headlines, tariff whiplash, and rising economic uncertainty. Since late January, the constant stream of negative news has impacted consumer and business confidence, dampened investor sentiment, and pushed volatility to its highest levels since last August. These factors have driven equity prices lower, with the S&P 500 now officially in correction territory – down ~10% from its recent peak. While this may be unsettling for investors, especially after the S&P 500 experienced its worst weekly drop in six months, it's crucial to maintain perspective. The key point: avoid panic and resist knee-jerk reactions in your investment portfolio. Volatility is a normal part of the market journey. Below, we put the recent volatility into perspective and explain why we believe this pullback will be short-lived.

- Growth Scare More Likely A Soft Patch Than A Recession | Between tariffs, DOGE’s cost-cutting efforts, and sweeping government layoffs, sentiment has soured quickly. While the economy started the year strong, prolonged uncertainty poses a significant risk. It could potentially lead to a 'self-fulfilling recession' if consumers and businesses simultaneously cut back on spending—but we don't believe we're there yet. Yes, 'soft' data is showing warning signs, but it hasn't appeared in the 'hard' data. Chair Powell recently downplayed the significance of 'soft' survey data, noting that sentiment hasn't reliably predicted consumption growth in recent years. While there are some cracks building, the labor market remains healthy, consumers are still spending, lower yields should boost housing, and a potential ceasefire in Ukraine could lower energy prices—keeping the economy stable. Remember, the first quarter was also affected by the coldest winter since 1988, which sidelined over 500,000 workers in January and February, and the worst flu season in 15 years—so a rebound is likely. While vigilance is necessary, these factors suggest the soft patch should prove short-lived, with growth remaining around 2% in 2025.

- Fed Easing Cycle Will Continue To Lend Support | Heading into 2025, expectations for Fed rate cuts had diminished. However, recent growth concerns and improving inflation data have brought rate cuts back into consideration. Now, three rate cuts are anticipated by the end of 2025—slightly more than the two our economist predicts. The key point: the Fed has ample tools to support the economy if necessary. While policymakers haven't shown urgency to cut rates until there's more clarity on the new administration's policies, next week's Fed meeting could be revealing. The March 18-19 meeting will provide updated economic forecasts, likely reflecting the Fed's initial views on how Trump's policies might affect its outlook, and a new dot plot. Although we don't expect a rate cut next week, Chair Powell might adopt a more dovish tone during the post-meeting press conference, given the recent slowdown in economic momentum and progress on inflation. If this happens, it could boost sentiment and support both the economy and financial markets.

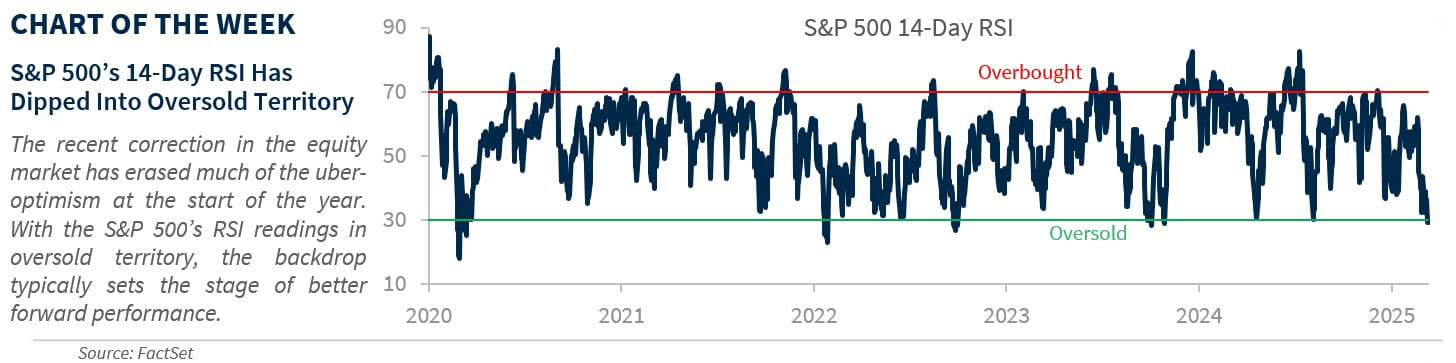

- Exuberance Has Been Washed Out | As our readers know, we started the year with a cautious, below-consensus 2025 S&P 500 year-end target of 6,375 due to concerns about investor overoptimism. However, the recent market decline has tempered much of this exuberance. For instance, the percentage of bullish investors has dropped significantly in recent weeks, reaching extremely low levels. Meanwhile, put volumes (indicating investors seeking downside protection) have hit record highs, and Wall Street strategists, who began the year with overly optimistic S&P 500 targets (some above 7,000), are now tempering their bullish outlooks. These signals, including oversold RSI levels, have historically been good contrarian indicators, suggesting that the market may be nearing a bottom as sentiment shifts from over-optimism to fear. When such extremes occur in a short period, it typically sets the stage for better forward-looking equity performance.

- Putting The Recent Volatility Into Perspective | Volatility is an inherent part of the market, and the recent decline is not unusual. Typically, dating back to 1980, the market experiences three to four pullbacks of 5% or more, one pullback of over 10%, and an average maximum intra-year drawdown of 13% each year. Given that the S&P 500 hasn't seen a 10% pullback since August 2023, this was long overdue. While volatility can be unsettling, it's important to maintain perspective. Pullbacks are inevitable, but investors who stay the course and ride out the volatility—whether short-lived or more severe—are often rewarded. For example, the S&P 500 has delivered an annualized return of over 12% over the past decade, despite the COVID downturn, the Russia/Ukraine war bear market, and several other 10%+ pullbacks. These pullbacks often present good buying opportunities for long-term investors. Another key point is that time in the market is more important than timing the market. While it's challenging to remain patient during volatile periods, history shows that the probability of a positive outcome increases with the length of the holding period.

Bottom Line | Volatility is never comfortable, but history shows that panic selling during volatile periods can harm performance. With over-optimism now tempered and the economy on solid footing, we are growing more optimistic about equity performance moving forward.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.