Tariff risks are likely overblown, but uncertainty may linger

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Tariff risks are likely overblown, but uncertainty may linger

- Government hiring freeze not likely to have a big impact

- Supply/demand factors will remain the key driver of oil prices

Stay Safe And Warm! This week’s Artic blast brought record low temperatures across much of the nation, and a rare winter storm that delivered snow to many parts of the Southern United States. While this once-in-a-generation storm closed schools, stranded travelers, and wreaked havoc across the nation, it was back to business in the nation’s capital after Inauguration Day. President Trump’s return to office was marked by a ‘flurry’ of activity, where he delivered nearly 100 executive orders on Day One of his second term. As expected, Trump swiftly reversed many of the Biden-era policies and advanced many of his campaign pledges on immigration and border control, trade and tariffs, energy policy, the federal workforce, and other key priorities. Given the significant impact these executive orders can have on the economy and the financial markets, here are the top five questions we’ve been receiving after President Trump’s active first week:

- Have Tariffs Been Lighter Than Expected? | From our perspective, President Trump's assertive stance on tariffs primarily served as a negotiating tactic to secure strategic advantages in other areas. His decision to delay the imposition of broad tariffs on day one, particularly against China, in favor of conducting trade reviews over the next 90 days, aligns with this view. Although the threat of tariffs remains, we expect any tariffs will be country-specific rather than universal, with potential exemptions for certain industries. For instance, President Trump has threatened a 25% tariff on imports from Canada unless they take more action to curb immigration across the border. However, it is unlikely that all Canadian goods will be targeted. Imposing a tariff on Canadian oil, the largest import from Canada, would likely raise fuel prices for US consumers, which contradicts Trump's goal of lowering energy prices. While the threat of tariffs will persist until there is more clarity (expected around February 1), this uncertainty is likely to keep market volatility elevated in the near term.

- How Will The Crackdown On Immigration Impact The Economy? | President Trump's campaign promises to crack down on illegal immigration should remain a focal point in 2025. Right out of the gate, he implemented stronger immigration enforcement measures, including declaring a national emergency at the southern border, reinstating the 'Remain in Mexico' program, ending birthright citizenship, and initiating some deportations. These policies could potentially slow economic growth, increase wages, and drive up inflation. However, some executive orders might face legal challenges or logistical hurdles, which could mitigate their impact. Given that immigration has been a significant driver of job and economic growth in recent years (with estimates suggesting it boosted 2023-2024 job growth by up to 100,000 jobs per month), any policy changes leading to reduced immigration will be crucial to monitor in the coming months. Sectors like agriculture, construction, hospitality, and restaurants could feel the immediate effects.

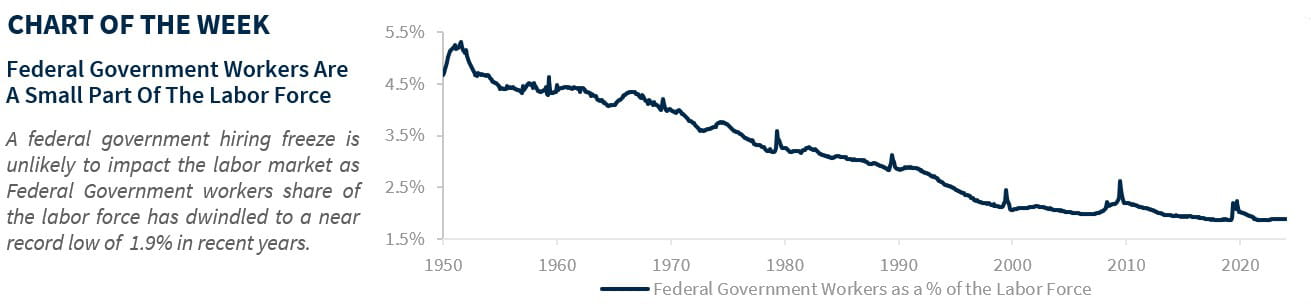

- How Will The Government’s Hiring Freeze Impact The Labor Market? | While a hiring freeze sounds ominous, incoming presidents have historically implemented one. In fact, the last six presidents have enacted a hiring freeze while in office. While there are some concerns that this could lead to a further slowdown for the labor market, we are not overly concerned. Why? Federal government workers only make up 1.9% of the total workforce—that’s nearly the lowest level on record! And considering that federal government workers have only accounted for 2.5% of jobs added over the last two years, President Trump’s hiring freeze should hardly make a dent in the overall labor market. More importantly, with private hiring plans (e.g. CEO Confidence survey, ISM Services employment) at healthy levels and job openings above historical averages, job growth should remain positive and supportive of the labor market in the coming months.

- Will Trump’s National Energy Emergency Support Lower Oil Prices? | President Trump swiftly declared a National Energy Emergency, vowing to reverse President Biden’s energy policies, speed up permitting, and reduce regulations to boost domestic energy production. However, growth of production ultimately depends on capex decisions by energy companies. Investors expect energy producers to maintain capital discipline, such as returning cash to shareholders through dividends and buybacks. Given that the US is already the largest global oil producer, President Trump has limited influence over increasing production growth. Consequently, economic conditions and supply-demand factors will continue to determine oil prices, supporting our year-end price target of $65 per barrel.

- Will The Trump Administration Continue To Focus On Tech? | President Trump quickly announced a new private partnership between Oracle, OpenAI, and Softbank, officially named Stargate, to build the critical infrastructure needed for further AI development in the US, such as data centers, power grids, and high-speed networks. This early achievement underscores the Trump administration's commitment to enhancing America's tech capacity and maintaining its position as a global leader in AI, particularly ahead of China. Additionally, the Department of Defense has pledged to prioritize using AI to modernize national security and cyber threat responses, including AI-enhanced weapons like drones. This ongoing commitment reinforces our preference for the Technology and Industrial sectors.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.