Recession Returns

What if somebody could tell you the exact date when the next recession will begin, so you could get out of the market and wait it out. Wouldn’t that be great?

You can fantasize about this if you want. But it so happens that sitting on the sidelines during an economic recession is actually bad for your portfolio returns.

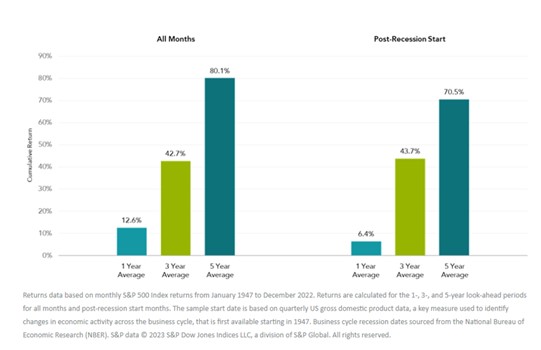

A study conducted by a mutual fund company called Dimensional Fund Advisors did something very simple:

- They looked at the start date of all recessions from January 1947 to December 2022, as announced by the National Bureau of Economic Research.

- Then they calculated the returns of the Standard & Poors 500 (S&P500) Index for the ensuing one, three and five years after the recessions were formally declared.

- Finally, it averaged those returns to show how investor portfolios, on average, fared during those times when the economy was in the tank.

The results: not encouraging to those who plan to move to the sidelines during recessions.

On average:

- One-year market returns after the start of a recession came to a decently positive 6.4%.

- Three-year market returns were 43.7%

- Five-year market returns were 70.5%

Looking over the data, the researchers noticed that markets have, on average, tended to experience most of their bear market declines before recessions were announced, and began recovering soon afterwards. The markets tended to trend upwards during the recession, perhaps because investors anticipated that it would end soon, and good times would restore corporate health.

In short, history shows that markets incorporate expectations ahead of the news.

The bottom line is pretty clear: even if you know the exact date and time that a recession would be announced (and you don’t), the future market movements would still be uncertain – and, on average, counterintuitive. Better to throw dice, or darts, or examine turtle shells to find out what’s coming in the future.

Regards,

Source:

https://www.advisorperspectives.com/articles/2023/06/16/tax-equity-stock-economic-forecasting-swedroe

http://elink.dimensional.com/m/1/62855187/02-b23156-d6a1f395214f448b94d84ebf9de8f870/2/25/34a9e829-8ec4-4cb8-9c7c-1de76cfbf3d1

Disclosure:

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision and it does not constitute a recommendation. Any opinions are those of Stribling~Whalen Financial Group and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Links are provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any third-party web site or their respective sponsors. Raymond James is not responsible for the content of any website or the collection of use of information regarding any web site’s users and/or members.