SECURE Act 2.0 - What you Need to Know

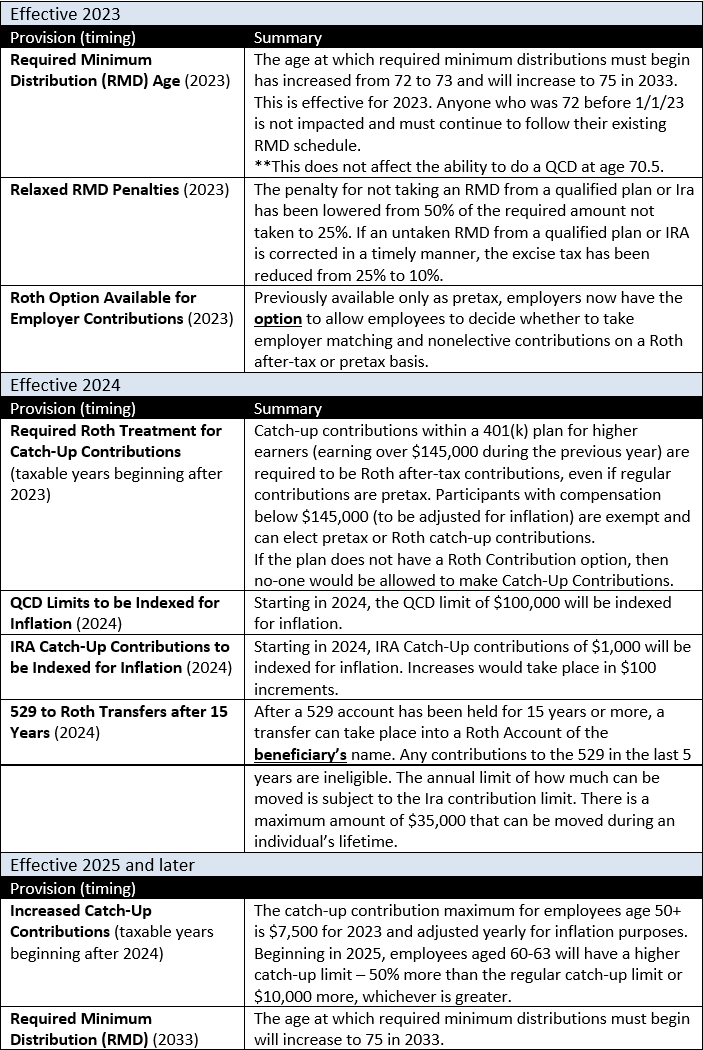

Passed into law on December 23rd, 2022, the SECURE 2.0 Act of 2022 builds on the improvements made by the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) of 2019 with more than 90 changes affecting qualified retirement plans, IRAs, SIMPLEs, SEPs, ABLEs and 529 plans.

SECURE 2.0 includes most of the major elements from the three separate retirement bills it consolidated. Here are summaries of the key provisions related to 401K plans. Not every provision is summarized below, such as those that affect 401(k) plans that are starting up.

As always, thank you for the introduction to your friends and family that so many of you have made. We are honored to serve you! As a service to our clients, we are happy to act as a sounding board for your friends and family. If any of them should need a second opinion on their financial situation, introduce them to www.striblingwhalen.com or call us at 678-989-0048.

Please follow us on Social Media:

Regards,

Warren D. Stribling, IV, CFP®

Principal

warren.stribling@striblingwhalen.com

Brian E. Whalen, CFP®, CIMA®

Principal

brian.whalen@striblingwhalen.com

RMD’s are generally subject to federal income tax and may be subject to state taxes. Consult your tax advisor to assess your situation. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™,  and

and  in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.