The opportunity right in front of investors

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

There are several ways to interpret data, yet one of the most influential sources is our perceptions of information through personal experience. A bad experience at a restaurant may sway our desire to revisit. We are also a nation that embraces competition. From the time we were little kids racing derby cars to adult pickleball battles attempting to top our opponents in a “social” friendly game, our competitive nature tends to keep our focus on overachieving. These traits are engrained into our behavior, which is why it is not surprising to see them spill over into our investment habits. We strive to outdo, outperform, and beat the averages because – well, we perceive ourselves as above average.

None of this is bad, of course. As a matter of fact, these American traits have helped shape our great nation and push us all to succeed or potentially reach higher levels of success. At the same time, it is equally important to avoid clouding the big picture by missing what is right in front of us. Sometimes, our preparation and hard work are rewarded by simply acknowledging what is presented. To cut to the chase, the primary goal of fixed income remains unchanged whether the economy is in a low-interest environment or a high-interest environment. Individual bonds are well suited to protect accumulated wealth irrespective of the interest rate environment. Striving to beat the average or time the market during a time of elevated interest rates may cause us to miss the opportunity right in front of us.

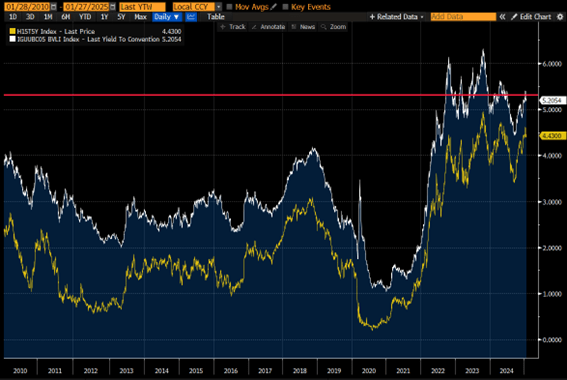

The gold line on the graph depicts the five-year Treasury yield. The shaded area or white line depicts a five-year BBB-rated corporate bond yield. The difference between the two is what is referred to as the “spread.” Since Treasury securities are considered perhaps the safest credit available to investors, any additional risk taken will usually provide an investor with additional yield to compensate them for taking the additional risk. In this case, the BBB-rated corporate bonds are high-quality investment-grade choices but not quite as secure as a government-issued bond. The spread of space between the two is relatively narrow, however, the nominal yield is elevated. Regardless of all the surrounding economic and political nuances and the comparative analytical ratios, the nominal yield is elevated. The income that investors can lock into is attractively high. There is no need to attempt to outdo or outperform when investors can lock into these superior yields right now. The red line depicts an achievable yield level for a pool of bonds invested over five to ten years. This level compares quite favorably over the last fifteen years.

Remember, when you purchase individual bonds and hold them to maturity, the results are locked. An individual bond will perform exactly as intended, whether it is day one or one thousand. Only a default, which is highly unlikely when investing in high-quality investment-grade bonds or selling prior to maturity (when results are subject to the market at the time of sale), can change these locked-in results. The best competitive move investors can make is to recognize what the bond market is offering and lock into the higher level of income that is being offered.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.