Diversifying Investments

Diversifying Your Money Using the Time Segmentation Strategy: A Comprehensive Guide

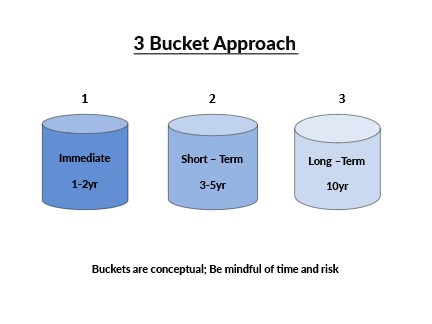

When planning for retirement, one of the most critical decisions you'll face is how to allocate and manage your investments to ensure a steady income throughout your retirement years. The Time Segmentation Strategy, also known as the "bucket strategy," is a powerful approach that helps you diversify your money based on your retirement timeline, balancing the need for safety, income, and growth. In this blog, we'll explore how the time segmentation strategy works, its benefits, and how to implement it effectively in your financial planning.

Understanding the Time Segmentation Strategy

The time segmentation strategy divides your retirement savings into different "buckets," each tailored to meet your financial needs at various stages of retirement. The idea is to align your investments with your time horizon for when you'll need the money, helping you manage risk while optimizing returns.

- Short-Term Bucket (1-2 years): This bucket covers your immediate needs, such as living expenses and other essential costs in the first few years of retirement. Investments here are low-risk, highly liquid, and stable, focusing on capital preservation.

- Medium-Term Bucket (3-5 years): This bucket is meant to provide income and cover expenses for the next phase of retirement. Investments should balance risk and return, aiming for moderate growth while maintaining some safety.

- Long-Term Bucket (10+ years): The long-term bucket focuses on growth, aiming to outpace inflation and increase your overall wealth. This bucket is invested in higher-risk assets, such as stocks, with the potential for higher returns over a longer time horizon

The Benefits of the Time Segmentation Strategy

- Risk Management: By segmenting your money based on when you'll need it, you can manage risk more effectively. Short-term needs are protected from market volatility with safer assets, while long-term funds are positioned for growth.

- Flexibility: The time segmentation strategy is highly customizable. You can adjust the buckets based on your retirement timeline, risk tolerance, and financial goals, making it a versatile strategy that can evolve with your changing needs.

- Tax Efficiency: This strategy can be tax-efficient by carefully selecting which accounts (e.g., taxable vs. tax-advantaged) to draw from in each bucket, minimizing your tax burden and maximizing after-tax income.

Practical Example of the Time Segmentation Strategy

Consider the case of Jane, who has saved $1 million for retirement and plans to retire in five years. Here’s how she might allocate her money using the time segmentation strategy:

- Short-Term Bucket (1-5 years): Jane allocates $200,000 to this bucket, investing in cash, money market funds, and short-term bonds. This ensures she has the funds needed to cover living expenses and unexpected costs in the early years of retirement.

- Medium-Term Bucket (6-10 years): She allocates $300,000 to this bucket, investing in a mix of intermediate-term bonds, dividend-paying stocks, and balanced funds. These investments offer a balance between safety and growth, providing income for the middle years of retirement.

- Long-Term Bucket (10+ years): The remaining $500,000 goes into the long-term bucket, invested in growth-oriented assets like stocks, real estate, or mutual funds. These investments aim to grow her wealth over time, ensuring financial security in the later years of retirement.

Conclusion

The Time Segmentation Strategy is an effective way to diversify your retirement savings, ensuring that you have the right mix of safety, income, and growth to meet your financial needs throughout your retirement. By aligning your investments with your retirement timeline, you can better manage risk, optimize returns, and achieve greater peace of mind as you enjoy your golden years.

Opinions expressed in the attached article are those of the author speaker and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of the strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. The foregoing is not a recommendation to buy or sell any individual security or any combination of securities. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.