“They took everything…” The Threat of Financial Exploitation

“While likely under-reported estimates of elder financial abuse and fraud costs to older Americans range from $2.6 Billion to $36.5 Billion annually.” – National Council on Aging

Between World Elder Abuse Awareness Day on June 15th, listening to a webinar on Elder Financial Exploitation, and personally my wife and I being targeted by a financial fraudster, there are many signs that we need to discuss this topic in more detail.

While most recently elderly individuals are the primary target, it goes without saying that financial fraud/exploitation can happen to anybody. Which is why I want to mention how my family was targeted and what red flags we saw prodding us to ask additional questions and not give additional information.

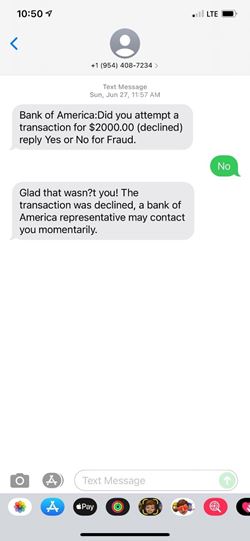

My wife and I were on vacation and received the text above followed by a call from a person who claimed to be from my bank. Both appeared exactly like every other questionable charge discussion I’ve had with my bank before. I thought this person was looking out for my best interest, stopping a large charge we didn’t make. Until we heard red flags:

- They didn’t want to turn off my wife’s card and send us a new one. (My bank, I’m sure like everyone else’s, LOVES to send new cards!)

- Instead of verifying our identity by using our names, birthdates or address. They asked what the balance in our account should be prior to the questionable charge.

- In verifying our email address, this person gave us an incorrect email address. Then asking to send a verification email with a code to verify the correct email address. The verification email was from a bank not affiliated with who I bank with.

By pushing back, asking additional questions, and not giving them the information they wanted, they hung up the phone. I immediately called a direct number to my bank. No charges were pending or on hold with any of our accounts. This was not a business practice they use. It was a fraud/exploitation attempt. BUT IT SEEMED SO VALID!

We were fooled for almost 75% of the conversation. Anyone can be a target of fraud or exploitation. If you are a victim or an elderly family member is a victim, you/they are not alone. It is more common than you think. Roughly one in three older Americans have been scammed in the last five years. With 33% of older Americans falling victim, sadly, only one in forty-four (~2%) elder abuse cases are ever reported.

There are numerous ways to attempt elder financial exploitation:

- Pop-up messages on websites that trick the victim into downloading a virus which then sends personal information.

- Telemarketing calls. Whether a solicitation for nonexistent charities or a frantic phone call to help a beloved relative stranded and in need of money.

- Sweepstakes or Lottery attempts where you’ve won a large sum of money but the fraudster needs you to pay taxes, duties or give them your personal information.

- The most heart wrenching, romance scams. And from 2019 to 2020 the reported (remember only 2% are ever reported) amount of money lost to romance scams alone has increased by 50%.

Romance scams are a con often used on a lonely individual, which is easy to see why the money lost to them increased by 50% in 2020. The con artist appears in person or as an online profile wanting to create a friendly or romantic relationship. They get close to the individual, building a trust that the con artist is in the victim’s life for a true relationship. Then the con artist begins to take financial advantage of the individual.

How is Stribling~Whalen Financial Group looking out for your best interests in regards to financial exploitation?

- Creating a personal relationship with our clients, helping to realize when something may seem different or not right with an individual.

- Creating a financial plan, which allows us to understanding your spending and saving tendencies.

- Raymond James is hosting a webinar called “Cybersecurity in Financial Services: Threats and Solutions” on Monday, August 16th from 4-5 PM EST and we would love for you to attend.

- Having a “Trusted Contact”

A trusted contact person is an individual you authorize us to be in contact with if we have trouble reaching you or have a reasonable concern about your physical health or financial well-being. SWFG cannot share any information with them about your accounts, investments or assets. Nor can we take any instruction or make any changes at their request (as long as they are not a joint account owner or power of attorney).

If the topics of Financial Exploitation, Elderly Financial Exploitation or a Trusted Contact, pose any questions, concerns or comments we would love to speak with you further.

Thank you for the trust and confidence you have placed in us, and for giving us the opportunity to provide education to you on your financial journey.

Sources:

- https://www.ncoa.org/article/get-the-facts-on-elder-abuse

- https://www.aba.com/advocacy/community-programs/consumer-resources/protect-your-money/elderly-financial-abuse

- http://www.canhr.org/factsheets/abuse_fs/PDFs/FS_FinanElderAbuse.pdf

- https://www.credit.com/blog/horror-stories-of-elder-financial-fraud-107857/

- https://solanpark.com/5-common-examples-of-elder-financial-abuse-to-watch-out-for/