The politics of markets

By David Jackson, MBA, CFP®, C(K)P™

There was a one-hit wonder song in the 1980s called “The Politics of Dancing” by the band Re-Flex. Some of the song’s lyrics went like this:

We got the message

I heard it on the airwaves

The politicians

Are now DJs

The broadcast was spreading

Station to station

Like an infection

Across the nation

Today, instead of the politicians being DJs, they are now reporters, pundits and opinion columnists. It’s hard to turn on the TV now and not be bombarded with political analysis and commentary, or someone telling you the incredible significance of the day’s news.

One of the most frequent questions I get from clients or prospective clients is some form of “Do you think we should do anything different with our investments in this political environment?”

Every election cycle, there is a segment of our client base that I have to “talk off the ledge.” They are often convinced that if a certain politician or political party wins an election, then the markets can’t possibly go up as a result. It may be a different group of people every cycle, but I can always guarantee that there will be some clients that will feel this way and want to adjust their strategy accordingly.

One of the greatest benefits that we provide to clients is that we have and are willing to share a different perspective. Most of the mistakes that I have seen investing through the years have been behavioral, not mistakes with the actual investments themselves. One of the biggest behavioral mistakes I see is overreacting to current events, especially elections and political events.

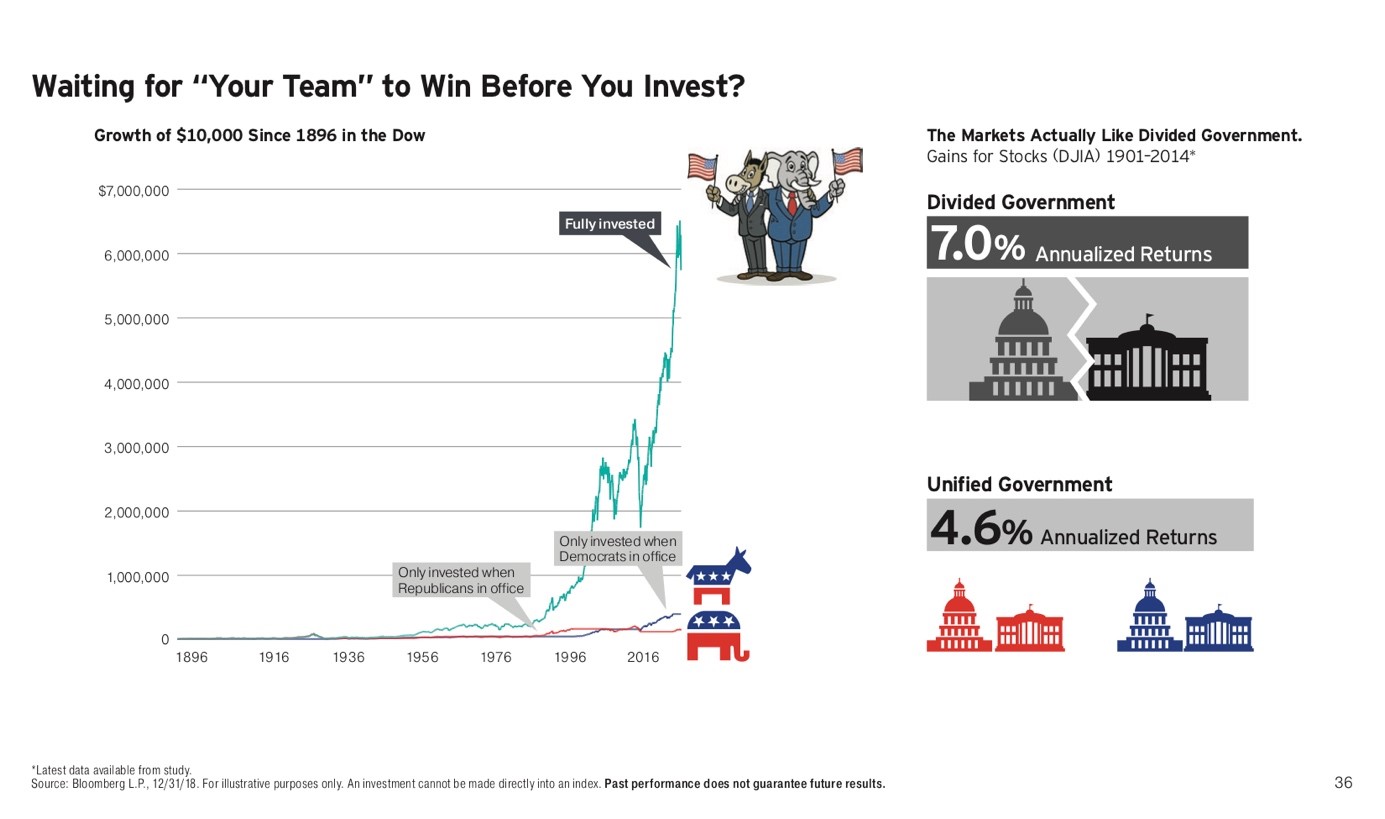

The chart below shows two things that I think are very important. One is that the return from being continually invested far outweighs the returns from only being invested during when Democrats are in office, or when Republicans are in office. The second is that returns have actually been slightly better when we have divided government versus when either party is in total control of all branches of government.

While there are rarely any sure things when it comes to investing, one thing I am confident of is that one of the greatest predictors of investment success is the length of time invested. Generally, the longer someone is invested, the greater their chance of investment success.

As we head into a Presidential election year, don’t let election results that don’t go your way get in the way.

Any opinions are those of the author and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Investing involves risk and investors may incur a profit or a loss. Past performance is not a guarantee of future results.