What is a Donor-Advised Fund?

As we begin the last quarter of the year, more individuals are starting to focus on charitable giving as part of their tax planning strategy. We are seeing an increase in knowledge and use of donor-advised funds.

A donor-advised fund (DAF) is a way to get maximum tax benefits from donations to charities. A DAF allows an individual to take multiple years’ worth of deductions in a single year.

How does a Donor-Advised Fund work?

Grantors open a donor-advised fund (DAF) account and make an initial contribution, which can be cash, stock, mutual funds, or other assets.

The DAF sponsor is a 501(c)(3) public charity, which means that the contribution is a charitable gift and, therefore, eligible for a deduction in the year of the gift.

The grantor/account owner can then recommend grants out of the DAF to eligible recipient charities.

ADDITIONAL DETAILS

The account can be invested, and gains will not be taxable to you, the taxpayer.

Major financial institutions custody DAFs. We can work together to find the right DAF custodian for you.

How a Donor-Advised Fund is helpful.

- You can take a charitable deduction this year, even if you don’t distribute that total charitable contribution from the DAF in one year. You can distribute the funds across many years to many different charities.

- Having one receipt to report your charitable contributions for the year is much easier than assembling multiple receipts yearly.

- Contributions to a DAF can allow you to donate a large amount and still make smaller dollar grants, which is more tax-efficient and feasible than gifting partial or single shares.

- You can donate appreciated securities that some charities may not be able to receive.

- Donations from some DAFs can be made anonymously.

How we have seen Donor-Advised Funds used.

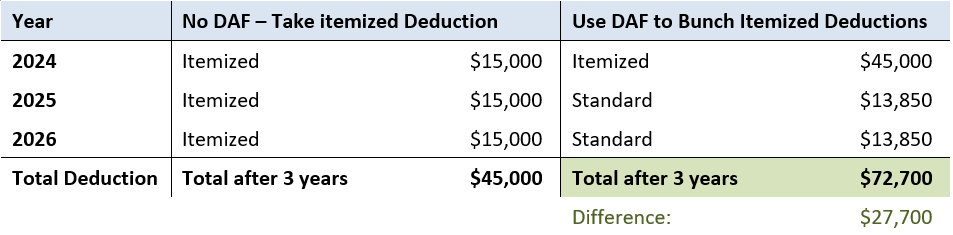

- Bunching – You never use the standard deduction.

If charitable contributions are consistently greater than the standard deduction, you will never get to use the standard deduction on your tax return. Grouping multiple years of donations into a single year allows you to take the standard deduction in future years.

For example, for a single tax filer, bunching three years of donations of $15,000 into a single year creates a single charity deduction of $45,000. Then, in each of the following years of the 3-year strategy, the standard deduction of $13,850 can be taken.

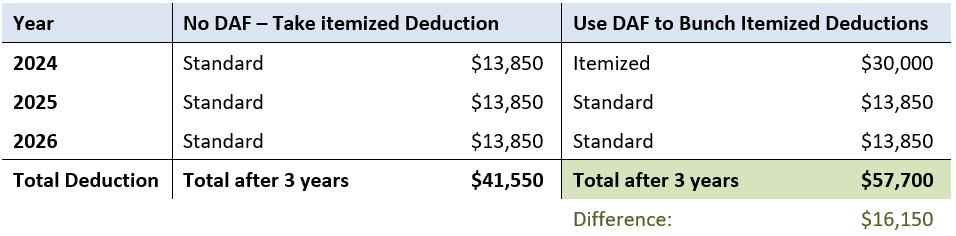

- Bunching – Charitable Contributions fall below the standard deduction.

If charitable contributions are consistently less than the standard deduction, you may never credit for them on your tax return. Grouping multiple years of donations into a single year allows you to take the standard deduction in future years. For example, for a single tax filer, bunching three years of donations of $10,000 into a single year creates a single charity deduction of $30,000. Then, in each of the following years of the 3-year strategy, the standard deduction of $13,850 can be taken.

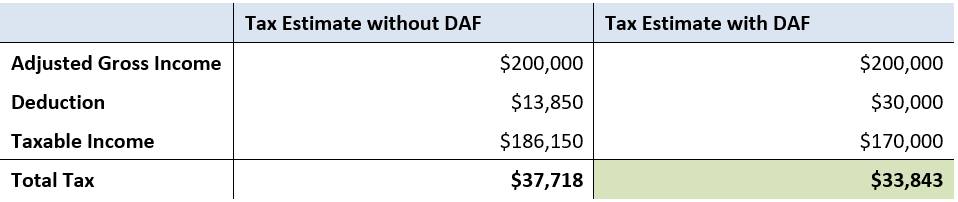

- Large Income Year

In a year where you expect your income to be larger than usual for one year, a deductible contribution to a DAF representing multiple years of expected charitable donations will help offset some of that income. For example, a single tax filer, who will earn $200,000 this year when they normally earns $150,000 can make a contribution to a DAF fund of $30,000 to decreased earned income.

If you have questions about donor-advised funds or charitable gifting and if this may be a consideration for you, please feel free to contact us at 678-989-0048 or www.striblingwhalen.com.

Regards,

Disclosures: The above examples are intended for information purposes only and do not constitute tax or legal advice. This report is not a comprehensive or definitive analysis of your tax situation and does not consider your specific circumstances, goals or objectives. Stribling~Whalen Financial Group and Raymond James do not provide tax or legal advice.