Our shadow dot plot for December: An attempt to read FOMC members minds?

Chief Economist Eugenio J. Alemán discusses current economic conditions.

As we approach next week’s Federal Reserve (Fed) Federal Open Market Committee (FOMC) meeting, a meeting during which the Fed is going to lower interest rates by 25 basis points, it would be interesting to ask ourselves what we would do if we were members of the committee. The question we would ask ourselves before deciding on our position regarding monetary policy going forward would be the following: are current interest rates conducive to the achievement of our inflation target of 2.0% over the long term? The short and quick answer to this question is probably, no, they are not! Although there is a small window early next year where the Fed is going to achieve or be close to achieving its 2.0% target, the environment does not look promising during the second half of the year.

As is always the case in economics, we probably need to qualify our answer because we know that the disinflationary process does not move in a straight line. Thus, the Fed will have to deal with temporary deviations from the disinflationary trend. And today is one of these moments where calm heads should prevail at the Fed. This is the reason we believe that the 25 basis points rate cut in December is baked in. However, the future path for rates has become considerably more difficult.

If Fed officials are watching the same numbers as we are, the later part of the first quarter of 2025 and the first half of the second quarter will look very promising for the path of inflation. There is a chance Fed officials could use this temporary lower inflation trend to cut rates further during the first or second quarter of the year, hoping for the rest of the puzzle to come together and deliver a continuation of the disinflationary process. However, this is very risky, especially due to the risks inherent in the policy changes advanced by the incoming administration. Furthermore, the second half of the year is going to look anything but promising because of base effects, even if there are no new policies implemented by the incoming administration.

In a ‘perfect foresight’ world in which economic actors know what is coming to them, this would not be an issue. But there is no ‘perfect foresight’, and the higher inflation is and/or the longer it remains high the greater the risk of a resetting of inflationary expectations.

Fed officials could use the argument that they look for a 2.0% inflation rate over the long run so short-term deviations shouldn’t be that concerning. But again, the longer it takes for inflation to come back down the riskier it becomes for inflationary expectations. And, as we argued last week, inflation expectations will be the key for policymakers going into 2025, especially because the Fed will have to deal with expectations of higher prices coming from the imposition of tariffs as well as the potential effects of the incoming administration’s proposed immigration policies.

This week’s inflation numbers, both the consumer price index and the producer price index were not a good omen for policymakers, especially because goods prices, which had been contributing considerably to the success of the disinflationary process have started to increase again. This may add to the Fed’s concerns regarding inflation going forward.

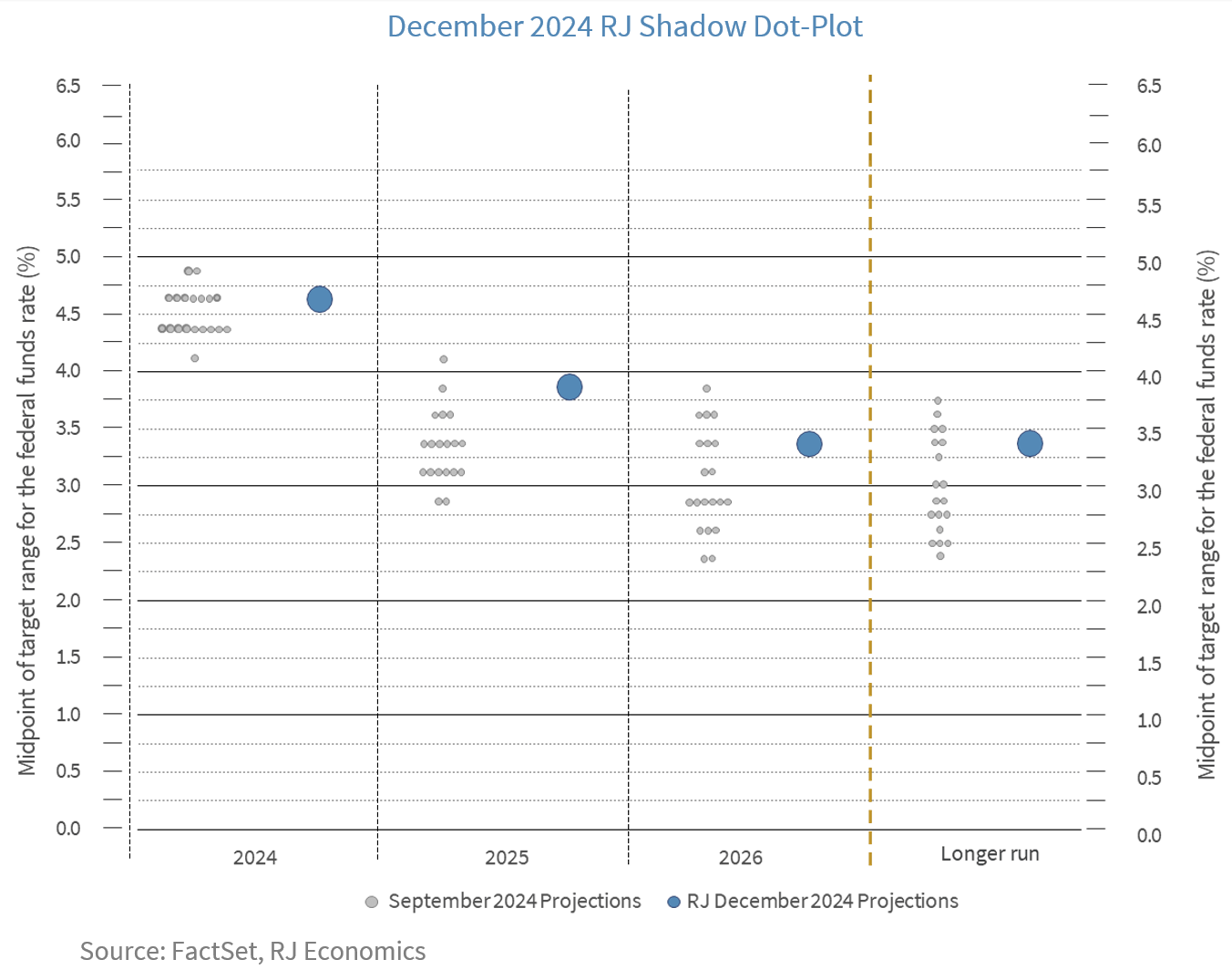

We’ll wait to make official changes to our forecast until the outcome of next week’s FOMC meeting, but with all of the (limited) information out, we are ready to interpret what next week’s dot plot decision is probably going to look like. September’s dot-plot had an expectation for rates to come down four times. We think that today’s environment would only allow the Fed to lower interest rates, at most, two times during 2025. This will take the federal funds rate to 3.75-4.00% at the end of 2025. After that, Fed members’ crystal ball may become a bit cloudier, and we expect probably another 50 basis point decline in the federal funds rate during 2026 to take the rate to 3.25-3.50%.

Of course, our view assumes that there are no surprises regarding inflation coming from the incoming administration’s new policies and that there is no external shock that threatens the Fed’s achievement of its inflation target.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Statistics. Currencies investing is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation. A value above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to consume. The opposite applies to values under 100.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

GDP Price Index: A measure of inflation in the prices of goods and services produced in the United States. The gross domestic product price index includes the prices of U.S. goods and services exported to other countries. The prices that Americans pay for imports aren't part of this index.

Employment cost Index: The Employment Cost Index (ECI) measures the change in the hourly labor cost to employers over time. The ECI uses a fixed “basket” of labor to produce a pure cost change, free from the effects of workers moving between occupations and industries and includes both the cost of wages and salaries and the cost of benefits.

US Dollar Index: The US Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the

U.S. dollar gains "strength" when compared to other currencies.

Import Price Index: The import price index measure price changes in goods or services purchased from abroad by U.S. residents (imports) and sold to foreign buyers (exports). The indexes are updated once a month by the Bureau of Labor Statistics (BLS) International Price Program (IPP).

ISM Services PMI Index: The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers' Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector.

Consumer Price Index (CPI) A consumer price index is a price index, the price of a weighted average market basket of consumer goods and services purchased by households.

Producer Price Index: A producer price index(PPI) is a price index that measures the average changes in prices received by domestic producers for their output.

Industrial production: Industrial production is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities. Although these sectors contribute only a small portion of gross domestic product, they are highly sensitive to interest rates and consumer demand.

The NAHB/Wells Fargo Housing Opportunity Index (HOI) for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income, based on standard mortgage underwriting criteria.

Conference Board Coincident Economic Index: The Composite Index of Coincident Indicators is an index published by the Conference Board that provides a broad-based measurement of current economic conditions, helping economists, investors, and public policymakers to determine which phase of the business cycle the economy is currently experiencing.

Conference Board Lagging Economic Index: The Composite Index of Lagging Indicators is an index published monthly by the Conference Board, used to confirm and assess the direction of the economy's movements over recent months.

New Export Index: The PMI New export orders index allows us to track international demand for a country's goods and services on a timely, monthly, basis.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The Conference Board Leading Economic Index: Intended to forecast future economic activity, it is calculated from the values of ten key variables.

Source: FactSet, data as of 12/6/2024