A Golden Perspective

“People have a habit of investing in their most recent and pleasurable experience”

-Warren Buffet, Chairman, Berkshire Hathaway

Stribling~Whalen Financial Group collectively has over 70 years of experience in the investment management and financial planning industry. How things have changed over the years. Being a part of this most excellent of professions, we have been saving articles of interest and placing them in a file photographed above. Routinely, we write short “research” notes on these articles to check back in five or ten years to see what our now deceased friend Paul Harvey would say “is the rest of the story.”

Brian, Warren and Jacob from time-to-time receive a few inquiries about gold because of the large market drop in March of 2020 as well as other small market dips along the way. We thought a visit to one of our aforementioned favorite files was in order and that visit didn’t disappoint!

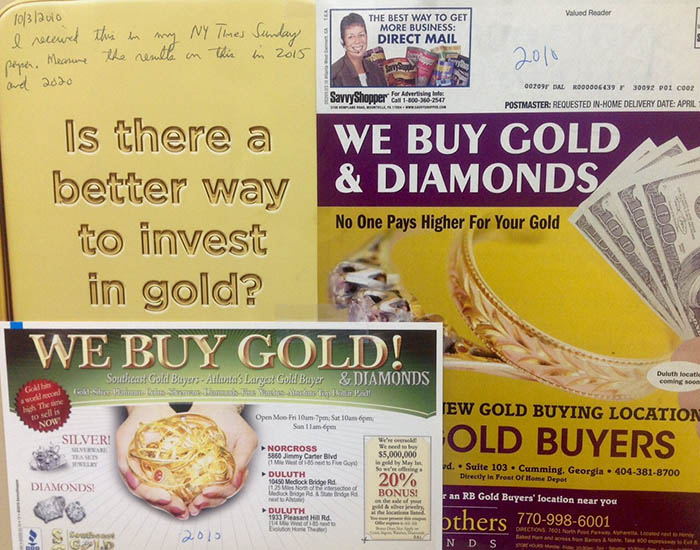

It didn’t take long to find the following in our files. These three pieces were all from the week of October 3, 2010.

You may not be able to make out the handwriting on the picture on the upper left. Brian scribbled “10/3/2010 – I received this in my NY Times Sunday paper. Measure the results in 2015 and 2020.” The other two pieces were received that same week in the mail. The clamoring for gold was at a fevered pitch. In Brian’s last role at American Funds, every year he spoke to thousands of individual investors in small and large groups. Barely a meeting could go by that he wouldn’t be asked about gold at least once. Many times, it was a very difficult discussion. Brian had to rely heavily on the fact that gold at the time was not a “Lonely Idea (Read Link)” and therefore not a great investment.

To add fuel to the fire Barron’s published the story “Why You Need to Own Gold” in its’ September 20, 2010 edition. The article quotes a Northern Trust Chief Investment Officer saying “gold has proved its value over and over again in the past century – in the faces of political upheaval, world wars and the debasement of currencies.” Perhaps some of that is true, but gold hasn’t come close to keeping up with inflation since its last meteoric rise in the early 1980s when it hit $873/ounce1. To get to that level in inflation adjusted terms gold would have to hit $3,119/ounce today. As you see below, the price of gold is just over half of that level as of 10/1/2021.

For “A Golden Perspective” we think it is only fair to look at the investment results from the time period of 2010 through the present (Bloomberg Barclays US Aggregate Total Return is the only exception going back to 10/14/2016).

|

Cumulative Investment Results |

|||

|

10/1/2021 Value |

10/1/2010 Value |

% Change |

|

|

Gold |

$1,756.30 |

$1,357.10 |

29% |

|

S&P 500 |

$4,357.04 |

$1,146.24 |

280% |

|

EAFE (non-US stocks) |

$2,263.90 |

$1,616.41 |

40% |

|

Bloomberg Barclays US Aggregate Total Return |

$2,361.40 |

$2,023.29 (10/14/2016 value) |

17% |

Unfortunately for many, the old proverb “what the wise man does in the beginning, the fool does in the end” proved true yet again for many. The S&P 500 outperformed Gold by almost 10x over an eleven-year period.

Warren Buffett wrote an incredibly succinct piece entitled, “Why Stocks beat Gold and Bonds” in the 2/9/12 edition of Fortune. I highly recommend you read yet another wonderful perspective from Mr. Buffett.3

I don’t know if we see a bubble out there like gold was in the early 2010s, but Warren, Brian and Jacob would warn you to be careful of reaching for too much yield in certain investments in this environment. If the yield is too good to be true, then it is! The same can be said of the current popular trend of cryptocurrencies. While they may be today’s trend, their volatility and uncertainty are real. Non-U.S. securities are still fairly priced compared to their U.S. counterparts.

As always, thank you for the introduction of your friends and family that so many of you have made. We are honored to serve you! As a service to our clients, we are happy to act as a sounding board for your friends and family. If any of them should need a second opinion on their financial situation, introduce them to www.striblingwhalen.com or call us at 678-989-0048.

Regards,

Warren D. Stribling, IV, CFP®

Principal

warren.stribling@striblingwhalen.com

Brian E. Whalen, CFP®, CIMA®, AIF®

Principal

brian.whalen@striblingwhalen.com

Jacob Beauchamp, AAMS®

Financial Advisor

jacob.beauchamp@striblingwhalen.com

Sources:

1. https://www.twincities.com/2008/03/12/gold-hits-1000-an-ounce-for-first-time/

2. https://www.moneymetals.com/precious-metals-charts/gold-price

3. http://fortune.com/2012/02/09/warren-buffett-why-stocks-beat-gold-and-bonds/

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Brian Whalen, Warren Stribling and Jacob Beauchamp, and not necessarily those of Raymond James.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. MSCI EAFE (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. Barclays Capital Aggregate Index measures changes in the fixed-rate debt issues rated investment grade or higher by Moody's Investors Service, Standard & Poor's, or Fitch Investors Service, in that order. The Aggregate Index is comprised of the Government/Corporate, the Mortgage-Backed Securities and the Asset-Backed Securities indices. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.