Market Update & New Office

Dear Friends & Clients,

Before delving into market analysis, we’re pleased to announce that we’re finally moving into our permanent office location! We think you’ll find it to be a significant upgrade over our current location and we look forward to seeing you all there. We’re still located downtown and specifics on the new office can be found in the bullet point section of this email. We’ll also be sending out postcards with the relevant information. We’ve been very happy with our move to Raymond James and look forward to being in an environment that we feel will more appropriately reflects both the firm and our team.

Market Update

After a strong first quarter, the “pendulum effect” of changing rate cut expectations has reintroduced some market turbulence in the second quarter. While markets vastly overshot rate cut expectations to start the year, April’s reaction of assuming we would get none, due to a hot March inflation report, looks to be premature. Although progress on inflation has slowed in recent months, the overall disinflationary trend appears to be intact and, most importantly, corporate earnings have shown continued growth.

We have begun to see signs that the US economy is cooling, and while this is good for the inflation fight, the Fed must be very careful not to overshoot in keeping rates too high for too long as it could turn the “soft landing” into a mild recession. Economic momentum in the form of job creation and corporate earnings growth remains supportive of US fundamentals, but markets are always vulnerable to a policy error. Ultimately, we believe that if the Fed follows through on their commitment to 3 rate cuts this year, that should ease financial conditions enough for the US to continue to enjoy the goldilocks scenario of continued (slow) disinflation and a stable economy.

The renewed focus on Fed policy as we get closer to the first rate cut, along with the increasing turmoil of an election year, may lead to a choppy summer/early fall as markets wait for more clarity before continuing their ascent.

Below is a more detailed summary of the current market drivers and concerns we’re monitoring:

From Goldilocks to Tradeoffs: while the market has been volatile over the past couple of years, the underlying economy has weathered the rate hikes much better than anticipated. Part of that is due to excess post-COVID stimulus still cushioning consumers in 2022, but, except for a few banks, corporate America has navigated the post-COVID era well. However, as inflation had receded, incremental gains from here are much harder to come by and the Fed must weigh whether damaging the economy is worth attaining their 2% inflation target. By keeping rates steady as inflation has continued to cool, and consequently widening the spread between inflation and the Fed funds rate, the Fed has been passively tightening policy. Not only are excess pandemic era savings gone, but consumers’ cash cushion is now slightly below pre-pandemic levels due to higher rates1. Monetary policy makers now face tradeoffs.

Home In the Range: good Q1 earnings helped justify the market’s YTD advance, but stocks seem to be lacking a catalyst to move substantially higher. Unless Q2 earnings blow past expectations, investors could face a range bound market until monetary policy eases.

Year End Targets & Policy Uncertainty: due to above consensus Q1 earnings, the year-end median street analyst consensus for the S&P 500 has increased from around 5,600 at the end of March to 5,8002 currently. However, it’s worth noting that analyst estimates tend to follow the market – just like we’ve seen since March. We believe estimates have become a bit optimistic. Humbling for analysts is the fact that the S&P 500 has not actually closed any of the last 4 years within the range of estimates major bank analysts put forth at the beginning of each year3.

New Office: we are moving to 60 North Market St., Suite 101, Asheville, NC 28801. Market street is located just north of Pack Square and is a much quieter location. All our phone numbers remain the same and we are coordinating mail forwarding. We anticipate being moved in by 6/20.

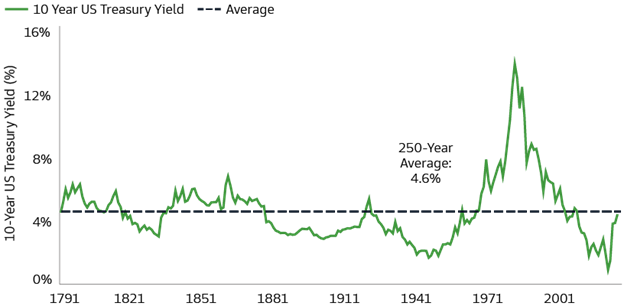

Bonds: after two years of pain in the bond market, yields in the US have reverted to their 250-year average4. We don’t currently see any impetus for yields to substantially overshoot this level and continue to believe that bonds, finally, look attractive going forward.

Source: Bank of England, GS GIR and GS Asset Management as of 12/31/2023.

As always, don’t hesitate to give us a call if you would like to discuss anything in more detail!

Any opinions are those of the members of the Stoneman Dalton Group and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance does not guarantee future results. Keep in mind that individuals cannot invest directly in any index. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

OUTSIDE RESEARCH

The attached third party research report is being provided to you courtesy of Raymond James & Associates solely for informative purposes. Any person receiving this report from Raymond James & Associates and/or its affiliates should direct all questions and requests for additional information to their Financial Advisor and may not contact any analyst or representative of the third party research provider. Neither Raymond James & Associates nor any third party research provider is responsible for any action or inaction you may take as a result of reviewing this report or for the consequences of said action or inaction.

ADDITIONAL DISCLOSURE

Complete risk and disclosure information for those companies which Raymond James & Associates also provides research coverage is available at: https://raymondjames.bluematrix.com/sellside/Disclosures.action