Don’t Be a Last Minute Rate Shopper

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

The 2024 wild ride has proven to be a continuation of last year’s. Many worldwide events have reigned consequences upon the markets through investor sentiment and volatility including: the BRICS Bloc expansion (Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, United Arab Emirates join Russia, India, China and South Africa), the Israel-Hamas war, university heads antisemitism caused resignations, campus pro-Palestinian protests, Epstein documents, Boeing airplane mishaps, the Mexico-United States border crisis, Odysseus (private spacecraft moon landing), mysterious high-altitude (spy?) balloon, Francis Scott Key Bridge collapse, AT&T data breach, General Electric split, multi-tornado outbreaks, solar eclipse, Dow Jones surpassing 40,000 points, $2 billion additional Ukraine aid, student-loan cancellations, Nvidia becoming the world’s most valuable publicly-traded company, Artificial Intelligence ChatGPT, Putin being re-elected, President Biden’s withdrawal – Harris’ nomination, CrowdStrike’s software glitch affecting airlines, American-Russian prisoner exchange, state abortion rules, Trump assassination attempts, Florida’s destructive hurricane season, announcement of the future Department of Government Efficiency, Trump cabinet choice debates… to name a few.

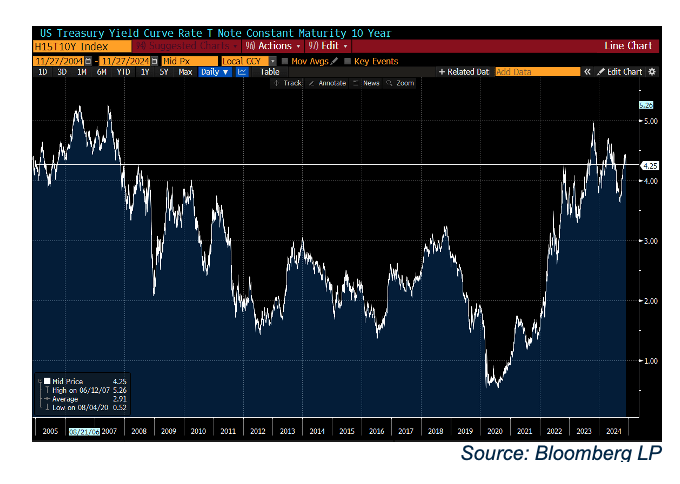

The consequences include this year’s Treasury market volatility. The 10-year Treasury yield began the year at 3.95%, peaked in April at 4.70%, fell as low as 3.63% in September, and sits at ~4.21%. The December 1, 2023, 10-year Treasury rate was 4.22%. All that volatility and yet the 10-year Treasury ends up nearly unchanged. 2023 was a volatile year with a silver lining – income opportunity. One year later investors still have an opportunity to reap the benefits of this silver lining.

Click here to enlarge

Source: Bloomberg LP

This has been the “chart of the year,” but with good reason. It reminds investors that rates don’t necessarily wait for them to time benefits that suit their needs. Instead, investors may benefit by taking advantage when attractive levels of income are offered. The current interest rate environment has been absent for roughly 17 years. Thus, the advantage may not last forever, so don’t to be a last-minute rate shopper.

The reality is that fixed income’s primary role is to hedge growth assets and provide long-term wealth preservation. The truth is that this can be done in any rate environment. What is special about today’s rate environment is that it allows investors to not only provide long-term wealth preservation but also be a significant income contributor. The message has been consistent all year and will remain prominent until it’s not. Right now, take advantage of this income and lock it in. Extend duration with high-quality investment-grade individual bonds and reap the dual benefit for years to come. It is the fixed income Cyber Monday gift to investors.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.