Our Clients

with knowing our clients

Your financial objectives may range from accumulating wealth to planning for retirement to making your money last as long as possible through retirement. In fact, over the course of your lifetime, you will undoubtedly pursue all of these goals. With the full range of financial services we offer through Raymond James, we can help you be prepared for all the significant events of your life.

Our clients tend to fall into one of several groups, each with their own specific needs, concerns, and challenges.

-

Families and

IndividualsThese clients’ lives are so busy and hectic that they often have little time to plan for their financial future. They may need assistance in defining goals such as saving for college or understanding their company’s employee benefit plans, or they have may questions about selecting from among the various types of retirement accounts.

Having someone to look after them with planning knowledge and a disciplined investment approach enables these families and individuals to focus on their other priorities.

-

Retirees

With their primary careers completed and their families out on their own, some of our retired clients may want to replace full-time employment with a second career, start a business, or seek greater involvement in community and charitable organizations. Others want to travel and enjoy their grandkids. In general, their financial priorities are preservation of principal and ensuring that their assets will provide a predictable and rising income for the rest of their lives.

Our relationship is often very interactive as we discuss issues such as monthly income and budgeting, including the potential need to offset significant medical expenses, or whether it makes sense to downsize to a smaller home. Creating a plan for the eventual smooth transition of assets to their heirs is significant for many.

-

Women

InvestorsMany of our women clients had been in relationships where they shared financial decision-making, and after losing their spouse, they want to make sure that they continue to make good choices. They ask questions and tend to be more disciplined investors.

We allow plenty of time for questions to make sure these clients understand the “how” and “why,” and to give them a sense of confidence leading to their long-term success.

-

Business

OwnersOur business owner clients tend to have their own unique situations. Some need a retirement plan while others are looking for help with exit planning. Many need help navigating what to do with the largest sum of money they’ll ever have from the liquidation their business.

Most of them have spent their lives building their businesses, and they trust us to help them get it right.

-

Corporate

ExecutivesThese clients have very specific rules and restrictions regarding their company stock and stock options.

We work with the specialists at Raymond James to make sure all the T’s are dotted, the I’s are crossed, and the reporting requirements are met. We also help mitigate the tax consequences by helping them select which portions to sell and when.

Client Advice Process

Our structured, five-step advice process enables us to provide our clients with a detailed assessment of their current situation

as well as a comprehensive, prioritized plan to fulfill their purpose and achieve their goals. We provide both initial and ongoing guidance so that clients can

see their progress and make refinements as necessary due to changes in their own situation or to adjust to changes in market conditions.

-

Step #1

Introductory ConversationDuring our Introductory Conversation, generally conducted by phone, we begin the process of getting to know one another to determine whether our investment philosophy and process are compatible with the goals you are seeking to achieve.

-

Step #2

Discovery

meetingOur Discovery meeting begins with a review of what was discussed during our Introductory Conversation leading to a full understanding of your goals as well as enabling you to more fully understand how I work with clients. We review your current holdings, analyze your savings rate and rates of return, and begin the process of developing financial strategies to achieve your specific goals.

-

Step #3

Recommendations & ImplementationNext comes creating your investment recommendations along with a written description of how your portfolio will operate. We provide you with a cover letter, your defined goals, your net worth, an educational funding analysis, a retirement plan analysis, your current asset allocation and a sample portfolio. During our subsequent telephone conversation, we review and discuss how the portfolio recommendations are aligned with your desired goals and make any adjustments that may be needed. After confirming your agreement, we begin to implement the recommendations.

-

Step #4

New Client

WelcomeWe review everything we have done to this point, including statements and other documents, to confirm your understanding of strategy implementation and how to access information.

-

Step #5

Progress

ReviewAt our first Progress Review meeting, we go over everything you have received in the mail and discuss what you need to retain and what can be discarded. We also review your first statement to make sure you understand what it is telling you. We also describe the various education pieces that we email to our clients from time to time. Finally, we add you to our call cycle which includes phone calls from us on a regular basis for updates and to answer any questions you may have.

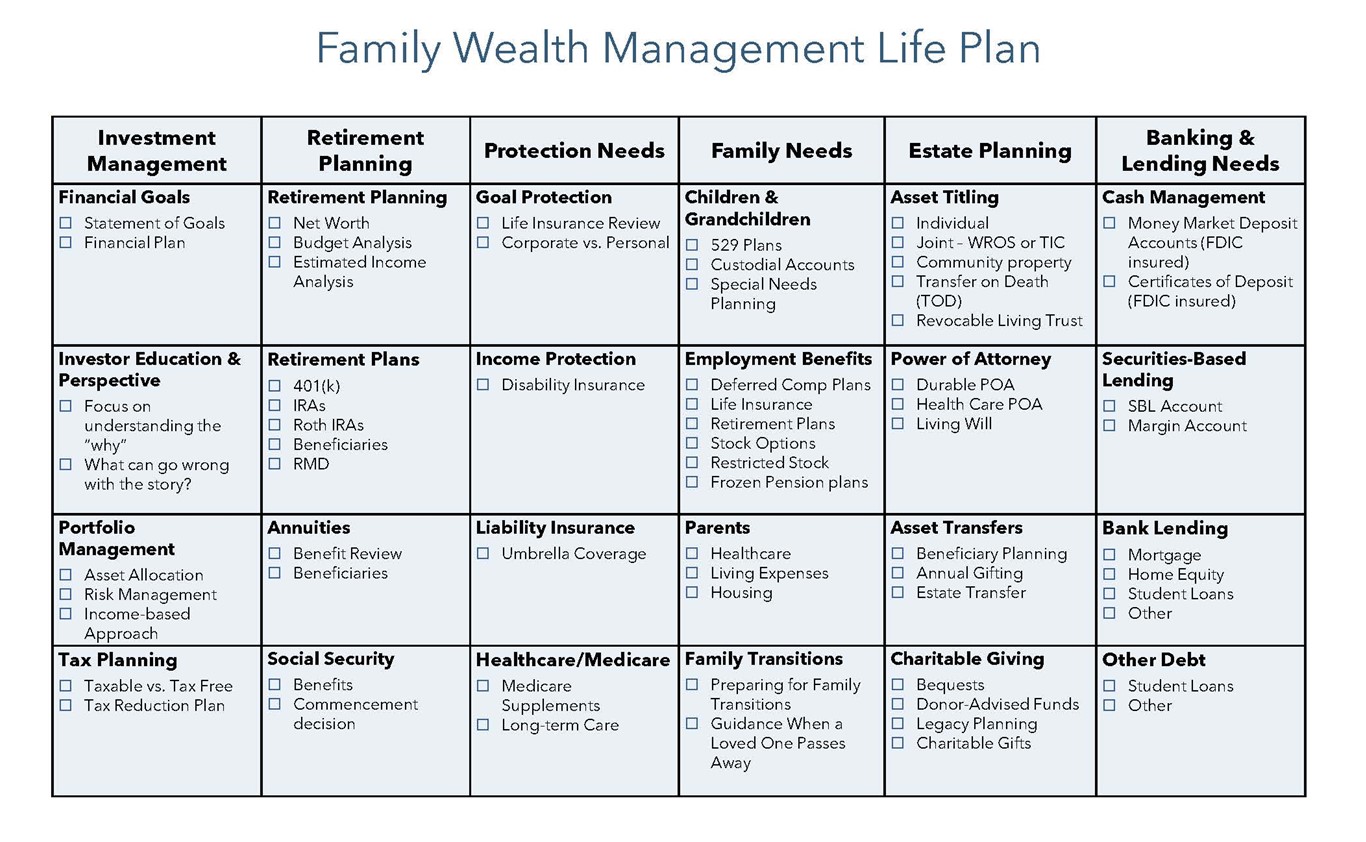

Our Family Wealth Management Life Plan table illustrates the various areas where we help our

clients achieve the goals that are most meaningful for them and their families.