Challenging Markets and You

This year has been challenging on many levels, and the Wall of Worry continues to build. In the past, investors have had to overcome the worry of COVID 19, The Great Financial Crisis, 9/11, the Dot Com Bubble, just to name a few. This year alone, investors have had to worry about:

- Inflation reaching new highs since 1981

- Worst bond market since 1949

- FED Funding rates being the highest since 2006

- The Ukraine War

- China/Taiwan Tensions

- Supply chain constraints

We can easily argue that the 56% decline during the Global Financial Crisis of 2007-2009 was meaningfully worse. How might your investments have fared if you stayed the course through the Global Financial Crisis?

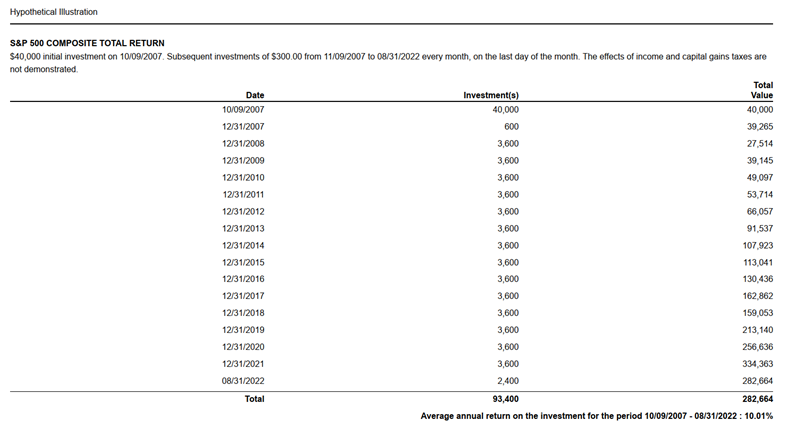

Consider the following*:

- On October 9th, 2007, your 401K balance is $40,000 and the S&P 500 is at 1565

- You are investing $300/month into your 401k into the S&P 500.

- One year and 5 months later, on March 9th, 2009, the S&P500 reached its low of 676

- Down 56% from it’s high of 1565 on 10/9/07

- By simply sticking to your plan, on 4/23/2013 your account value was $75,415

Why is the date of 4/23/2013 important?

That is the date the S&P 500 climbed back to its value of 1565 that it reached in October 2007 – not quite 6 years later

What if you continued to invest $300/month through 8/31/2022?

Your account value would have reached $282,644 on a total investment of $93,400

This demonstrably shows the power of patience and time in the market. Stick to your plan!

Please follow us on Social Media:

- LinkedIn - https://www.linkedin.com/company/swfg-rjfs

- Facebook - https://www.facebook.com/StriblingWhalen/

- Twitter - @brianedwhalen

Regards,

Warren D. Stribling, IV, CFP®

Principal

warren.stribling@striblingwhalen.com

Brian E. Whalen, CFP®, CIMA®, AIF®

Principal

brian.whalen@striblingwhalen.com

Jacob Beauchamp, AAMS®

Financial Advisor

jacob.beauchamp@striblingwhalen.com

*This is a hypothetical illustration and is not intended to reflect the actual performance of any particular security. Future performance cannot be guaranteed and investment yields will fluctuate with market conditions.

Opinions expressed are those of the author and not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice.