Bonds – The dual benefit

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

The excitement for fixed income professionals over the last year plus, has been the delivery of dual benefits for investors. A more conservative investment portfolio allocation dictates both growth assets (such as stocks) and wealth preservation assets (such as fixed income) regardless of whether the interest rate environment offers 1% or 10% returns. The enthusiasm around purchasing fixed income in today’s environment is that it, as expected, provides wealth preservation and in addition, it is providing higher yields that are hitting many investors cash flow demands. Rather than ramble on about the prospects of implementing or timing fixed income allocations, a simple chart and graph express the opportunity for all investors.

Click here to enlarge

Source: Bloomberg LP

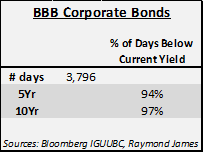

The chart uses the Bloomberg BBB corporate index as a market gauge. A 5-year BBB corporate bond can be purchased at around a 5.36% yield, which is a higher yield than could have been achieved for 94% of the last 15 years. Today’s 10-year BBB 5.83% corporate yield is higher than it was for 97% of the last 15 years.

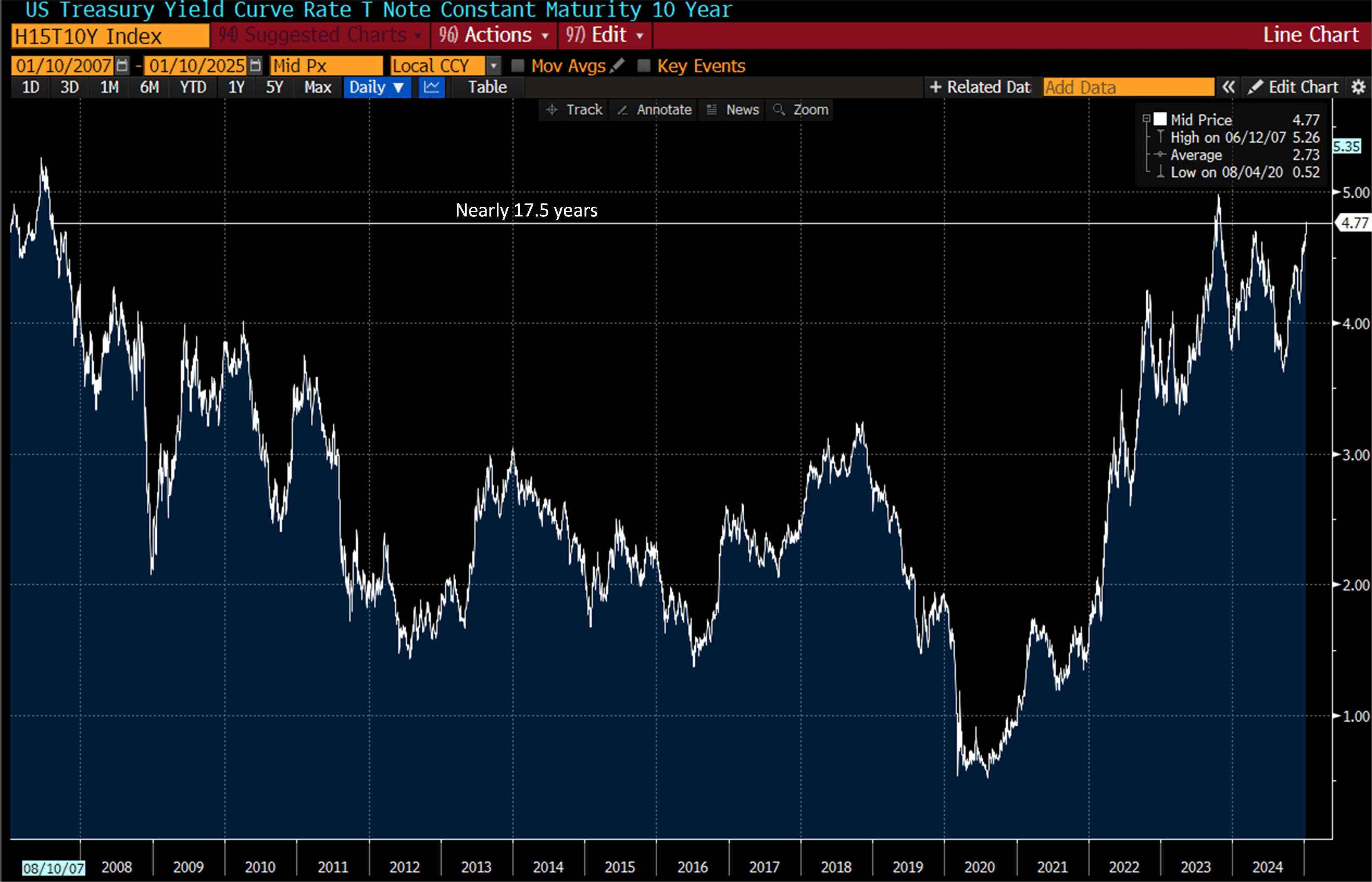

The following graph puts into perspective today’s Treasury rate relative to where this rate has been for the last 15+ years. The significance is that corporate and municipal bonds trade based on a spread or percentage of the Treasury market. The higher the Treasury market rate trades, the higher the corporate and municipal market yields trade.

Click here to enlarge

Source: Bloomberg LP

Timing fixed income purchases are typically based on the need to balance allocations to asset classes and not on prognosticating current and future market environments. With that said, the current rate environment is rewarding high levels of cash flow and income streams to investors engaging now.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.