Up Markets and Fear

“The best opportunities are usually found among things most others won’t do.”

Howard Marks, Co-Chairman, Oaktree Capital

F.alse E.xpectations A.ppearing R.eal

One of the oddities of a significant bull market—and this one we’re in today(2017) qualifies, as the second-longest in modern American history—is that they tend to go on longer than you might expect from the pure market fundamentals. The last leg of a bull market tends to be driven by psychology; people have recently experienced an up market, and so they tend to expect more of the same. They buy at prices they would never consider buying at when the markets have experienced a downturn, driving prices ever higher without regard to the price. As a result, the long tail of the bull market will also see some of the greatest, fastest increases. It seems hard to believe that the Dow first crossed 20,000 on January 21, 2017 (see Predictions and Dow 20,000).

Whenever stocks become more expensive than their long-term averages, we enter a time of when a market downturn should not be a surprise. One must remember that investments never rise and fall in value in isolation. They are constantly being compared and calibrated against other competitive investments. When interest rates are as low historically as they are today, it is not surprising stocks are commanding a higher valuation.

Of course, we have no way of knowing whether the next year will bring us more good news or the long-awaited downturn of 20% or more (the definition of a bear market). Other than market valuations, the signs are positive. American corporations continue to report strong earnings, economic expansion continues steadily albeit more slowly than historical norms, and finally a synchronized global expansion is upon us. And, as mentioned before, the end of a bull market tends to be very generous to patient investors.

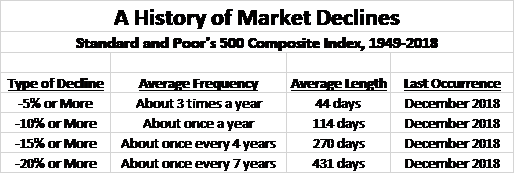

The key point to remember is that investment markets are, by their nature, volatile and unpredictable as the following illustrates. Though we have not even had a 5% decline in close to 18 months. There have only been 5 years in the last 60 without at least one 5% decline.

Though these declines may take the successful investor by surprise, to some degree, he also expects them.

We are certain that a more precipitous bear market (defined as a drop of 20% or more) is in our future, but we have no idea when or how. We do not practice market timing because we believe that long-term investment success comes from patience. When you jump out of the market to avoid a downturn, there is no way to make up for the returns you lost while you were on the sidelines.

So what can we do to ameliorate these certain downturns?

- For those in the income phase of life, many times we build up over a year’s worth of income in cash or short-term bonds

- Reduce and eliminate debt well ahead of the next downturn

- Save more

- Take (little) action:

- Review your long-term plan

- Review your risk tolerance

- Make sure your asset allocation matches your goals and risk tolerance

What do we know you will feel when the inevitable downturn comes?

- Every day it will feel like you are losing money

- You will want to do something – anything

These feelings will lead you to want to deviate from your plan. This feeling is normal. But as Mr. Marks commented at the beginning of this piece, you must seek opportunity “among things most others won’t do.” Being calm during this future downturn sounds easy and doable at this juncture, but will be excruciatingly difficult when the time comes and is not what the average investor does (see (Your) Portfolio Value & Gymnastics).

Here’s a prediction we can all be confident in: over the next few months or years, you will read financial headlines that say the bull market has a long way to run, and others that will say a devastating bear run is imminent. We are fond of saying that our crystal ball is every bit as bad as yours. The more important thing to remember is that markets in the past have experienced terrible losses, only to experience new highs a few years later.

Thank you for the trust and confidence you have placed in us and giving us the opportunity to provide education to you on your financial journey.

As always, thank you for the introduction of your friends and family that so many of you have made. We are honored to serve you! As a service to our clients, we are happy to act as a sounding board for your friends and family. If any of them should need a second opinion on their financial situation, introduce them to www.striblingwhalen.com or call us at 678-989-0048.

Follow us on Twitter - @brianedwhalen

Regards,

Warren D. Stribling, IV, CFP®

Principal

warren.stribling@striblingwhalen.com

Brian E. Whalen, CFP®, CIMA®

Principal

brian.whalen@striblingwhalen.com

Sources:

https://www.americanfunds.com/advisor/tools/client-conversations/keys-declines-common.html

https://www.capitalgroup.com/individual/planning/market-fluctuations/past-market-declines.html

If you would like to unsubscribe to these messages, please reply with UNSUBSCRIBE in the subject line

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Brian Whalen and Warren Stribling and not necessarily those of Raymond James. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members. Raymond James Financial Services, Inc. does not provide advice on legal issues. These matters should be discussed with the appropriate professional.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and CFP® in the U.S. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. Past performance may not be indicative of future results.