Sharing knowledge and experiences

“Art enables us to find ourselves and lose ourselves at the same time.”

– Thomas Merton

Short-Term, Long-Term Market Perspective

Financial assets, namely stocks, bonds and cash, are different from what we call “real” assets. Of course, financial assets are real but “real” assets for this discussion are defined as real estate, a business, and things like that - stuff you can kick and that can’t be turned into cash in three days.

Another feature of financial assets is that their price is updated every day - actually minute by minute in many cases. Your home or business is not. When you get a home or real estate rental or a business appraised you do get an idea of what it’s worth but you don’t do that every day. Zillow tries to give people a more frequent sense of the value of their real estate but generally this has been known not to be that accurate. Besides you wouldn’t do that every day anyway … I hope.

With financial assets it happens every minute of every trading day. This can be distracting to investors because they can see the value of their financial assets rise and fall so frequently. One would wonder, how would I feel if my real estate or business value were posted every day?

So short-term daily valuations can distract investors from their long-term goal, especially when you add on daily prognostications about where the financial markets are going - good or bad - up or down. I remember in 2016 when the Brits voted to exit the EU. The Dow Jones Industrial Average (DJIA) went down over 600 points and the commentary was, “If you need your money within 5 years get out of stocks.” (Source: CNBC Commentary)

So let’s look at that advice.

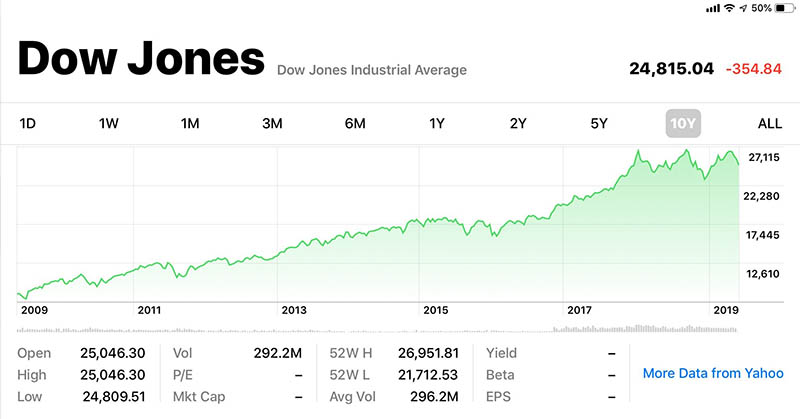

The Brexit vote was on June 23, 2016 when 51.9% of Brits voted to leave. (Source: Google) The DJIA closed the day before at 18,011. The next day it closed at 17,400 and the next day closed at 17,140. So in two days it dropped 871 points of -4.80% in just a couple days. (Spoiler Alert: even after our recent market declines of the last several days the DJIA is at 24,815 (Friday, May 31, 2019). One should note this is only 3 years after the Brexit vote, the time you were supposed to be out of stocks for the next 5 years).

So what’s the point? Markets go up and down. They can look like this. This is a one month chart taken June 1, 2018- (Source: Yahoo Finance)

This is a one year chart:

And this is a 10 year chart:

So, again, what’s the point? Perhaps the point is that if your time horizon for needing your money is short you may consider not being in the stock market in the first place so you can pretty much ignore the day-to-day market gyrations as well as the commentary and prognostications.

If, however, your time horizon is longer, you can pretty much ignore the day-to-day market gyrations as well as the commentary and prognostications.

Make sense?

You see, we don’t want you to do this.

Look, we can all get distracted by market swings and we all seem to pay more attention to negative market swings instead of positive market swings. We just want to impart some perspective.

Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. Any opinions are those of the Financial Advisor and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation.

Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Past performance is not a guarantee of future results. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.